A shell company is a special purpose vehicle used by individuals and companies for the transaction of strategic business on their behalf. The word “shell” denotes that such an entity does not own assets and is only active on paper. They are established with the intention of circumventing legal barriers, maintaining secrecy on the actual ownership, sourcing for foreign capital investment, among other functions.

In some instances, shell companies are used for transacting illegal businesses. Some of the common illegal activities in which shell companies are involved include tax evasion, money laundering, and funding crime. In addition, shell companies are often registered by persons engaged in crime but who are keen on staying under the radar of law enforcement officers.

Such illegal maneuvers have led to increasing calls for tighter regulations against shell companies. While it is widely perceived that shell companies are exclusively large corporations, in actual terms, even small companies are allowed to operate as shell companies.

The bottom line is shell companies are often shrouded in mystery, with many people perceiving them as instruments of deceit.

How shell companies are formed

According to the Securities Exchange Commission, a shell entity does not own nominal assets or operations. The process of registering a shell company is in many ways similar to registering a conventional company. The company must pay a registration fee and submit the required documents and details of the owners and directors.

Reasons for forming a shell company

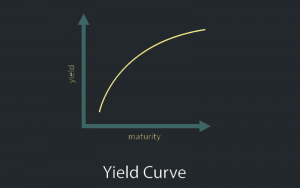

To invest in tax havens: These entities may be registered as a way of benefiting from tax havens. This allows them to maximize their returns from their business deals. By operating from tax havens, they can do business in other countries and benefit from friend tax regimes in the tax havens.

Investment vehicle: In some instances, a company may want to invest in an overseas territory, but barriers against foreign companies may prevent them from seeking such investment opportunities. Under such circumstances, a shell company would be an ideal entry vehicle for breaking down market barriers.

Takeover strategy: In some cases, investors’ bid to acquire a company may be met with resistance due to unfavorable perceptions of the would-be new owners by the target company’s management. In order to succeed, a shell company may be used to mask the real owners from harsh scrutiny.

A strategy for hiding transactions: Some large corporations use shell companies to conduct transactions whose details they prefer keeping hidden from public scrutiny. The details may include information like payment for security services, kickbacks for business deals, etc.

For hiding identity: Some investors establish shell companies out of the need to keep their operations and identities hidden. For example, they may want to hide the trail of their dirty money or protect their money from the prying eyes of criminal organizations.

Advantages and Disadvantages

Below are the advantages and disadvantages of shell companies.

Advantages

Low taxes and increased rate of growth: They can be used as a means to reduce the tax burden on a company. This results in increased profit margins for them, thereby enabling them to grow at a faster rate.

Circumventing investment barriers: Through them, investors can do business in countries where they would otherwise be unable to invest due to legal restrictions. These companies are, therefore, enablers, making it possible to expand their markets. This also includes the ability to trade in security markets of other territories.

Safety net against lawsuits: They can cushion their owners against seizure of their assets in case they run into trouble with tax authorities. Most of the assets owned by shell companies cannot be traced easily.

Disadvantages

They have a high degree of risk: Since shell companies tend to hide some of the business transactions they are involved in, an investor may inadvertently channel their money towards illegal investments.

Perceived bad image: They are generally viewed with suspicion due to their tendency to be used in tax evasion and their usage giving an undue advantage over competitors. This can taint the images of these companies to the extent that makes a recovery expensive.

In recent times, shell companies have been adversely mentioned in major global tax evasion and money laundering scandals such as the infamous Panama Papers leaks.

Perceived as tax evasion vehicles: They are often seen as perpetrators of tax evasion. This is because of their liking for tax havens and highly-guarded secrecy in financial transactions. Therefore, they are typically easy targets for tax evasion accusations.

In summary

Shell companies can be useful investments for people who want to break through various barriers that exist in the administrative and tax jurisdictions. They also offer owners an opportunity to keep their operations hidden from the public.

However, by enjoying the tax privileges and operating anonymously, shell companies raise both warranted and unwarranted suspicions. In some cases, these companies can be used in illicit trades. Therefore, before investing in one, ensure that you weigh the risks involved and have a clear target to aim for.