Pepperstone is Austrian forex and CFDs broker based in Melbourne. It started the business operation in Australia and then expanded worldwide. Pepperstone brokers offer trading in multiple currencies, stocks, metals, CFDs, and cryptocurrencies. Besides, they offer MT4, MT5, cTrader, and TradingView platforms with copy trading functions for all traders from beginners to advance. However, it does not provide services for US clients.

Pros

- Offers strong regulation from ASIC and FCA

- Multiple trading platforms: MT4, MT5, cTrader, TradingView

- Multiple account types to cover all kinds of traders’ need

- Provides NDD trading environment

Cons

- The minimum deposit requirement is A$200

- Does not provide services for US clients

Pepperstone is a forex broker based in Australia that started the operation in 2010. After capturing the local market, the company opened the London office in 2015 and served European clients.

The main aim of Pepperstone is to provide forex and CFDs trading opportunities with multiple trading platforms. Moreover, the company offers investment opportunities through its social trading platform.

The average daily trading volume for Pepperstone is US $12.55 bn, making it one of the largest forex brokers. Currently, they have more than 70,000 active traders who are continuously trading with the platform under ASIC and FCA regulations.

The trading cost in Pepperstone is high compared to other brokers that might be a discouraging fact for the company. However, based on the availability of funds with more increased regulation, investors can easily rely on this platform.

Regulation

Pepperstone is a multi-regulated broker from different authorities. Therefore, traders’ accounts might experience a change in policy with the change in geographical location.

The regulation and geographical Pepperstone’s offices are mentioned below:

- In Australia is licensed by the Australian Securities and Investments Commission (ASIC).

- In the UK is authorized and regulated by the UK Financial Conduct Authority (FCA).

- In EU is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

- In AE is authorized and regulated by the Dubai Financial Services (DFSA) Authority.

- Pepperstone Markets is authorized and regulated by the Securities Commission of the Bahamas (SCB).

- Pepperstone GmbH is authorized and regulated by the Federal Financial Supervisory Authority of Germany (BaFin).

- Pepperstone Markets Kenya Limited is authorized and licensed by the Capital Markets Authority (CMA).

Pepperstone mainly focuses on clients’ money protection, risk management, training, accounting, audits, and anti-money laundering within these regulations. However, based on our research, we found that the company follows all rules imposed by the statute. We did not find any significant complaints against the broker in multiple social channels.

Account Types

Pepperstone focused on clients’ requirements by providing two pricing models in their account types. The first one is the commission-based razor account, and the second one is the standard account. Therefore, traders may experience a change in trading costs among these account types.

- Razor account

The Razor account provides trading services in MT4 and cTrader platforms. This account type is a commission-based account where investors should pay an additional commission besides regular spreads.

Other features of the Razor account is mentioned below:

