SaxoBank Group Limited is an online trading and investment bank facility headquartered in Philip Heymans-Copenhagen, Denmark. It made its debut in the financial industry in 1992 and received a banking license from the Danish FSA. It claims to serve more than 800,000 clients in the trading and investment space with state-of-the-art technology, competitive spreads and leverage, and fast order executions of multiple asset classes.

Pros

- Well-established brokerage company

- Highly regulated

- Does not charge deposit or withdrawal fees

- Trade and invest in over 40,000 products

- Best broker for institutional traders

- Experience competitive spreads

- Maximum security of funds

- Over 25 years of experience in the industry

- Intuitive trading technology

- Access cutting-edge trading platforms

Cons

- High minimum deposit

- No negative balance protection

- Poor customer service compared to other brokers

- High trading fees and commissions on assets such as stocks, bonds, options, and futures

- It charges high inactivity fees capped at $100 after six months of account dormancy

- Users also face currency conversion fees

- High minimum deposit compared to other companies

SaxoBank group of brokers launched in 1992 as a private financial firm envisioning revolutionizing the trading and investment arena. It obtained a bank license from the Danish FSA, granting it the imprint as a fully licensed European finance institution. With time, the brokerage company diversified its products and expanded across the globe.

It now operates several brokers in different corners of the world, with its main office in Copenhagen, Denmark. It offers trading and investment services to retail and corporate traders fueled by innovative trading platforms and tools. SaxoBank claims to serve over 800k clients speculating 40,000 plus products with ultra-competitive spreads, leverage, and commissions.

The asset classes include:

- Stocks

- ETFs

- Bonds

- Mutual funds

- Crypto ETFs

- Futures

- Listed options

- CFDs

- Commodities

- Forex

Users access these assets leveraging the broker’s state-of-the-art trading platforms that integrate with powerful trading tools to offer a profitable trading environment. The investment and liquidity provider has two trading platforms dubbed the SaxotraderGo and the SaxotraderPro. They help the clients to tap into the markets with fast order executions. As a result, the broker reports executing about 188,000 trades per day.

Some of the integrated tools include:

- Currency converters

- API’s

- Trending view

- Multicharts

- Up data tool for analysis

- MT4 tool features

The trading and investment conditions depend on the account type the client chooses. SaxoBank provides multiple account types catering for retail, corporate, and professional traders. The minimum deposit varies based on the account type and is capped at $2,000 for the classic account traders but stretches to $200,000 for the platinum account traders. However, the spreads and commissions are determined by the assets traded.

For SaxoBank clients to trade or invest in its products, they must fund their account type with any amount above the minimum requirement depending on the account they are using. The broker provides payment options with low fees for efficient transactions. Moreover, it notes to provide top security to the clients’ funds.

SaxoBank payment options include:

- Bank wire transfer

- Bank cards

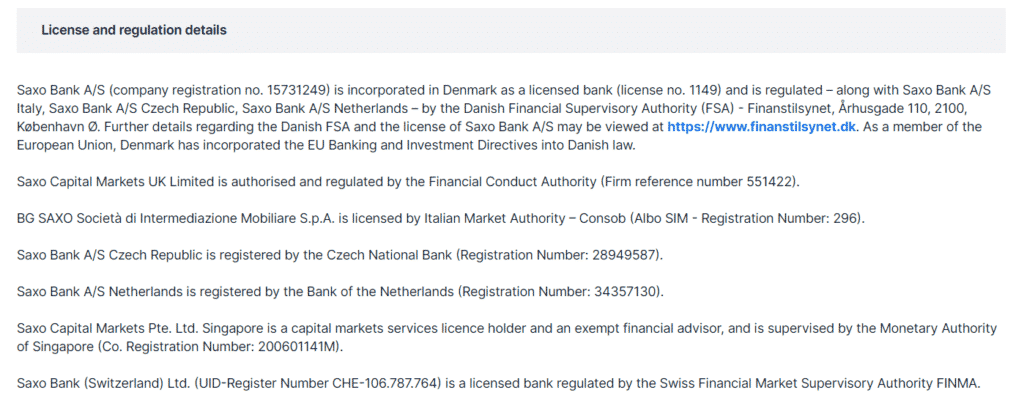

Regulation

SaxoBank operates under a reputable regulation framework as its offices hold licenses from regulatory bodies based in different regions. The agencies include both top-tier and low-tier bodies making SaxoBank a safe brokerage company to deal with. Its registrations include:

- Saxo Capital Markets UK Limited is authorized and regulated by the Financial Conduct Authority (license number 551422).

