The commodities industry is going through a supercycle that has seen most prices rise to record highs. The cycle has been caused by increasing global demand, supply chain disruptions, and high transport costs.

Lithium has seen its demand jump to record highs as many countries map their electric vehicle future. This article will explain what lithium is and how to invest in it during the global crisis.

What is lithium?

Lithium is an industrial metal that is known for being the least dense metal and solid in the world. It is known for other qualities as well. For example, it is an alkali metal that is highly flammable, meaning that it must always be stored in an inert atmosphere.

These characteristics make lithium to be one of the most useful metals in key industries. For example, it is used in the manufacturing of batteries, glass, ceramics, and lubricating grease. Further, lithium is used in making air purification, optics, and silicon nano-welding products.

The most important use of lithium in modern times is in the battery industry, considering that the world is transitioning to electric vehicles. At the same time, many countries are embracing energy storage solutions in a bid to reduce their carbon footprint.

Biggest lithium producers

As an investor or trader in all types of commodities, it is important to know where they come from. For example, in 2022, the price of wheat surged when Russia invaded Ukraine since the two countries are the two biggest producers in the world.

The biggest lithium producer globally is Australia, even though it does not have the biggest reserves. It is followed by Chile, China, Argentina, and Brazil. In terms of reserves, the top countries with vast lithium resources are Bolivia, Argentina, Mexico, and the Democratic Republic of Congo.

With this in mind, let us look at some of the most popular ways of investing in lithium.

Invest in lithium CFD

A contract for difference (CFD) is a popular financial asset that is provided mostly by forex brokers. The product gives people an opportunity to buy or trade assets without directly owning them. They are essentially price trackers since an investor will make money when the price rises and vice versa.

Investing in a CFD is relatively easy. First, you need to find an online broker who offers these services. In particular, you should go for a broker who has lithium as one of their assets. As you will find out, many brokers don’t provide lithium since it is not a major financial asset like crude oil and gold.

Second, do your fundamental and technical, and price action analysis to determine whether buying the asset makes sense. In fundamental analysis, look at the macro factors that will affect prices. On technical analysis, focus on tools like Moving Averages and the Relative Strength Index. Finally, on price action analysis, focus on chart patterns like triangles and bullish and bearish pennants.

Invest in lithium futures

Another way to invest in lithium is through futures contracts. A futures contract is a popular method of investing in commodities. In fact, it is an instrument that helps to ensure that commodities are able to flow well internationally.

In the futures contracts, buyers and sellers agree on prices in advance. For example, a producer of commodity A can reach a deal with a buyer who will buy it at a future date, which is known as an expiry.

The same concept has been introduced in the financial market. Today, brokers like TD Ameritrade and Schwab provide futures ad options products on most commodities.

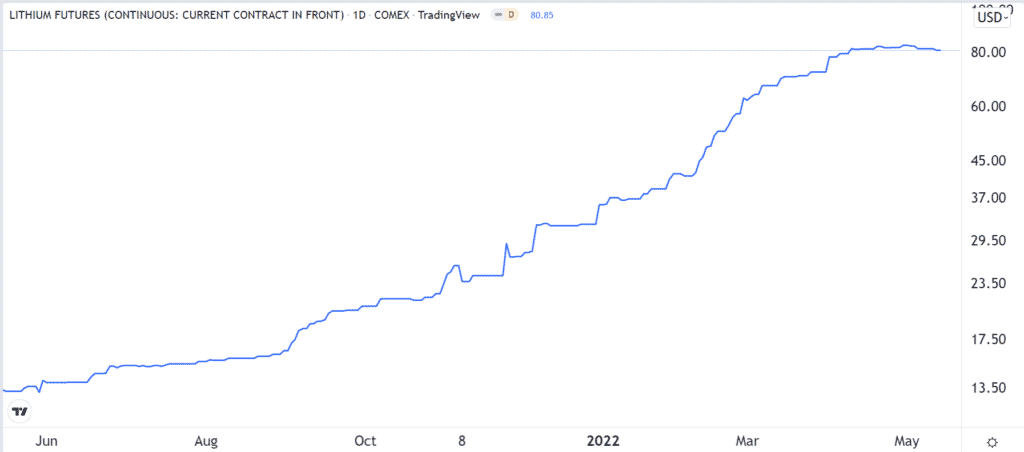

However, a closer look shows that most brokers don’t offer lithium futures. The chart below shows the performance of Lithium futures in the past 12 months.

Invest in lithium stocks

Meanwhile, many investors prefer investing in stocks as a proxy for lithium and other metals. The idea behind this is relatively simple. These investors believe that lithium stocks perform well when the overall prices of the commodity rise and vice versa. It is a concept that has been used to invest in other commodities like crude oil, natural gas, and copper.

For most Americans, investing in companies in the lithium industry is not easy since most of them are located abroad. The most popular lithium producers that are listed in the US are Lithium Americas and Livent.

Lithium Americas is a company in the mining industry that has operations in Nevada and Argentina. On the other hand, Livent manufactures lithium products like batteries, polymers, and grease.

Other international lithium stocks are firms like Albemarle, Pilbara Minerals, and Glencore.

Lithium ETFs

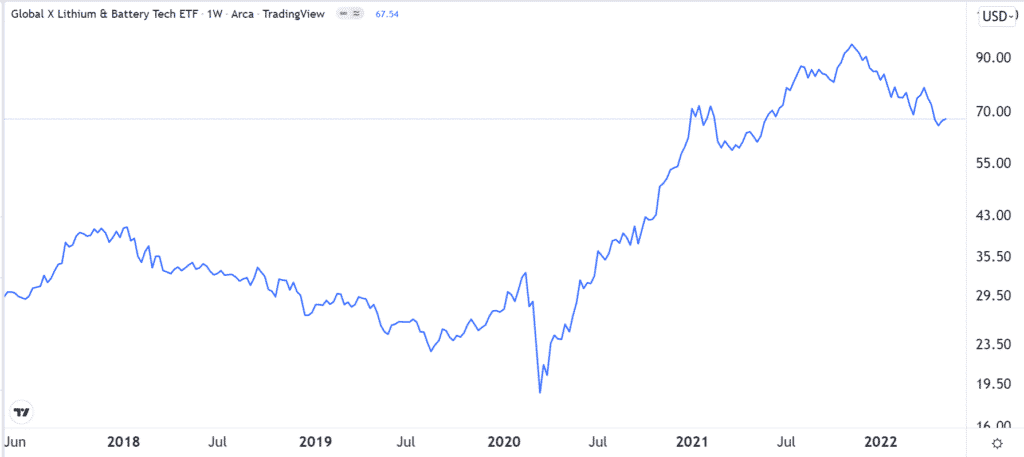

Finally, one can invest in lithium by focusing on ETFs. For most people, this is the easiest method since ETFs are provided by most brokers like Robinhood and Schwab. Another benefit of investing in ETFs is that they give you access to foreign companies that are big players in the lithium industry.

There are lithium ETFs in the US. The biggest of them all is known as the Global X Lithium & Battery Tech ETF. It has over $4.1 billion in assets and has some of the biggest names in the industry. 42% of its constituent companies are from China.

The top holdings are firms like Albemarle, Yunnan Energy New Materials, LG Chem, BYD, and Panasonic Holdings.

Most of these companies are highly inaccessible to American investors, meaning that the ETF serves them well. The chart above shows the performance of the LIT ETF in the past five years.

Summary

Lithium is a leading metal that has vast uses today. However, it is also a highly illiquid commodity, unlike crude oil and gold. In this article, we have looked at some of the most important features of lithium and how to invest in it well. We have also identified the popular lithium assets for investors.