Why would an economy be expanding yet significantly underperforming in terms of investors’ interest? China was one of the few countries that overcame the spread of the pandemic, finishing the year 2020 positively in terms of GDP growth.

Today mere economic growth might not be enough for the market to look appealing to investors.

That’s what happened to China. Although the country’s GDP grew 2.3 percent in 2020 and showed an extremely positive dynamic since then, China’s stock markets fell out of investors’ favor. Chinese equities started the year 2021 with strength but dived into a deep correction, erasing all of the current year’s gains.

Has China fallen out of favor?

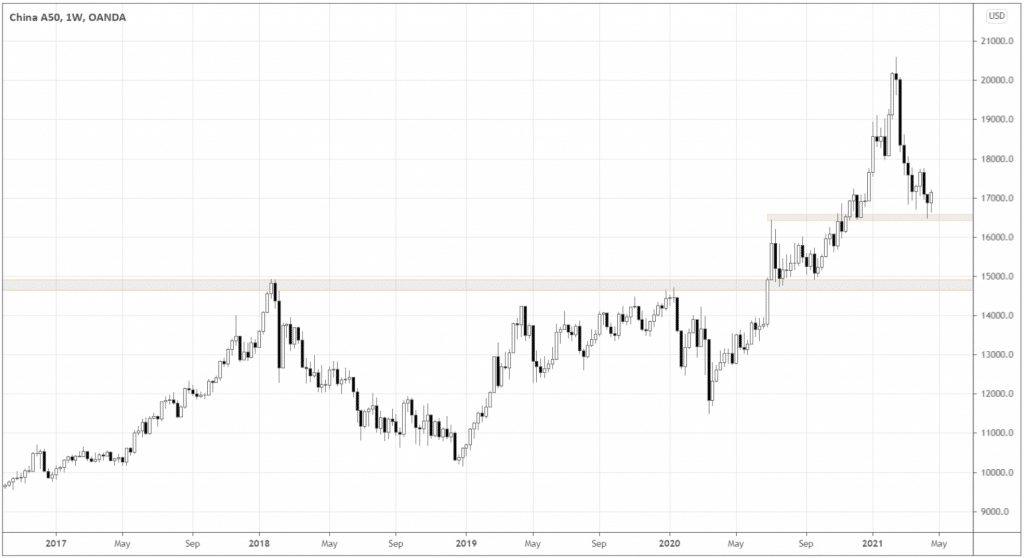

Look at that steep surge of ChinaA50 at the beginning of 2021! That’s what happens when the positive market narrative is playing out.

Since the middle of February, the Mainland index has been sharply declining, reaching the former resistance-turned-support around 16500.

After such explosive growth, the correction is healthy. I’d expect the one to stop around 18000. However, the relative weakness dragged the index deeper to the technical level of 16500.

Reasons for the stained sentiment

What could have such an impact on the Chinese index? Let’s look at the loudest reasons that have been prevalent lately.

1. The state of the credit market is often the earliest indicator of economic health. There’s been havoc in the Chinese bond market recently. The concerns over the solvency of the biggest partially state-owned bad-debt manager China Huarong Asset Management Co caused increased volatility in the company’s bonds.

China’s regulator doesn’t seem to bail out Huarong because of insufficient liquidity to repay the debt. Will the uncertainty about the debt spill over to other asset management companies?

2. Chinese regulator dealt fiercely with Ant Financial and its founder Jack Ma, which previously spoke openly against the government’s policies.

The government had forbidden Ant Financial to go public right before its IPO and fined Jack Ma’s Alibaba $2.8 billion due to antitrust law violations.

China likes to see its enterprises succeeding, as long as they aren’t a threat to the government’s control.

If Chinese companies’ growth is limited due to political reasons, investors may have concerns.

3. China increased military activity around Taiwan, including frequent air force incursions. The possibility of the military conflict may bring serious trust concerns in the Chinese stock market.

4. China has been clashing with Australia since 2018 after Australia blocked Chinese investments into its national security-sensitive assets. China slapped Australia with numerous trade tariffs, destabilizing international trade.

Where is the relative strength?

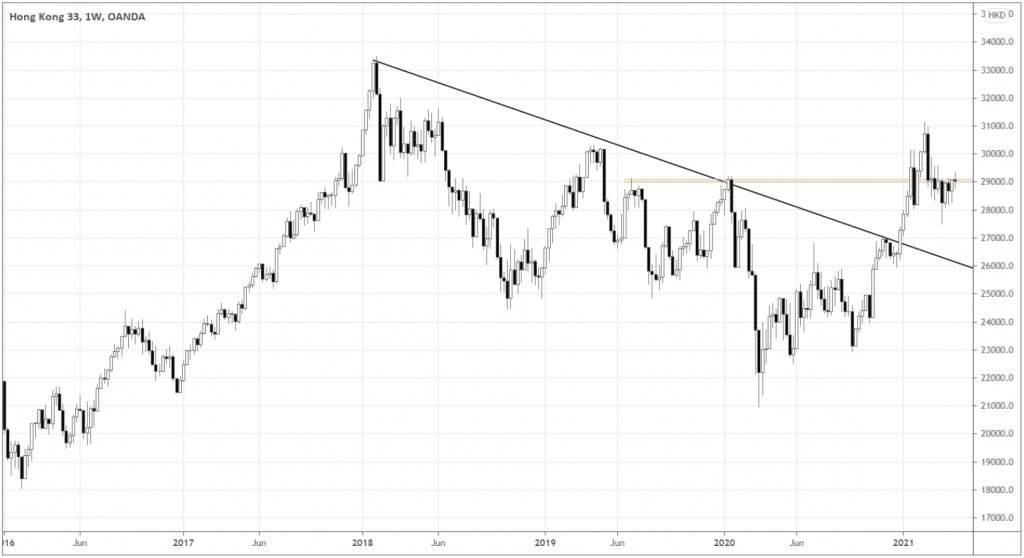

A fair alternative to investing in China could be the Hong Kong index HK33, as it’s currently relatively stronger than China A50.

