The cost of most things is rising in the US. Official data show that the overall cost of items is rising by more than 5% year on year. This is substantially higher than the broad target by the Federal Reserve of 2%. As a result, people with cash see its value depreciate over the years. This article will look at what inflation is and identify some of the top hedges against inflation.

What is inflation, and how does it work?

Inflation refers to the overall upward change of prices of basic items. This change is mostly caused by movements of commodity prices and the overall policies by Central Banks. When a central bank slashes interest rates, it incentivizes spending by companies and individuals. This, in turn, leads to higher prices.

The opposite of inflation is deflation. It refers to a situation when the prices of items are falling. Although falling prices sound good, it is usually not good for an economy because it signals weak consumer spending. It also leads to a higher unemployment rate since many companies are selling their products at lower prices.

Another concept about prices is known as stagflation. This is when there is a stubbornly high unemployment rate and higher inflation. This is typically one of the worst situations that can happen in an economy.

Inflation tends to devalue cash. For example, if a can of ice cream is selling at $10 today. This means that you can buy ten cans if you have $100. If the price rises to $12 in a year, it means that your $100 will only buy eight cans of the same product.

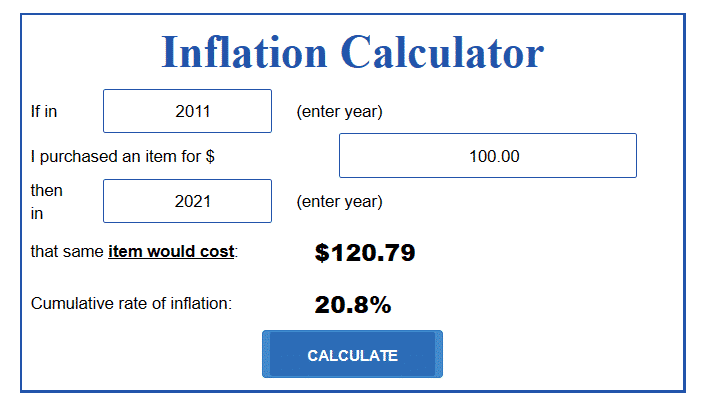

Inflation calculator example

Inflation has been on a strong upward trend in the past few years. As shown below, if you bought an item for $100 in 2010, the same item would cost about $120.79. That’s because the cumulative cost of inflation has risen by about 20.8% in the past 11 years.

What is an inflation hedge?

An inflation hedge is an asset that helps ensure that your money is growing faster than inflation. Investing in an inflation hedge will help protect your money and grow your wealth. In the above example, your funds would have been safer if you invested in an asset that grew by at least 20.8% in the past ten years. Such an item is known as an inflation hedge. Let us look at some of the top inflation hedges you can invest in.

Major indices

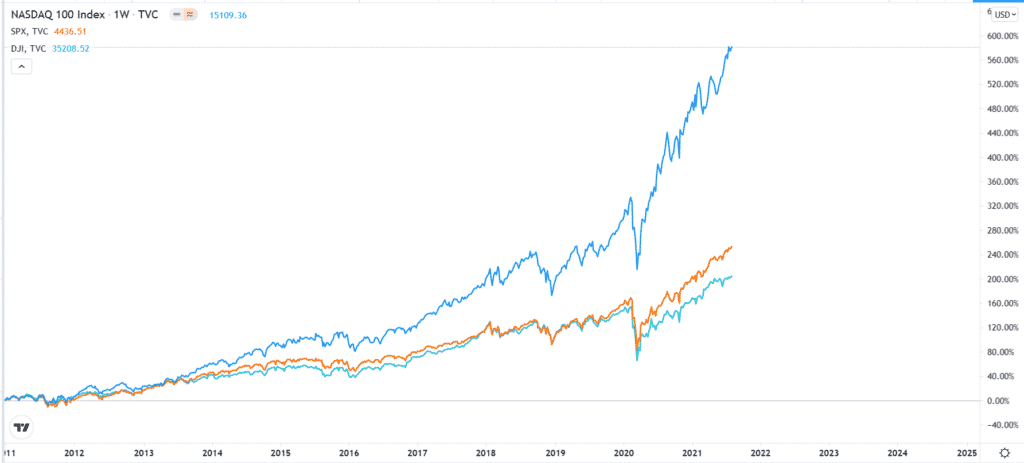

Stocks have done relatively well over the past decades. Notably, stocks tend to do even better when inflation is rising because it tends to rise in a period of easy money. The three major indices in the US are the Dow Jones, S&P 500, and Nasdaq 100. These indices track the biggest companies in the USA.

While investing in stocks is always risky, historical data shows that these funds always go up. For example, while inflation rose by about 20% in the past decade, the three indices have risen by more than 100% in this period, as shown below.

S&P 500, Dow Jones, and Nasdaq 100

This is the main reason why most investors and wealthy individuals invest in stocks. To hedge against inflation, we recommend that you invest in funds that track these indices.

Other exchange-traded funds that have historically outperformed inflation are those that track the Russell 2,000 and Russell 3,000 indices.

Gold

Gold is an often misunderstood asset, especially among new traders. That’s because gold is a metal that has no major uses other than manufacturing medals and jewelry. This is unlike other precious metals like platinum and palladium that are used in the manufacture of catalytic converters.

While gold has no meaningful use, it is one of the most valuable precious metals after palladium. It has also been used for centuries as a medium of exchange.

Gold’s role as an inflation hedge can be traced to the 1970s when President Richard Nixon did away with the gold standard. Since then, its price has been in an overall bullish trend. It has moved from about $35 in the 1970s to almost $1,500.

Gold price performance

This price action is mostly because of the fact that gold is bought by central banks and investors. Like stocks, it does well when interest rates are low and when the Fed has implemented an easy-money policy. The chart above shows that gold has risen by more than 25% in the past 5 years.

Treasury inflation-protected securities (TIPS)

TIPS are financial assets that are listed by the US government. The only difference with the rest of Treasury bonds is that these ones are pegged to inflation. Therefore, their returns rise as inflation rises. As such, they provide a safe place to keep your money since it will always be pegged to inflation.

The main disadvantage is that the Treasury Department uses the official inflation figure like the consumer price index (CPI). At times, this figure does not provide the most accurate measure of inflation. Another disadvantage is that they have weak returns in a period of low inflation.

iShares TIPS Fund

While you can buy the TIPS directly, we recommend that you use ETFs like the iShares TIPS Bond, Schwab US TIPS, and the Vanguard Short-Term Inflation-Protected Securities. The chart above shows the performance of the iShares TIPS ETF.

Summary

Protecting yourself from inflation can help you preserve your cash. This article looks at the three popular inflation hedges that you should allocate your funds in.

Other assets that are famous hedges are real estate. In the past decades, the price of certain real estate assets has been in a strong upward trend. There is also an ongoing debate about whether cryptocurrencies like Bitcoin and Ethereum are good hedges against inflation.