Lithium is one of the most important metals as the world transitions from internal combustion engines to electric cars. It is used in the manufacture of batteries, where the movement of lithium ions creates free electrons in the anode.

Only a few companies have lithium deposits. The most endowed one in Australia is responsible for about 46.3% of the world’s total. It is followed by Chile, Argentina, the United States, and Zimbabwe.

Therefore, most companies that produce lithium are not publicly traded in the United States. In the article, we will highlight some of the best lithium stocks to invest in.

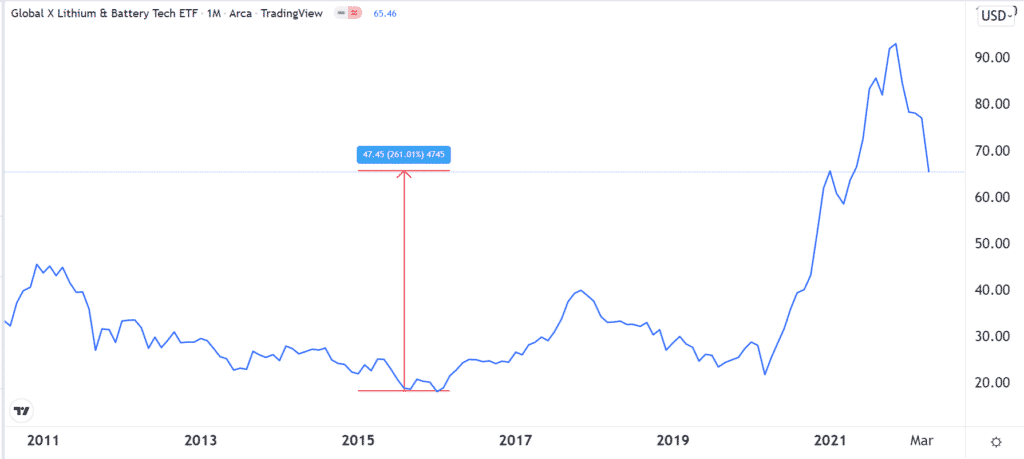

Lithium & Battery Tech ETF (LIT)

The Lithium & Battery Tech ETF is a fund provided by Mirae Asset’s Global X division. It is the biggest ETF that has exposure to lithium metal. According to its documents, the fund has over $4.16 billion in assets under management. It is a relatively expensive fund that has an expense ratio of 0.75%. The fund tracks the Solactive Global Lithium Index.

The benefit of investing in LIT is that it allows investors to invest in the full lithium cycle, which includes mining and refining. It also has companies that manufacture lithium batteries. Another advantage is that it makes it possible to invest in companies that are extremely difficult to invest in since they are listed in countries like China and Australia.

The biggest companies in the LIT ETF are Albemarle Corp, Tesla, TDK, Samsung, Panasonic, and Quimica.

Lithium & Battery Tech has had a good time as a publicly traded fund. It started trading at $33 in 2020 and reached an all-time high of $93. The fund has risen by over 260% from its lowest level of all time in 2015.

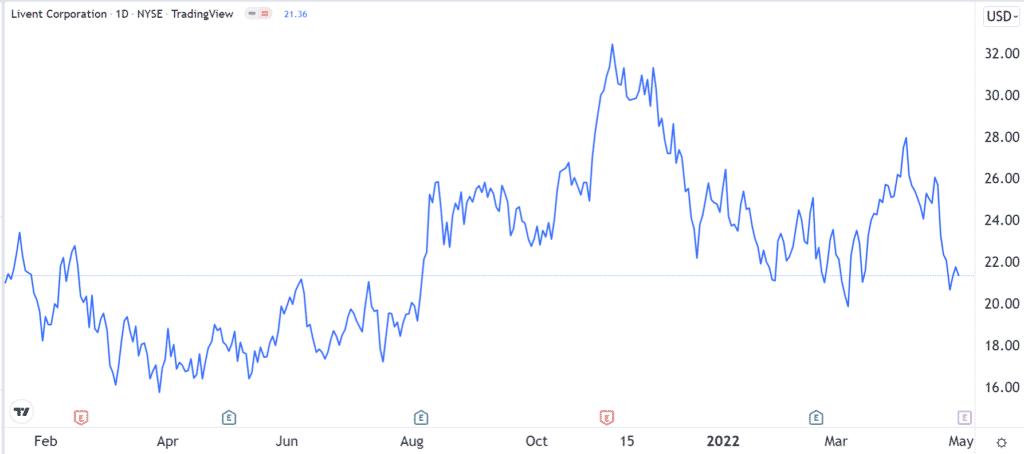

Livent Corporation (LTHM)

