Breaking Equity Review is a comprehensive analysis of the stock market that provides readers with valuable insights and recommendations on market trends, news, and investment opportunities. Our team of experts analyzes various sectors such as technology, healthcare, energy, finance, and more to identify promising stocks and industries that have strong growth potential and favorable risk profiles. We also provide strategies for mitigating risks associated with equity investments, including diversification, research and analysis, long-term investing, and risk management tools. Stay informed and make informed investment decisions based on objective data and insights from top experts in the field with Breaking Equity Review.

Features

The main features of Breaking Equity Review include:

- Market Trends and News: In-depth analysis of current market trends, updates on major sectors, the impact of global events, and analysis of earnings reports.

- Promising Stocks and Industries: Identification of promising stocks, analysis of industry trends, investment opportunities, and risk factors.

- Mitigating Risks Associated with Equity Investments: Diversification, research and analysis, long-term investing strategies, risk management tools, and regular monitoring.

- Expert Insights: Commentary from renowned analysts and experts in the field.

- User-Friendly Format: Breaking Equity Review will be presented in a user-friendly format that is easy to navigate and understand.

By covering these areas, Breaking Equity Review provides readers with valuable insights and recommendations on how to make informed investment decisions based on objective data and insights from top experts in the field.

Market Trends and News

The Market Trends and News section of Breaking Equity Review provides readers with in-depth analysis of current market trends, updates on major sectors, the impact of global events, and analysis of earnings reports. Here’s what readers can expect from this section:

- Analysis of Current Market Trends: We will provide insights on current market trends such as economic indicators, interest rates, inflation, and more. This information will help investors understand the direction of the market and make informed investment decisions.

- Updates on Major Sectors: Our team of experts will analyze major sectors such as technology, healthcare, energy, finance, and more to provide updates on key developments and trends in these industries.

- Impact of Global Events: We will provide insights on how global events such as elections, geopolitical tensions, and natural disasters are impacting the market and specific industries.

- Analysis of Earnings Reports: Our team will carefully review earnings reports from major companies to provide insights into their financial performance, management teams, and growth potential.

By covering these areas, our Market Trends and News section will provide readers with valuable insights and analysis of market trends, sector developments, and global events that impact the market. Investors can use this information to stay informed and make informed investment decisions based on objective data and insights from top experts in the field.

Promising Stocks and Industries

The Promising Stocks and Industries section of Breaking Equity Review provides readers with insights on identifying promising stocks, and analysis of industry trends, investment opportunities, and risk factors. Here’s what readers can expect from this section:

- Identification of Promising Stocks: Our team of experts will conduct thorough research and analysis to identify promising stocks that have strong growth potential and favorable risk profiles.

- Analysis of Industry Trends: We will provide insights into major industries such as technology, healthcare, energy, finance, and more to help readers understand the dynamics and trends of these sectors.

- Investment Opportunities: Based on our analysis of promising stocks and industry trends, we will recommend investment opportunities that align with readers’ investment strategies and goals.

- Risk Factors: We will also provide insights on risk factors associated with specific stocks and industries to help readers make informed decisions and manage their risks effectively.

By covering these areas, our Promising Stocks and Industries section will provide readers with valuable insights and recommendations on how to identify and invest in promising stocks and industries. Readers can use this information to potentially achieve better long-term returns and manage their risks effectively.

Mitigating Risks Associated with Equity Investments

The Mitigating Risks Associated with Equity Investments section of Breaking Equity Review provides readers with strategies for mitigating risks associated with equity investments. Here’s what readers can expect from this section:

- Diversification: We will highlight the benefits of diversifying one’s portfolio across different sectors and asset classes to reduce risk exposure.

- Research and Analysis: We will provide insights on how readers can conduct thorough research and analysis to make informed investment decisions based on objective data and insights from top experts in the field.

- Long-Term Investing Strategies: We will recommend long-term investing strategies that can help readers achieve their financial goals while mitigating risks associated with short-term market fluctuations.

- Risk Management Tools: We will provide insights on various risk management tools such as stop-loss orders, put options, and more to help readers manage their risks effectively.

- Regular Monitoring: Finally, we will emphasize the importance of regular monitoring of one’s portfolio to identify potential risks and make necessary adjustments.

By covering these areas, our Mitigating Risks Associated with Equity Investments section will provide readers with valuable insights and recommendations on how to manage their risks effectively and potentially achieve better long-term returns.