- The Italian office is authorized and regulated by the Italian Market Authority (registration number 296).

- In the Czech Republic, SaxoBank A/S is registered by the Czech National Bank (registration number 28949587).

- The company is also registered in the Netherlands (registration number 34357130).

- Saxo Capital Markets in Australia is licensed by the Australian Securities and Investment Commission (ASIC) (license number 1395901).

- The financial institution also holds registration licenses in Hong Kong, Japan, and the UAE.

Account Types

SaxoBank provides an array of accounts to its clients. The client’s account type depends on his objectives and whether he intends to use a corporate, retail account, or professional account. A client can only qualify for the professional if his portfolio exceeds 500,000 euros and has worked in the financial sector for at least one year.

Classic account

- Tight entry prices

- Minimum initial funding $2,000

- Best-in-class digital service and support

- 24/5 technical and account support

Platinum account

- Access even tighter spreads and commissions

- Minimum initial funding $200,000

- Best-in-class digital service and support

- 24/5 technical and account support

- Priority local-language customer support

VIP account

- Access the best prices

- Minimum initial funding $1,000,000

- Best-in-class digital service and support

- 24/5 technical and account support

- Local-language personal relationship manager

- Direct access to our trading experts, 24/5

- 1:1 SaxoStrats access

- Exclusive event invitations

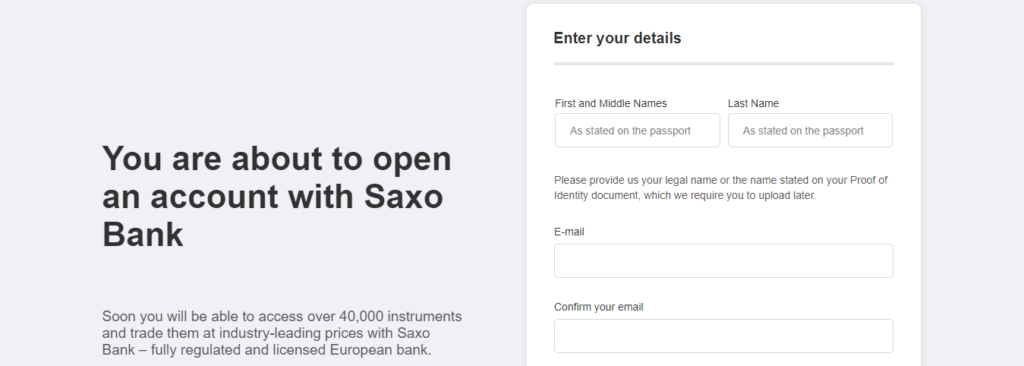

How to open a SaxoBank account?

Step 1. Click the “open account” button on their official website.

Step 2. Fill in your registration details.

Step 3. Verify email and other details.

Step 4. Fund the account.

Step 5. Start trading.