| Institutional grade spreads | Yes (with no markups) |

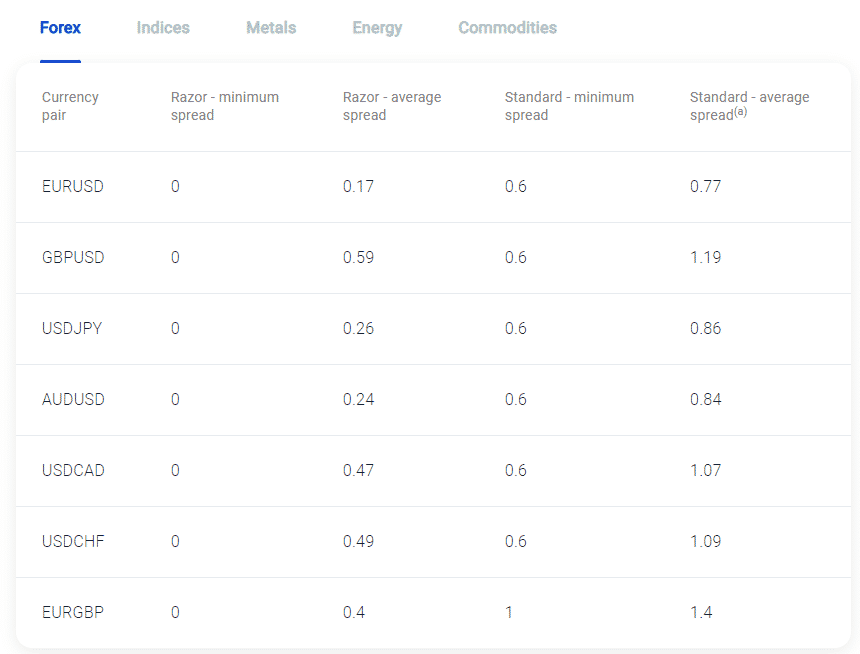

| Average EUR/USD spread | 0 — 0.17 pips |

| Commission | It starts from AUD 7 |

| Rollover swaps | It depends on the trading platform for market rates |

| Best for | Scalpers and algorithmic traders |

| Leverage | 1:30 Retail, 1:500 Pro |

| Minimum lot size | 0.01 |

| Hedging | Yes |

| Expert advisor | Yes |

- Standard account

In the standard account, spreads are higher than the razor account, but it provides trading opportunities in a commission-fee environment. During our review, the lowest spread was found at one pip.

Other features of a standard account are mentioned below:

| Institutional grade spreads | Yes |

| Average EUR/USD spread | 0.6 — 1.4 pips |

| Commission | $0 |

| Rollover swaps | It depends on the trading platform for market rates |

| Best for | New traders |

| Leverage | 1:30 Retail, 1:500 Pro |

| Minimum lot size | 0.01 |

| Hedging | Yes |

| Expert advisor | Yes |

Copy-trading

Besides personal trading, Pepperstone offers copy trading via MetaTrader signals and Myfxbook.

Furthermore, Pepperstone has the Chasing Returns and DupliTrade for social-copy trading — available for the traders with more than $5000 investment.

Fees and Commissions

The average spread for razor accounts starts from 0.0 to average 0.17 spreads in EUR/USD. Moreover, in minor currency pairs, the lowest average spread is found 0.3 in the AUD/CAD pair. Overall, based on our review, spreads are relatively higher than the other brokers, but the lowest spreads are found in AUD-related pairs under the ASIC regulation.

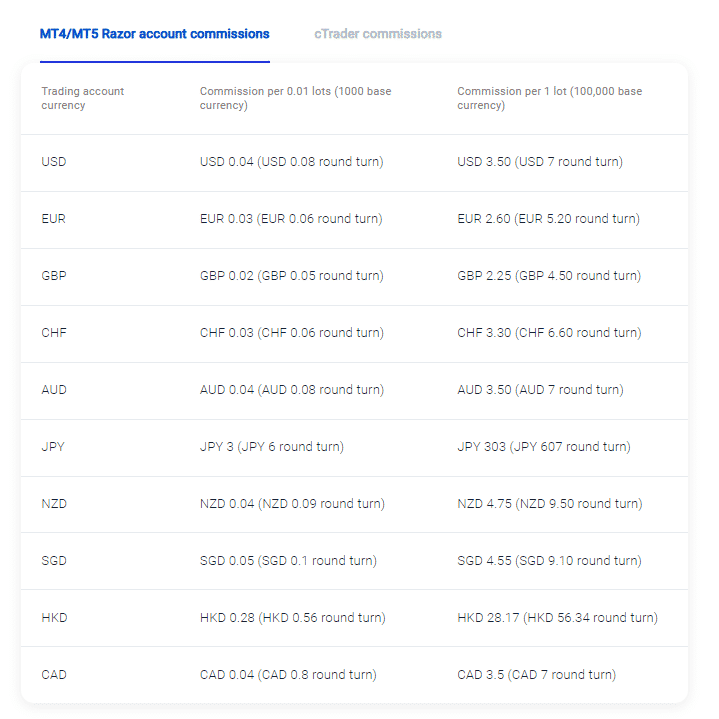

Furthermore, Peperstone’s commission rate is mentioned below:

- Pepperstone takes commission per 0.1 lots on the MT5 razor account. The value of the commission is $0.04 per 1000 base currency and USD 3.50 for 100000 base currency.

