- JPMorgan stock up 20% plus ahead of Q3 report.

- Q3 Earnings and revenues expected above estimates.

- Focus on interest income that has underperformed the past year.

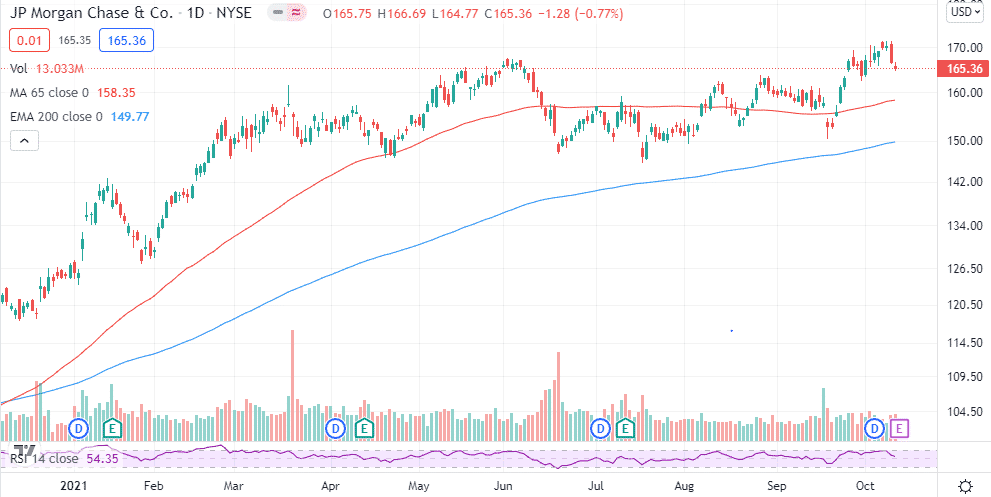

JPMorgan is poised to kick off a pivotal Q3 earning session in the banking sector at a time when the equity market can’t seem to find a breather after a recent pullback from record highs. The U.S. largest lender will report before the market opens on October 13, 2021.

Expectations are high the bank will report moderately higher third-quarter profits before pandemic related accounting adjustments that have doubled earnings taper off. JPMorgan heads into the earning session at the back of an impressive run in the market.

The stock is up by more than 20% year to date and is trading near record highs. Additionally, the stock has gained more than 10% in recent weeks, its sentiments and outlook bolstered by a spike in U.S. Treasury yields.

The Q3 earnings report comes at a time when the overall market has corrected from record highs, with the three major indices pulling back by more than 5% from record highs. Consequently, the report could be pivotal if JPMorgan is to hold on to gains at record highs or pull back.

Q3 expectations

Wall Street expects the U.S. lender to deliver earnings of $3 a share, representing a 3% year-over-year increase. Revenue, on the other hand, is expected to land at $29.79 billion flat when compared to the same quarter last year.

The expected Q3 EPS of $3 and revenue of $29.79 billion are slightly higher than the original estimate following revision upwards. In the second quarter, JPMorgan’s revenue was down 8% year-over-year as earnings per share rose 174%.

The Q3 earnings report will be supported by healthy corporate credit markets and bond issuance. The bank’s three segments of consumer, commercial, and capital markets are expected to post decent growth metrics despite the Federal Reserve maintaining the benchmark interest rate at record lows.

While revenue from interest has been flat for the better part of the year, that could change in Q4 as interest rates inch higher. JPMorgan should be able to earn better returns from its cash balances. The bank should be able to charge higher rates to consumer and commercial loans expected to bring in higher margins and profits as the year comes to a close.

For the full year, earnings per share is expected to grow 59% year-over-year as revenue tick up 2%.

What to look out for

When JPMorgan reports, the focus should be on the investment banking division. The market expects the segment to deliver spectacular gains thanks to a record-breaking boom in takeovers. In addition, strong equity trading volume and brisk M&A activity should have a significant impact. However, the fixed-income trading volume could decline significantly and is likely to be offset by strong equity volumes.

Additionally focus will be on the net interest revenue, which accounts for nearly half of all revenue in the banking sector. Revenue on this front has been stagnant for the better part of the past year owing to the prevailing record low-interest-rate environment.

The segment could receive a boost in the coming months on the Federal Reserve hiking interest rates as it moves to ease the accommodative monetary policy. New loan demand for businesses and consumers with the opening of the U.S. economy is also expected to drive net interest revenue higher in the coming months.

Valuation

JPMorgan heads into the Q3 earning session fully valued and trading at 2x tangible book at about $165 a share. It currently offers a decent 2% dividend yield while trading with 12x and 14x 2021 and 2022 EPS estimates.

Bottom line

JPMorgan Q3 report comes at a time when the stock is trading near all-time highs. A better than expected report could strengthen investor sentiments in the stock resulting in a price jump. Additionally, rising treasury yields and easing of monetary policies should continue to support a positive long-term outlook.