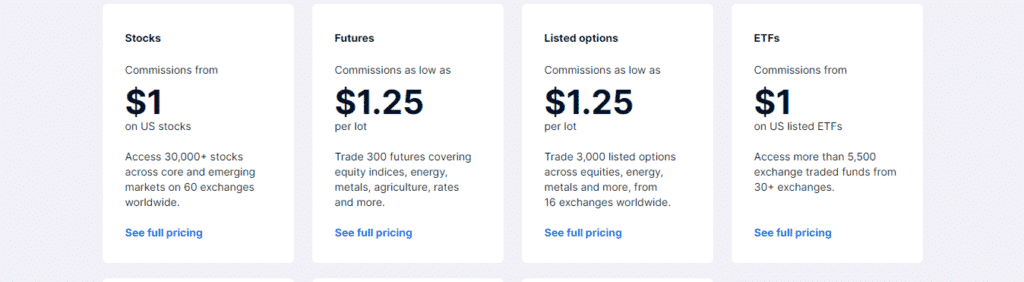

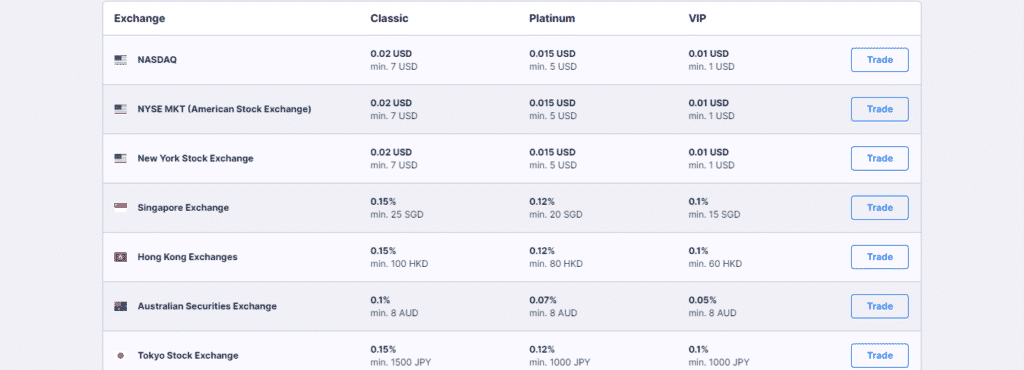

Fees and Commissions

Saxo Bank operates as a market marker, thus it charges fees on the spread and commissions on an array of products depending on the asset class. For example, the minimum spread for trading currency pairs starts from 0.6 pips and increases up to 1.2 pips on some FX crosses. Moreover, clients incur commissions when trading instruments like options, stocks, futures, and others.

Saxo Bank users also face other fees such as overnight fees, inactivity fees, currency conversion fees, and custody fees. The broker also notes that it does not provide negative balance protection to clients. Thus, you can lose more than your initial investment.

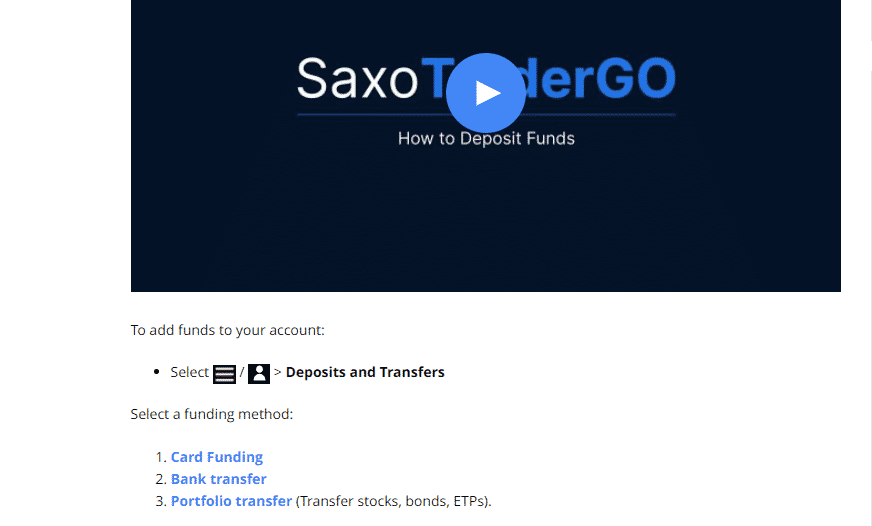

Payment options

The financial entity offers several payment options to clients. It also confirms that users can fund and withdraw money for free. Some of the deposit methods include Bank transfers, Bank cards, and portfolio transfers.

Pros

- Deposit and withdrawal of funds are free.

Cons

- Few payment options compared to other brokers.

Deposit

Saxo Bank accepts deposits from these methods:

- Bank wire transfers

- Bank cards

- Portfolio transfers

Withdrawals

Deposit methods apply to withdrawals.

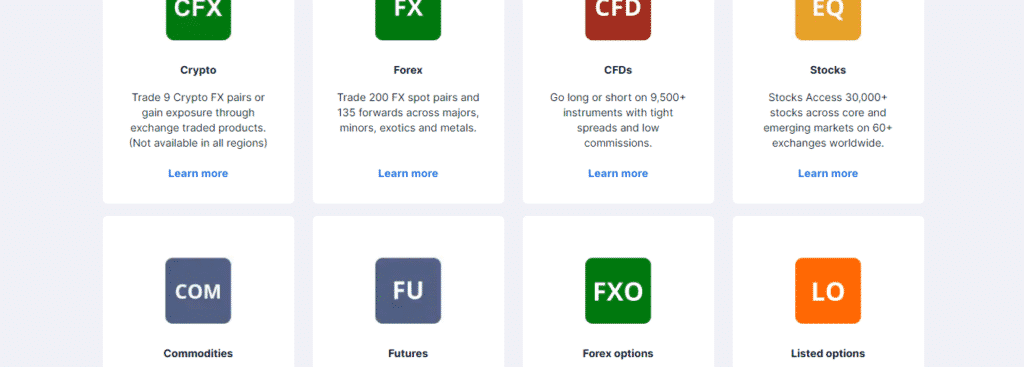

Available Markets

Saxo Bank boasts of offering more than 40,000 instruments to over 800k users for trading and investment opportunities. They access these markets with the help of a 24/5 client support team and state-of-the-art trading platforms. Each asset class comes with unique trading conditions, as we will explore in this section.

