Investment Thesis

- At the moment, the market believes nCino, Inc. (NASDAQ: NCNO) is overpriced because of a 17.37 price to book (P/B) value, even as the P/E ratio is in the negative territory nCino is close breakeven with 52.5% YOY quarterly revenue growth.

- We believe NCNO is underpriced for the following reasons. First, the company’s revenue per share (TTM) has been increasing in the past two years (it was at 0.65 in January 2018 and 1.54 in January 2020). Secondly, NCNO has a strong financial position considering that the debt to equity ratio stands at 0.16 as at Q2 FY2021.

- Investors could be playing the wait-and-see game with this stock because it is still in transition in terms of service delivery. In the most recently released financials, 53.68% of NCNO’s earnings accounted for the cost of revenues.

Should you include NCNO in your growth stock portfolio?

nCino went public a little over a month ago and, so far, the stock has not registered significant volatility. Moreover, the stock has maintained a 14% gap above the IPO price. It is possible that this gap might widen further due to an increased demand for nCino’s SaaS products.

This month alone, two major banks, Fifth Third Bank and Barclays, selected nCino as their partner in their quest to adopt digital transformation and cloud banking solutions. The banks seek to use the nCino Bank Operating System as a tool to streamline their operations, including onboarding of new customers and loan service management.

If the modernization of banks grows faster than expected, then nCino is likely to encounter more opportunities for expanding the adoption of SaaS solutions. nCino’s revenue future appears solid if the cost of revenue lags the expected growth. With the company’s stock fresh on Nasdaq, more exposure to investors who are yet to catch wind of its potential could ignite an exponential growth in the coming years.

What does nCino, Inc. do?

nCino, Inc. is a software-as-a-service (SaaS) solutions company with the head office in Wilmington, North Carolina, and it was founded as Bankr, LLC back in 2011. Pierre Naude is the President and CEO, who is also a cofounder of the company. nCino’s target customers are financial institutions both in the United States and internationally.

The nCino Bank Operating System platform is the company’s flagship product. In addition to digitizing operations, the platform streamlines and automates complex workflows and processes. Moreover, the platform utilizes artificial intelligence and data analytics to enable clients to onboard new clients, to manage loaning services and customer accounts, and comply with regulations.

The platform’s unique selling point is that it is cloud-based, meaning users can access it from any internet-connected device. Furthermore, its solutions span business lines. This means financial institutions can deploy the software to onboard new customers while at the same time managing loans and opening deposit accounts.

NCNO’s fundamentals provide a strong price support

NCNO’s fundamentals are strong. nCino generated $ 48.765 million in revenue for Q2 FY2021 (three months ended July 31), which is 52.50% higher than the same quarter the previous year. Looking at the revenue growth from the perspective of six months ending July 31, one notices that Q2 revenue growth was better than Q1, because the revenue growth for the six-month period was slightly lower at around 51.22%.

The revenue growth is adding to the company’s already strong financial position. nCino’s financial position is largely propped up by the stockholder’s equity as confirmed by the 0.16 debt-to-equity ratio.

Even rosier is the company’s guidance. nCino expects revenues to grow to up to $50 million in Q3 FY2021, a 2.53% growth relative to Q2 FY2021. For the FY2021, nCino sees its revenue ranging from $193 to $194 million. It means nCino’s cash runway is sufficient to last three or more years of operation.

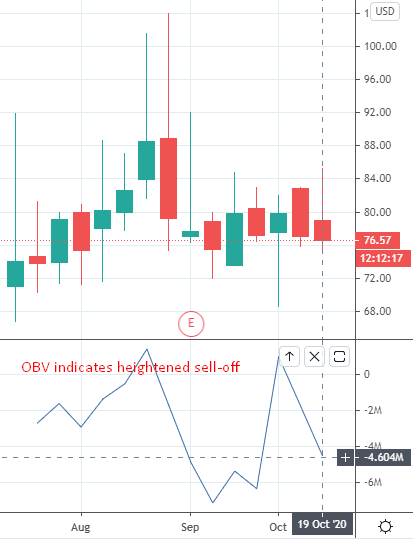

Technically, NCNO displays substantial volatility

NCNO has traded for a little over two months and the price action in this period appears to be ranging. While the market is ranging, it seems the long-term value of NCNO is still in limbo if one were to focus on on-balance volume (OBV) indicators on the weekly chart. The indicator points to a situation where investors are exiting the market in droves. In the last one week alone, 4.518 million NCNO shares were sold.

As argued earlier, the NCNO stock is currently underpriced and, as such, it is perfectly normal for investors to exit the market at the moment. It would be misleading to rely on OBV to predict the long-term scenario for NCNO’s price action.