Livent Corporation is a leading materials company with a market cap of over $3.45 billion. The company uses lithium to produce important components that are used in various industries like automotive, pharmaceuticals, agriculture, industrial, and aviation. It creates energy storage & battery systems, polymers, and grease.

Livent’s business has seen robust growth in the past few years. For example, its total revenue surged to over $420 million in 2021 from the previous year’s $288 million. It also moved back to profitability as its profit jumped to $23 million.

While Livent has done well as a company, its stock price has lagged in the past few years. While the demand for its products has risen, the cost of doing business has been elevated since lithium prices have risen. Still, there is a likelihood that the shares will do well as prices stabilize and demand stay high.

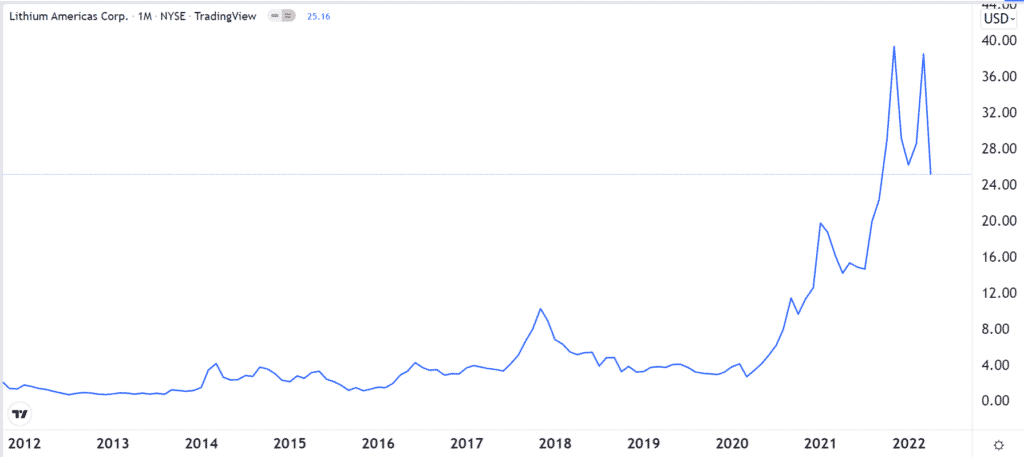

Lithium Americas Corp (LAC)

Lithium Americas is a leading Canadian company whose shares trade both in Toronto and United States. The company has a market capitalization of over $3.3 billion, making it one of the biggest firms in the industry. It has operations in both Argentina and Nevada.

Lithium Americas has had no revenue in the past few years as it continues to develop its mines. It has about 1,500 workers in Argentina who are building its mine, which has cost over $741 million. Further, the firm acquired Millenial Lithium Corp in Argentina for over $390 million.

In the United States, the firm’s Measured and Indicated Resource placed the estimates of lithium deposits at over 13.7 million tonnes. Lithium Americas has over $511 million in cash.

Lithium America’s stock price has had a successful run as a publicly-traded company. It rose from a listing price of $2.16 in 2011 to an all-time high of $39.27 in 2022. The stock will likely keep doing well in the coming years as the lithium industry continues to do well.

Pilbara Minerals (PILBF)

Pilbara Minerals is one of the biggest lithium mining companies in Australia. The firm, which has a market cap of over $6 billion, has operations in the Pilgangora Project, which is located in Western Australia. This mine is notable since it exists at the largest hard rock lithium deposits in the world.

The company also owns the 2 million tonnes per annum Pilgan Plant in the country. This is a relatively new mine that started shipping in 2018. Its other plant is in Ngungaju, which is expected to start producing products in the coming years.

Pilbara generates revenue of over $296 million per year and has a net income of $60 million. This growth is expected to accelerate in the coming years as the company brings more mines online.