- For the MT4 Razor account, the cost is $3.76 per 100000 base currency.

- In cTrader, the 7 unit charge per lot refers to the first currency displayed in the traded pair.

Moreover, Pepperstone is flexible in non-trading fees. There are no inactivity fees for trade, but it charges a withdrawal fee that is a drawback of the platform compared to other brokers. Specifically, while withdrawing through international bank transfer, it takes $20 as a fee.

Payment options

During our review, we have found seven methods of deposit in Pepperstone, including both bank and electronic payments. Moreover, while making any withdrawal, investors should follow the same channel of deposit. Otherwise, in case of a problem with the deposit channel, Pepperstone processes the exit through an alternative pipeline.

Pepperstone deposit option

Here is the list of deposit channel found on the Pepperstone website:

- Visa

- PayPal

- Mastercard

- POLi

- Union Pay

- Bank transfer

- BPay

- Neteller

- Skrill

Besides, any international telegraphic transfer (TT) fees may charge AUD 20. The withdrawal through the bank wire transfer may take 3-5 working days to complete, while the deposit through the electronic payment is instant.

Pepperstone withdrawal option

Pepperstone processes all withdrawals on the same day if the request is received within 21:00 (GMT).

Withdrawal forms received after 21:00 (GMT) will be processed the following day. If these are received before 07:00 (AEST), they’ll be processed on the same day. Funds can only be returned to a bank account in the same name (or joint) as your Pepperstone trading account due to third-party transaction regulations.

Available Markets

Pepperstone is suitable for portfolio diversification as traders can expand their investment in forex, index CFDs, commodities, and cryptocurrencies.

Forex

Forex is the most liquid market globally where Pepperstone allows trading in major, minors, and exotic pairs with the leverage of up to 30:1.

Here, Pepperstone allows more than 40 exotic pairs, nine minor pairs, and six major currency pairs with a minimum spread of 0.0 pips.

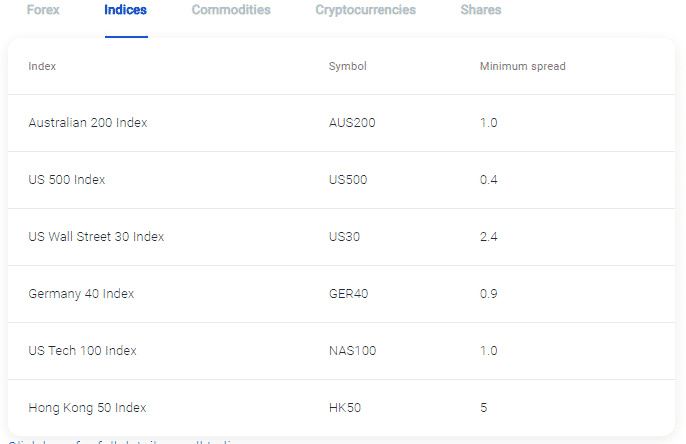

Index CFDs

Pepperstone allows trading in 14 major stock markets with no commission. Here investors can trade with the leverage of up to 1:20 (1:200 Pro).