Forex

The foreign exchange market at Saxo Bank holds 200 FX spot pairs and 135 forward forwards across majors, minors, exotics, and metals. They trade with competitive spread and leverage placed at 1:30. However, the minimum spread depends on the forex pair. Clients trade and invest in these assets 24/5 and the broker also notes that orders execute at high speeds. Some of the products include GBP/USD, USD/JPY, XAU/USD, and many others.

CFDs

Saxo Bank provides a furnished Contract for Difference (CFD) market supporting more than 9,500 products. Clients have the option to go long or short on these instruments fueled with tight spreads and low commissions. CFDs trading is spread across stocks, indices, forex, commodities, options, and bonds.

Stocks

The stock market also trades 24/5 at Saxo Bank allowing clients to speculate and invest in over 30,000 stock instruments across 60+ exchanges. Some of the exchanges include NYSE, LSE, NASDAQ, and many others. The rates and prices depend on the exchange that the client uses.

Commodities

Saxo Bank allows clients to trade multiple commodity assets as CFDs, futures, options, spot pairs, and more. The pricing depends on the clients’ account tier, although the entire market traded with tight spreads and low commissions.

Some of the available products include gold, silver, crude, and other soft commodities in the agricultural field. This helps clients diversify their portfolios by going long or short on these instruments with max leverage of 5:1.

Futures

The broker supports about 16 global exchanges for futures trading. Three hundred futures instruments covering equity indices, energies, metals, agriculture, rates, and FX are available. However, the contract depends on the account type.

ETFs

Clients also have access to more than 5,500 ETFs from 30+ exchanges at Saxo Bank. The market also traded 24/5 with competitive pricing and margins. But, the ETF commissions depend on the client’s account tier and instrument traded.

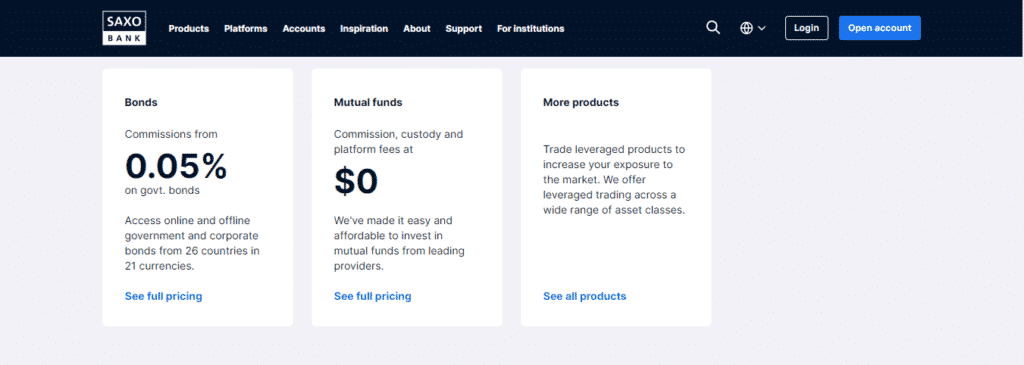

Bonds

About 5000 bonds trade with a commission rate starting at 0.20% that shaves down to stabilize at 0.05%. Bonds also have space at Saxo Bank as the broker cites to offer online and offline government and corporate bonds from 26 countries against 21 currencies. In addition, Saxo Bank grants direct access to tier-1 liquidity, allowing clients to trade these products with the best available spreads.

Cryptocurrencies

Saxo Bank hosts nine crypto FX pairs that trade as CFDs against major fiat currencies. Some of the crypto assets available include BTC, ETH, LTC, and others. They pair against USD, EUR, or JPY. With their nature of short-term volatility, clients have the advantage to trade the market in any direction by going long or short.

