- PayPal stock up 29% year to date ahead of Q2 report

- PayPal expected to beat top and bottom line

- Venmo on the spotlight given role in driving mobile payments

- Impact of cryptocurrency support on the spot

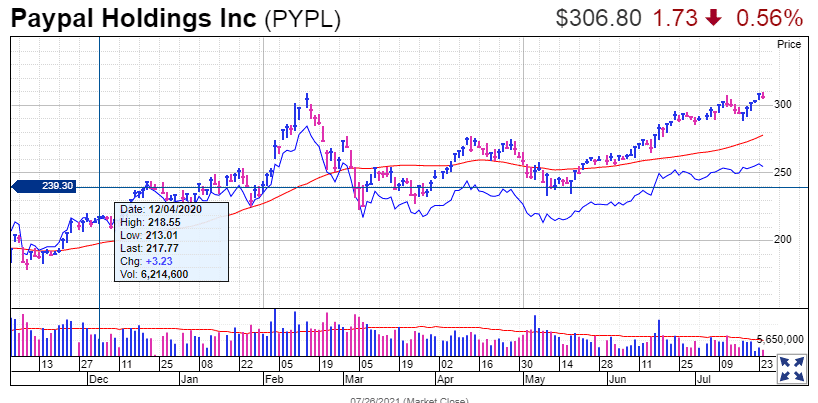

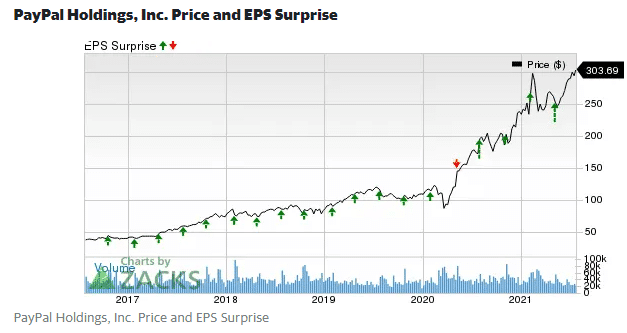

PayPal (NASDAQ: PYPL) will report its second-quarter results on July 28, 2021, after exiting the market with a blockbuster first-quarter report in May. Ever since the company reported solid Q1 results, the stock has been on a fine run, rallying to all-time highs.

The stock is up by about 29% year to date and is trading near its 52-week highs recorded in February.

The impressive run comes on the company starting the year on a bang, topping analysts’ expectations on revenue and earnings growth. The total payment volume processed surged to $285 billion in Q1. Management lifting the full-year outlook only went to affirm the underlying growth.

Q2 earnings expectations

Wall Street expects PayPal to report a 16% year-over-year growth in revenues to $6.26 billion as the company projects $6.25 billion. In the first quarter, sales were up 29% year over year to $6.03 billion, topping analysts’ projections of $5.90 billion. The increase was mostly driven by a 50% jump in total payment volume.

The digital payment specialist is projected to deliver earnings per share of $1.12, up from $1.07 delivered last year in the same quarter. In the first quarter, earnings nearly doubled to $1.22 from $0.66 a share a year ago. PayPal, on its part, is projecting non-GAAP earnings of $1.12 a share, suggesting a 5% increase.

What to look out for?

When PayPal reports, the focus will be on how the opening of the US economy impacted e-commerce spending. Increased spending translates to more fees for the company through its array of payment applications led by One Touch and Venmo.

Payment volume is believed to have increased significantly owing to increased consumer spending, as has been the case in the aftermath of the pandemic. Customers are increasingly shifting to contactless payment options in the aftermath of the pandemic, a trend that is increasingly benefiting PayPal transaction volumes.

In addition, net new active accounts will be closely watched as more people turn to contactless payments. The focus will be on the payment transactions per active account and the total number of payment transactions.

Wall Street expects PayPal to deliver active customer accounts of about 404 million, suggesting a 16.8% increase from last year. Payment transactions per active user, on the other hand, are expected at 43.2 million, signaling a 10.2% increase from last year’s level with the total number of payment transactions at 4.7 billion, signaling a 25.1% increase from a year ago.

Venmo, the company’s peer-to-peer payment app, has emerged as a major catalyst for PayPal revenues in recent quarters. It accounted for $51 billion of the company’s $285 billion total payment volume in the most recent quarter. In addition, increased e-commerce payment spending during the pandemic should have bolstered the company’s payment transactions and payment volumes.

In April, PayPal diversified its revenue base once more with the addition of support for cryptocurrencies. The company now allows people to buy, sell, and hold cryptocurrencies from which it generates fees expected to have had some impact on total revenues in the quarter.

Bottom line

PayPal has been on a fine run jumping more than 60% over the past 12 months. The impressive run stems from heightened e-commerce activity that has triggered strong demand for contactless payments.

The strong business momentum on the payment front has helped strengthen the stock’s sentiments in the market, fuelling the rally. Consequently, a solid Q2 report that affirms growth will only strengthen investors’ confidence and is likely to fuel another leg higher.