If the market breaks out and holds above 29000, there are good chances for an upside move continuation. Look for a big white body candle with the close around 29200 to consider buying.

How China’s rivals are doing?

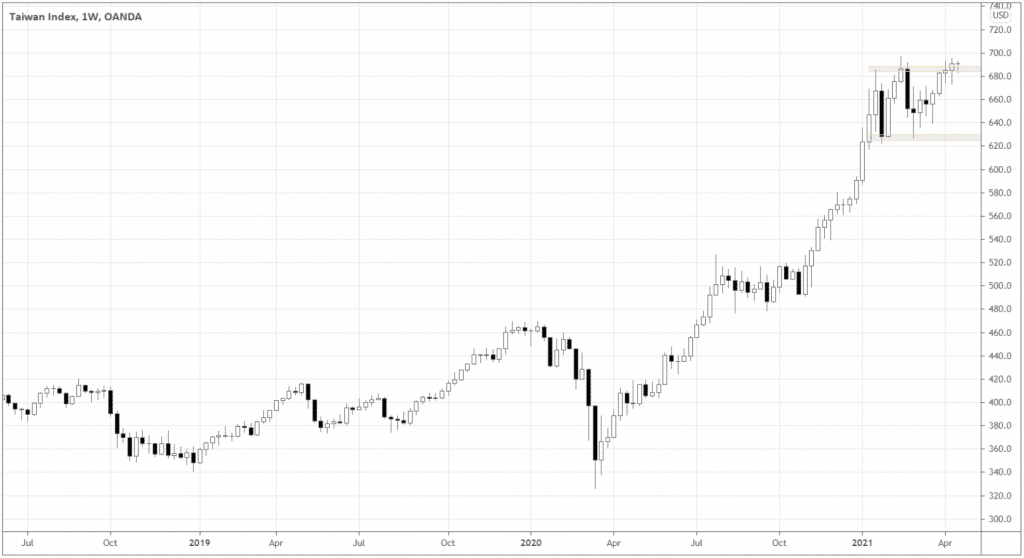

Although Taiwan might be under threat of the military conflict, its economy still dramatically benefits from the world chip shortage, boosting the biggest chip producer TSMC, which constitutes roughly a half of the Taiwan Index’s weighting.

Taiwan Index is recovering from the correction and approaching an all-time-highs. It’s nice to participate here if the index is above 700.

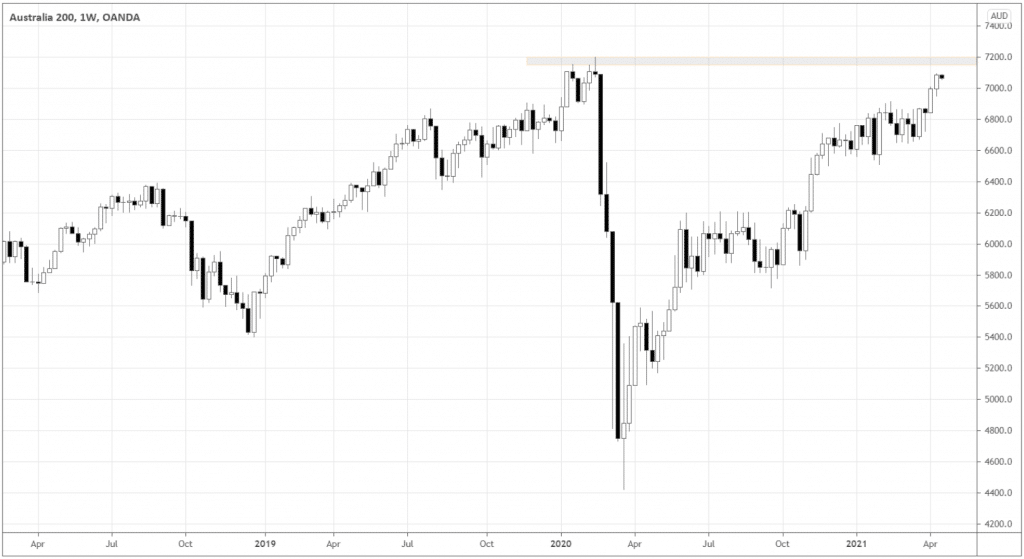

How about the Australian stock market?

Considering that China is Australia’s biggest trading partner, the impact of trade tariffs is reasonably muted. Australia’s index is approaching an all-time high after a breakout from a recent base.

What would happen if China eases the tariffs then? Any progress in lifting the tariffs may accelerate Australian stock market growth even more.

Conclusion

China’s foreign and domestic affairs may spread doubts among investors over the country’s financial markets as a trustworthy investment vehicle. HK33 could be a good alternative if you want to get exposure to China due to its relative strength. Taiwan and Australia that are supposed to be negatively affected by China’s geopolitics, show strength in their respective stock indices.