The Peloton (PTON) stock price crashed on Wednesday after the company announced a decision to recall its popular treadmills after a series of accidents. The PTON share price declined to $81.38, which was the lowest level since September last year. The shares are 51.78% off their year-to-date high.

Peloton rally turns sour

Peloton is a company that is revolutionizing the fitness industry. The firm manufactures treadmills and other fitness products and accessories. It makes money through hardware sales and subscriptions.

As such, the firm was a major beneficiary of the coronavirus pandemic. With gyms closed, more people flocked to its platform to buy the items.

Indeed, the company faced supply challenges to deliver its products. This, in turn, made the Peloton stock price one of the top performers. Between March 2020 and January this year, the stock was up by more than 850%.

Recently, though. The PTON stock has struggled as investors question whether the company will be able to maintain its growth trajectory as people go back to the offices.

This week, the situation worsened when the company announced that it recalled its treadmills for causing accidents and deaths. This decision came a few weeks after the Consumer Product Safety Commission (CSPC) warned customers about the risks of these products. The firm was also sued after a child died a few months ago.

The recall is a major risk for Peloton, which is ramping up sales of the product. Also, there is a reputational challenge for the company if its customers cannot trust the products that it sells.

Peloton earnings preview

The recall announcement came a day before the company is expected to deliver its quarterly earnings. Analysts expect that the firm’s total revenue jumped by 113% year-on-year in the first quarter.

Furthermore, many Americans who received stimulus checks likely spent money on Peloton hardware or subscription products.

Analysts also expect that it will report an Earnings per share (EPS) of -$0.08, which will be a 60% year-on-year growth. Still, the company will likely surprise by beating on revenue, EPS, and margins. Besides, most tech companies are usually a bit conservative in their guidance.

In the conference call, analysts will likely question the company on safety issues and what they expect will happen going forward.

Is the PTON stock a buy?

Peloton’s stock price is struggling. Nonetheless, the company has an excellent market share in an industry it helped create. Further, while the firm is facing negative headlines, there is a possibility that it will use it to its advantage.

In fact, in the past, many companies have done exactly that. For example, a few years ago, Chipotle Mexican Grill (CMG) faced challenges because of an e-coli outbreak. Today, the shares have jumped by more than 300% from their lows.

Recently, in the UK, Boohoo also faced challenges when it was accused of mistreating its workforce in Leicester. On Wednesday, the firm reported a 38% sales growth.

Therefore, while the negative headlines will remain, there is a possibility that the PTON stock price will bounce back.

Peloton stock price analysis

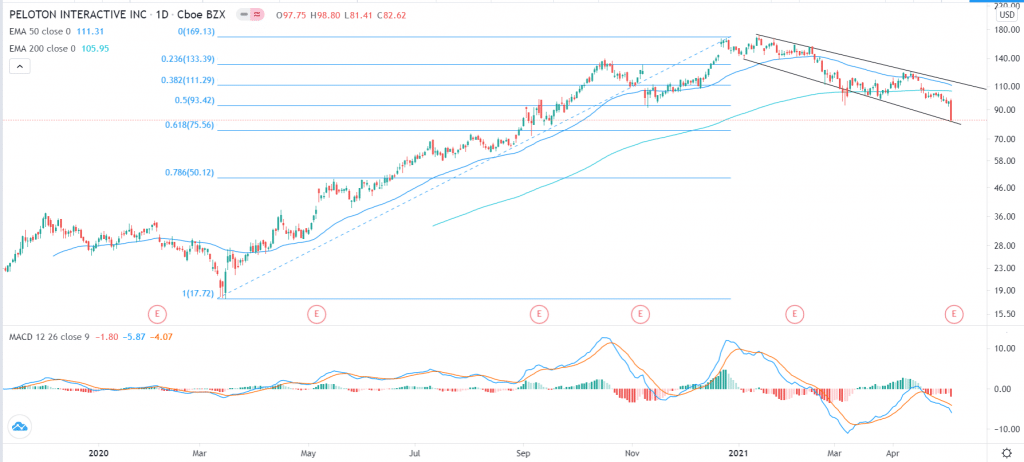

The daily chart shows that the Peloton stock price crashed below the 50% Fibonacci retracement level. The stock has also moved below the 50-day and 200-day exponential moving averages.

The two seem close to forming a death cross while the MACD has continued to drop. Therefore, the stock could drop to the 78.6% retracement at $50.12. In the long-term, though, I can’t rule out an eventual bounce to its all-time high.