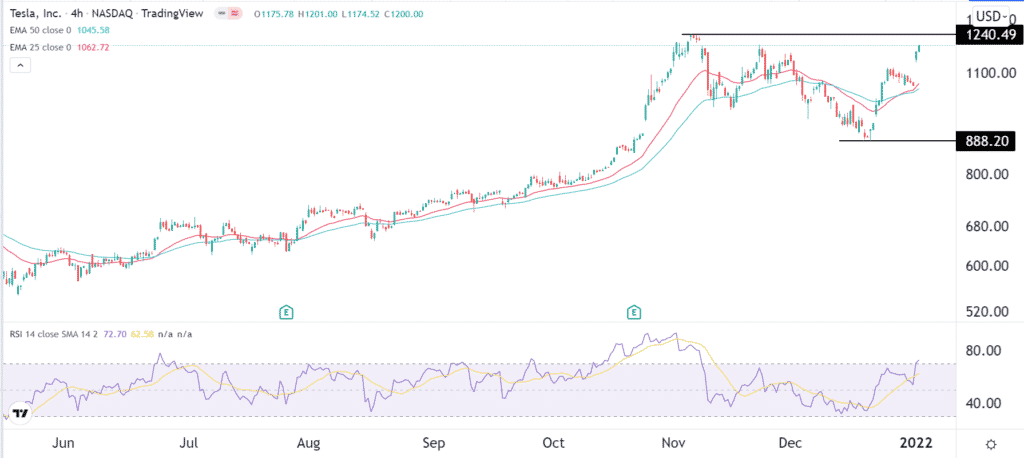

The Tesla stock price surged by 13% on the first trading day of the year after the company announced strong delivery numbers. The shares ended the day at $1,199, which was slightly below the all-time high of $1,240. This price was also about 35% above the lowest level in December.

Strong deliveries

Tesla, the world’s most valuable automaker, was the top performer on Monday as investors reflected on the strong December deliveries. In an announcement, the company announced that it delivered 308k cars in the fourth quarter of 2021. That figure was better than what most analysts were expecting by about 40k.

For the full year, Tesla delivered 936k cars, which was almost double than what the company delivered in the previous year. These numbers were impressive for two main reasons.

First, they showed that Tesla managed to deal with the supply chain disruptions better than most companies. As you recall, most automobile companies like Ford and General Motors lowered their estimates because of the chip shortage.

Second, the numbers were good because they show that the company is ramping up production even before it opens its new plant in Berlin. Therefore, with the plant set to open this year, there is a likelihood that the company will deliver millions of cars this year.

Tesla pole position

The Tesla stock price has done well in the past decade. It has risen by over 1,000% in the past three years. The strong performance is mostly because of the company’s pole position in the EV industry.

By delivering over 936k cars in 2021, the company has beaten all competitors that hope to become leading players in the EV industry.

Also, the company has mastered the art and science of efficiency. For example, it has managed to build large plants in a less period than other companies.

Most importantly, Elon Musk was visionary to invest in the company’s charging infrastructure in the United States and around the world. That has left other automakers behind. Most of them are now relying on the Electrifying America system and those offered by private companies.

Another reason why the Tesla stock price has done well is that the firm has a strong following around the world. On Monday, it was revealed that the company had opened its first outlet in Xinjian, a place where it has strong demand. Its demand in China is even higher than that of Chinese companies like Nio and Xpeng.

Tesla also has higher margins than other automakers. For example, the company does not spend money on marketing, which is one of the biggest expense that other automakers face.

Additionally, Tesla is expected to start selling its pickup truck in 2022, which will be a catalyst for its stock price. The same is true for its semi truck business.

As a result, analysts are generally optimistic about the Tesla stock price. RBC analysts boosted their forecast from $950 to $1,005 while those from Deutsche Bank and Credit Suisse expect it to rise above $1,200.

Tesla stock price forecast

The four-hour chart shows that the Tesla stock price has been in a strong bullish trend in the past few days. As a result, the stock has moved above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) and MACD are tilting upwards.

It is also at a key resistance level since it was the highest level on November 22nd. Therefore, the outlook for the stock is still bullish, with the next key level to watch being at $1,300.