Expert Insights

The Expert Insights section of Breaking Equity Review provides readers with commentary from renowned analysts and experts in the field. Here’s what readers can expect from this section:

- Commentary from Renowned Analysts and Experts: We will feature commentary from top analysts and experts in the field of finance and investment to provide readers with diverse perspectives on market trends, investment opportunities, and risk management strategies.

- Objective and Unbiased Analysis: Our experts will provide objective and unbiased analysis to help readers make informed investment decisions based on the latest insights and trends in the market.

- Timely Insights: Our experts will share their insights promptly to help readers stay informed on the latest developments and trends in the market.

By featuring commentary from renowned analysts and experts, our Expert Insights section will provide readers with valuable insights and recommendations on how to navigate the complexities of the stock market and achieve their financial goals. Readers can use this information to potentially achieve better long-term returns and manage their risks effectively.

User-Friendly Format

Breaking Equity Review will be presented in a user-friendly format that is easy to navigate and understand. Here’s what readers can expect from the format:

- Clear and Concise Language: Our content will be written in clear and concise language that is easy for readers to understand.

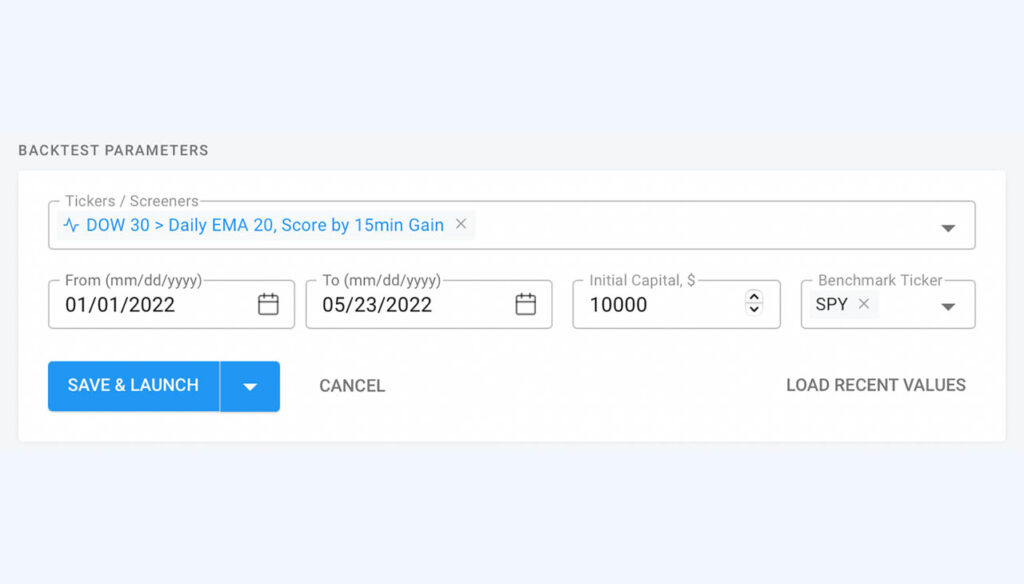

- Visual Aids: We will use visual aids such as charts, graphs, and infographics to help readers better understand complex financial concepts and data.

- Navigation: Our website will have an intuitive navigation system that makes it easy for readers to find the information they are looking for.

- Mobile-Friendly: Our website will be optimized for mobile devices, so readers can access our content on the go.

- Subscription Options: We will offer multiple subscription options including a free newsletter and a paid subscription that provides access to premium content.

By presenting our content in a user-friendly format, we aim to make it accessible to a wide range of readers, including those who may not have a background in finance or investment. Readers can use this information to stay informed, make informed investment decisions, and potentially achieve better long-term returns.

Pros

- Comprehensive and up-to-date information on equity investments

- Objective and unbiased analysis from experts

- Timely insights on the latest developments and trends in the market

- Easy to navigate user-friendly format for a wide range of readers

Cons

- Limited availability of content without a subscription

Summary

Breaking Equity Review is an informative and comprehensive guide to equity investments that provide readers with the latest insights and trends in the market. Our content covers topics such as mitigating risks associated with equity investments, long-term investing strategies, risk management tools, regular monitoring of one’s portfolio, and commentary from renowned analysts and experts. We also present our content in an easy-to-navigate and user-friendly format. By providing readers with valuable insights, our goal is to help them make informed investment decisions and potentially achieve better long-term returns.

Review

- Comprehensive and up-to-date information: 5

- Objective and unbiased analysis: 5

- Timely insights on the latest developments: 4

- Easy to navigate user-friendly format: 3

- Limited availability of content without subscription: 3