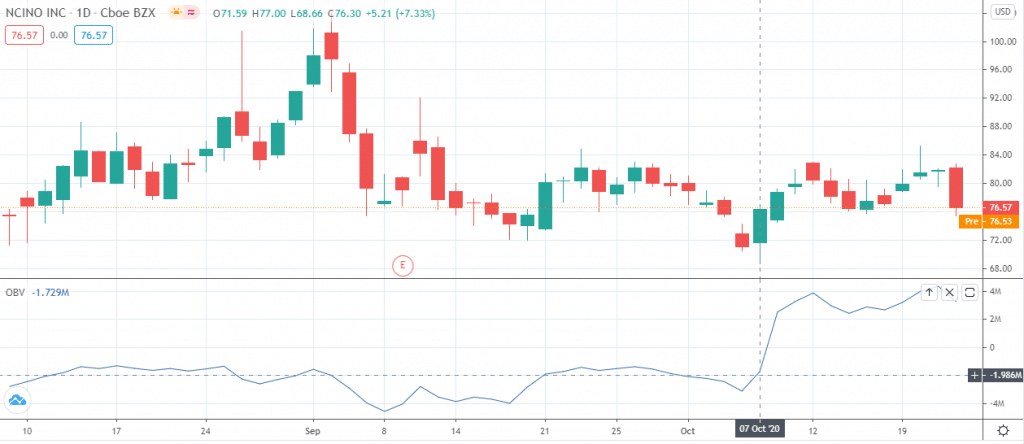

The scenario appears different when you consider the daily NCNO price chart. Although the market is still ranging, the OBV indicates positive price action over the past two weeks.

From a daily perspective also, it looks like the market is beginning to recognize the strength of NCNO’s fundamentals because signs of an uptrend are present. When the MACD is added onto the daily chart, one notices a slight cross-over when the volume spiked and climbed out of the negative zone.

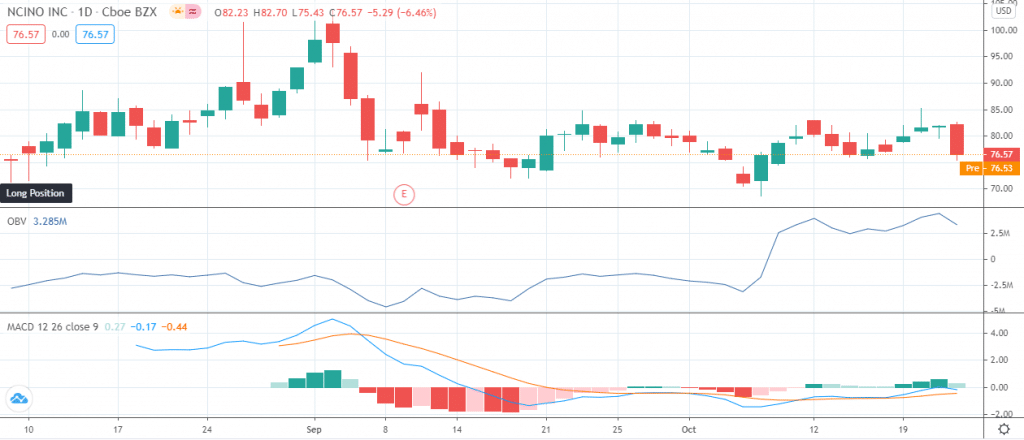

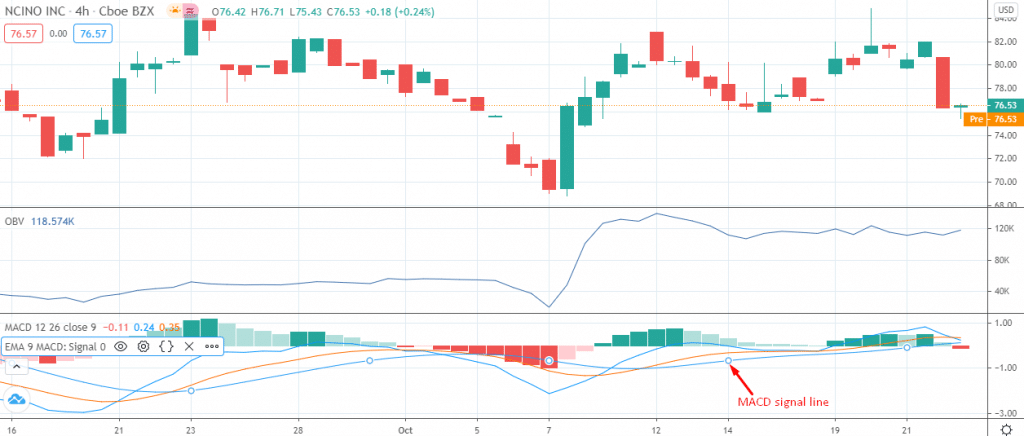

Zoomed into a 4-hour price chart, NCNO begins to show possible market entry points. To help us out, we added a signal line on top of the MACD. This MACD signal line is simply a 9-period exponential moving average (EMA), as labeled in figure 4 below.

The signal is BUY when the MACD crosses above the 9-period EMA, and this is what happened at around October 12. However, the signal is not as strong as one might want but at least there is a possibility of NCNO bottoming out.

Furthermore, the 4-hour chart yields a risk/reward ratio of 4.87 in the period since the market bottomed out. It means investors earned $4.87 for every $1 risked since October 7.

Conclusion

From a fundamental and technical perspective, NCNO has the strength to outperform the market. As such, our recommendation is BUY.