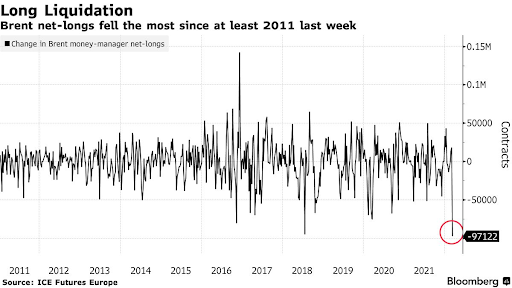

(Bloomberg) Liquidations on net-bullish bets on Brent crude hit a record last week as hedge funds exited positions following a run to almost $140 a barrel.

The Intercontinental Exchange Inc. says that a reduction in bullish bets in Brent was the biggest since 2018, as investors cashed on the run to the $140 a barrel level.

Oil has since retreated to almost $108 as speculators cut their long contracts, with last week’s net longs falling the most since 2011.

The closing on positions happens even as markets place bets that the war in Ukraine would disrupt the global supply chain. The speculations saw Brent trade at its highest weekly range since the futures were launched in the late 1980s.

The closing of long positions coincided with an increase in bearish bets, with about 34,000 contract additions, the highest since 2016.

CL1! is down -4.13%