In the trading world, the problem is no longer that of availability. Many of the sophisticated products which were available to only hedge funds and institutions a decade back are now available to retail traders as well. All this has been made easier due to technology and the rise of discount brokers. So the key issue for today’s trader is not the unavailability of the right product but rather the ability to pick a structure that perfectly fits his or her view.

For example, a trader might be of the view that stock A is going to rise from $100 to $115 in the next 1 month. One way to trade this view is by buying the stock in the cash market at $100. But why should one invest $100 when one can also make the exact same trade by buying a future on stock A on just 20% margin that is $20. This is where stock options are even more helpful.

Options are among the most popular financial derivatives especially among the new traders. That is because they offer a very high upside at a low cost. For example, suppose a stock it is trading at hundred dollars and your view is that the stock price should go $115 next month so to take advantage of this you can buy a call option of strike price $110 and typically the cost of this option would be something like 2 to 4 dollars so you can see that at a very low cost you are able to get the upside of nearly $15 or even more.

Option spreads – offering precision

But let us go a step further. By paying for a call option, one gets exposure to unlimited upside on the stock. But since our view is that the stock will rise to $115, why should we even pay for the extra upside? This is where option spreads come in. Vertical option spreads mean that we are buying and selling options of the same expiry simultaneously but different strike prices.

So in the above example, when the stock is trading at $100, we can buy a call option of $110 strike and sell a call option of strike $115 both with a one month expiry. So how does this structure differ from just a call option with a $110 strike and what benefits does it offer?

Let us look at the costs of both these structures. Let us say that the call option with a $110 strike costs $3. In that case, the call option with a $115 strike will cost slightly less so let us say $1.5. But remember that in our vertical option spread, we are selling the 2nd option. That means we will be getting the premium back. So while a call option will cost $3, the call option spread will cost us only $1.5, that is half the cost!

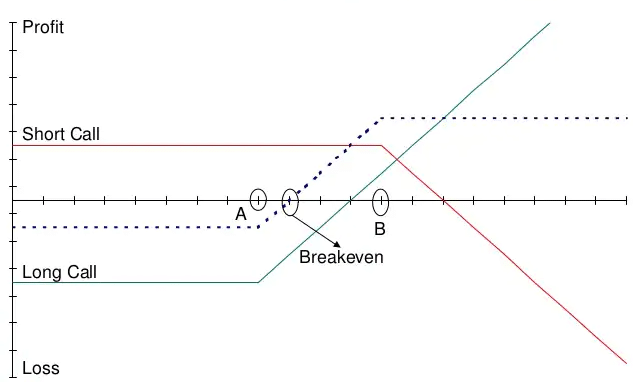

Call vs call spread – payoff

Now coming to the payoff structure for both – we know that for a call option costing $3 and strike price $110, the structure will start becoming profitable once the stock price crosses $113. Now for a call option spread, the breakeven price will be $111.5, which means we will start earning profit right from the point when the stock price crosses this level.

However there is a flipside. Since we sold a call option for strike $115, our profits will stop increasing once the stock price crosses $115. That is to say that unlike the unlimited profits that we might receive in case of a call option, our profits will be limited to $3.5 per structure in case of a call option spread as can be seen below.

Now in theory, this sounds pretty bad right? Who would pick a $3.5 profit over unlimited profits? But here we are talking about a case where we have a strong view that the stock price will rise till $115. That means we don’t expect the stock to cross that level anyway. So if the stock price ends at $115, then our profits in case of a call option would be just $2. That is less than 60% of the profits in case of an option spread.

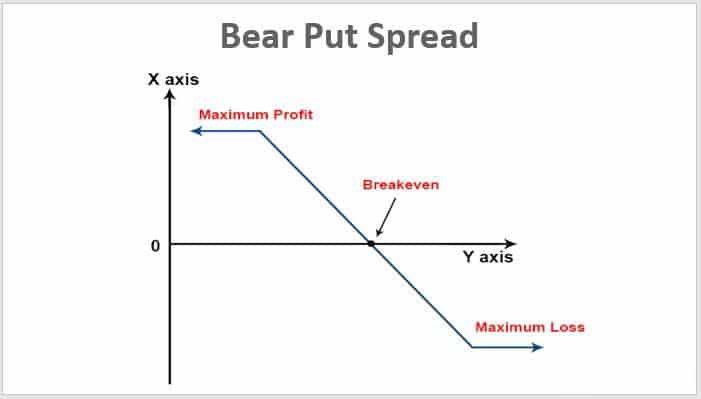

Put spreads

Option spreads with put options are also quite similar in nature with the direction flipped. As put options benefit when the price of stock falls, it means that the strike of the option we are buying is higher than the one that we are selling.

Let us take a similar example of stock A which is trading at $100. But our expectation is that the stock will go down to $85. So in this case we can either simply buy a put option or go for a put spread. The scenario plays out in a similar manner.

A put option with a strike price $90 will cost $3. It will give us profits once the stock price falls below $87, i.e. the breakeven price. On the other hand, if we go for a put spread, we will also sell a put option with a strike price $85 since we don’t expect the stock price to fall below that level. Selling that option will make our structure cheaper and reduce the breakeven price.

As can be seen above, a put spread will not see an increase in profits once the stock price falls below the strike price of the 2nd option that is $85 in our example. Although it won’t matter since our view is of the price falling only to $85 and not beyond.

So overall, vertical options spreads allow the traders to achieve one critical goal – precision. If we have a price target in mind then we can leverage it via option spreads to make our structure cost effective. This provides the perfect balance between profitability and cost.