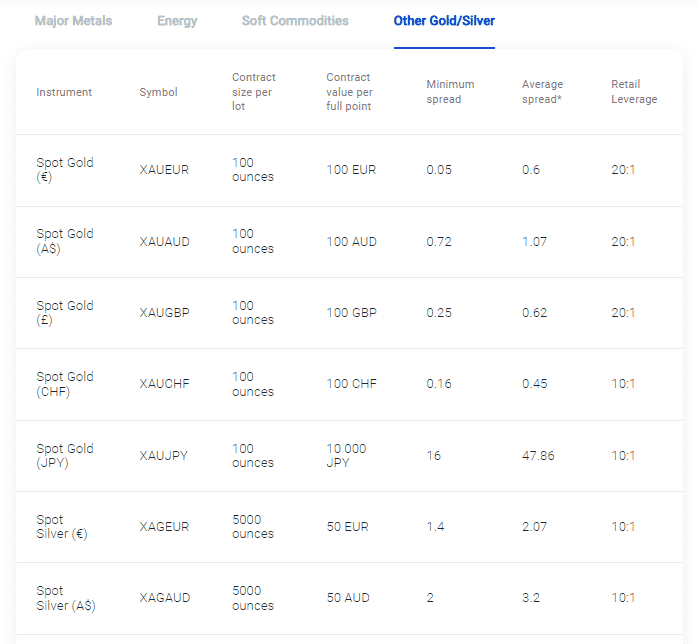

Commodities

Pepperstone allows trading in gold, silver, coffee, cotton, orange juice, sugar, silver, gas, oil, and many pairs.

Moreover, Pepperstone allows 5 gold crosses and 2 silver crosses against the US Dollar and Euro.

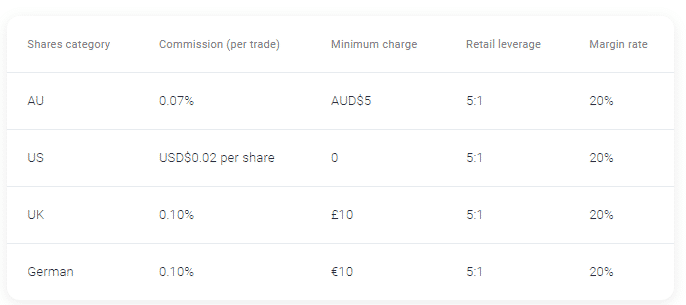

Shares CFDs

Pepperstone provides service in Shares CFD from AU Shares, US Shares, and German Shares. The minimum margin rate for these instruments is 5%.

| The commissions per trade for Shares CFDs | |||

| Share denomination | Commission (per trade) | Minimum charge | Margin rate |

| AU | 0.07% | AUD 5 | 5%-20% |

| US | USD 0.02 per share | – | 5% |

| Germany | 0.10% | EUR10 | 5%-20% |

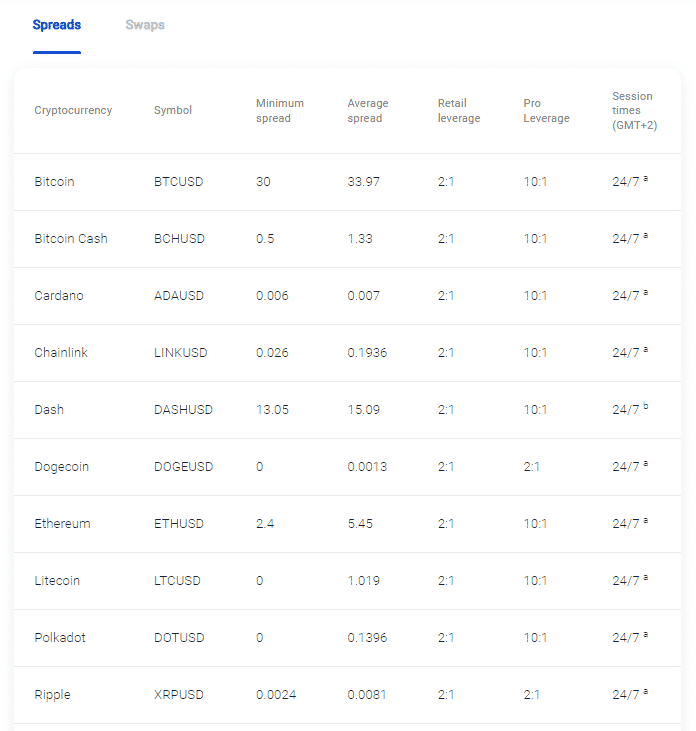

Cryptocurrencies

Some essential features of the Pepperstone cryptocurrency trading are mentioned below:

- Weekend trading in Bitcoin, Ethereum, Bitcoin Cash, etc.