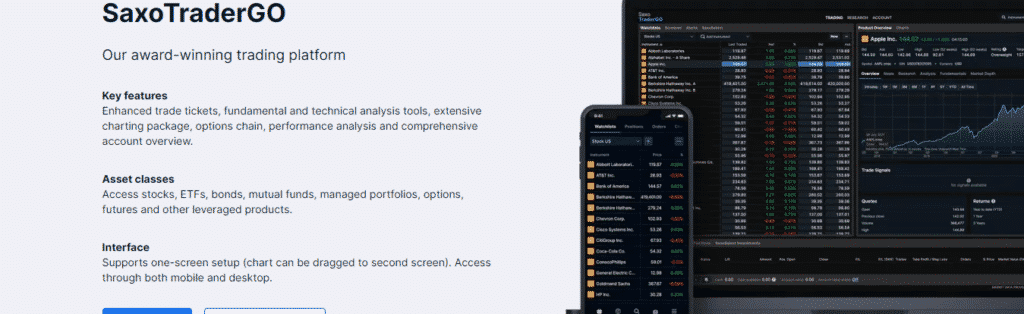

Trading Platforms

Saxo Bank claims to offer its users award-winning platforms to access the broker’s wide range of markets as traders or investors. The platforms integrate with smart tools like APIs, currency converters, indicators, and many more for conducive trading. They include the SaxoTraderGo and SaxoTraderPro.

Analysis of the trading platform

SaxoTraderGo

- Enhanced trade tickets

- Fundamental and technical analysis tools

- Extensive charting package

- Options chain

- Asset classes — stocks, ETFs, bonds, mutual funds, managed portfolios, options, futures, and other products

- Supports one-screen setup

- Available on both mobile and desktop

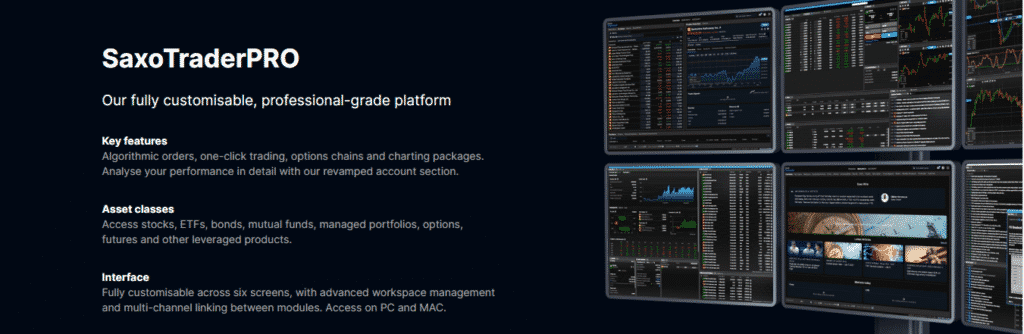

SaxoTraderPro

- Fully customizable, professional-grade platform

- Algorithmic orders

- One-click trading

- Options chains and charting packages

- Ability to analyze your account.

- Asset classes — stocks ETFs, bonds, mutual funds, managed portfolios, options, futures, and other products.

- Customizable interface across six screens

- Available on PC and MAC

Features

Saxo Bank features generally include:

- Powerful trading tools, such as APIs

- Good broker for trading and investment services

- It is a multi-regulated broker

- Offers multiple trading instruments

- Provides competitive spreads, leverage, and margins

- Trade with fast executions

Education

Saxo Bank fails to provide an educative platform on its website. The liquidity provider only offers webinars and a few video tutorials to its cluster of traders. As a result, novice traders would find it difficult to kickstart their trading journey with the broker.

Customer Support

Saxo Bank provides a support center that it claims is led by a multilingual team 24/5. Clients can reach out to the support via email and phone calls, but the platform also supports multiple resources in articles. Users can easily find the information they need in the articles. Some of the topics covered include “How to get started,” “Introduction to SaxoTraderGo,” and many more.

Review Summary

Saxo Bank Group Limited made its foray into the financial industry in 1992. The trading and investment services provider offers over 40,000 instruments to clients with competitive spreads and commissions. The broker confirms that more than 800k clients have trusted its services from around the globe and operates under a legit regulation led by top-tier bodies such as the FCA.

However, clients experience high fees on CFDs and assets such as stocks and the minimum deposit is way high compared to other brokers. As a result, Saxo Bank is suited for intermediate and veteran traders as newbies would find it hard to cope with the charges.