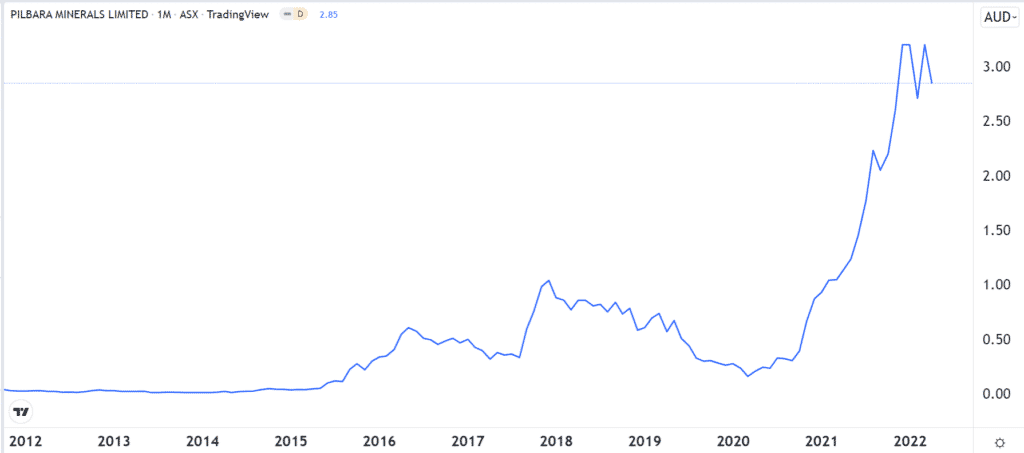

Like Lithium Americas, Pilbara shares have been in a strong bullish trend in the past few years. The stock moved from a low of A$0.04 in 2012 to an all-time high of A$3.20 in 2022.

Albemarle Corporation (ALB)

Albemarle Corporation is a leading chemicals company that has a market cap of over $22 billion. The American company manufactures many products that are grouped into Lithium, Bromance, and Catalysts.

Its lithium business creates products like lithium compounds, lithium hydroxide, lithium carbonate, and lithium aluminum hydride. These are important products that are used in the manufacture of many items like greases, car tires, and vitamins.

Albemarle sources its lithium mostly in Chile and Nevada. It also has a joint venture with Windfield Holdings, which has large operations in Australia. The benefit of this model is that the company has little exposure in China. The Lithium segment is the most important for the firm, bringing in over $1.3 billion in annual revenue.

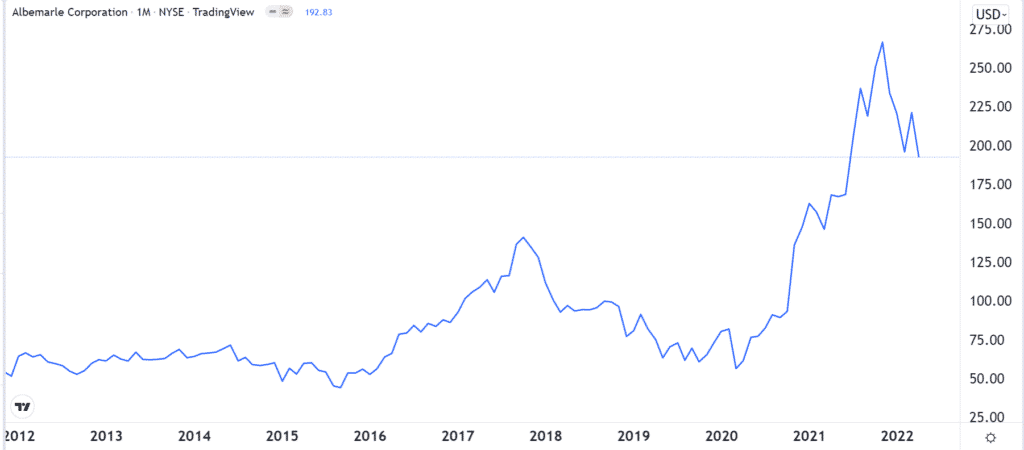

Bromine has more than $1.1 billion, while the catalyst is the smallest segment. Like the other companies, Albemarle stock has done well, as shown above.

Summary

In this article, we have looked at some of the most important lithium stocks in the world. In addition to these ones, other notable mentions are Savannah Resources, Piedmont Lithium, and Galaxy Resources.