- The opportunity of trading cryptocurrencies without any digital wallet.

- Ability to hedge on a single account.

- Available leverage of Bitcoin CFD is up to 2:1 (10:1 Pro).

Trading Platforms

Pepperstone provides trading services through MetaTrader and cTrader platforms, where traders can operate their web, mobile, and desktop platforms.

| Pepperstone MetaTrader 4 | Pepperstone MetaTrader 5 | Pepperstone cTrader | TradingView |

|---|---|---|---|

| MetaTrader 4 is the world’s most used trading platform that is famous among most retail traders. In MT4, traders can see real-time charts, live quotes, market analytics, etc. Some other facts provided by Pepperstone is mentioned below: Twenty-eight trading indicators and available expert advisors. Provides autochartist to find high probability trades. Opportunity to hedge tradings. All trading instruments are available on the MT4 platform. | MetaTrader 5 is the upgraded function of the MT4 platform, where both of these platforms are user-friendly by traders. MetaTrader 5 provides faster processing times, advanced orders, and hedging opportunities. Other features are mentioned below: In the MQL5 language, traders can build automated trading tools. Lots of inbuilt indicators and faster processing. Advanced customization of the trading style. | cTrader is an advanced platform developed by Spotware that offers sophisticated charting and trading features. cTrader provides an institutional trading environment where traders can fill their orders with a progressive environment. Other features are mentioned below: Advanced cTrader features to fill orders and control features. Access FIX API. Provides automated trading functionality with C++ platform. | TradingView offers customizable charts with advanced functions for Pepperstone users. The service is also a community center for millions of traders. To date, over 8 million ideas and custom scripts have been shared by the community members. Here are some other facts about this platform: Various alert categories, each having multiple alert conditions. Pine Script for analysis and creating indicators. Paper trading for testing trading plans with virtual money. |

Pepperstone social trading

Pepperstone proved to trade to follow and copy trades from famous traders using third-party services. In social trading, Pepperstone provides multiple functions to copy trades, such as:

- Myfxbook: is a famous social trading platform where Pepperstone is a listed broker. The details of the Myfxbook trading opportunity are mentioned in the Myfxbook auto trade section.

- MT4 Signals: available through the MT4 platform directly. Investors can subscribe to the trading signals from the MQL website.

- DupliTrade: the proprietary platform for Pepperstone broker. To avail of this service, you need to open an account in a duplicate besides having the Pepperstone account.

Features

Besides some general features, Pepperstone provides some services that may encourage traders to consider it as a trustworthy broker.

Premium trading tools

Here is the list of some premium trading tools featured by Pepperstone:

- Innovative Trader Tools for MT4 and 5: this tool includes alarm manager, excel RTD, mini terminal, and many more.

- cTrader Automate: it provides an automated trading functionality with C# language.

- Autochartist: this tool is focused on highlighting the currency pairs, data intervals, and technical indicators.

The Daily Fix

The Daily Fix provides trading functionality in details of forex, stocks, equities, and other marketplaces. The company offers services on fundamental analysis and market sentiment analysis. Furthermore, other Pepperstone services are provided on the telegram channel.

Customer Support

Pepperstone website is available in 5 languages so that traders from multiple countries can access the website.

Moreover, the Pepperstone support page has some popular FAQs, but the number of questions was found not sufficient compared to another broker. Furthermore, trading hours and account security-related information are available on the support page.

The most convenient way to contact Pepperstone is the live chat that is available 24/7. During our review, we found the Pepperstone Live chat as effective.

Review Summary

In summary, we can say that Pepperstone multi-regulated forex brokers allow trading in many trading instruments.

Based on our review, we found Pepperstone is a trustworthy broker based on regulation and funds safety. However, the trading cost is higher than other brokers. Therefore, investors may incur a little bit of a higher price to achieve a trustworthy trading environment. Moreover, the functionality of multiple trading platforms, availability of social trading, and various regulations may attract it as an attractive platform.