The Nike stock price surged in extended hours on Thursday after the company published strong quarterly results. The shares closed at $133 on Thursday and then jumped by more than 14% to $152 in after-hours. The jump pushed the company’s market cap to over $220 billion.

Nike earnings

Nike, the leading sports apparel maker, had a strong quarter as the world economy reopened and many sports restarted. The company said that its fourth-quarter revenue rose by 96% year on year to more than $12.3 billion. This revenue figure was $1.32 billion, better than what analysts were expecting.

Similarly, the firm reported earnings per share of $0.93. In total, the company’s annual revenue rose by 19% to $44.5 billion. Most importantly, the company’s Nike Direct offering continued gaining traction as its revenue rose by 73% to $4.5 billion in the fourth quarter.

Nike’s business grew globally, with sales in North America rising by 141% as the US and Canada reopened. This is evidenced by the recent retail sales numbers published by the government. Sales in Europe and the Middle East saw 124% growth.

Before earnings, investors were generally worried about the company’s business in China. This is because the company has come under fire recently in the country because of its stand on Xinjian issues. As such, there have been calls to boycott the brand in the country. This is reflected by the relatively slower revenue growth in the country. Revenue rose by 9% in Greater China.

Most importantly, the company upgraded its forward guidance. It expects its revenue to grow by double digits to more than $50 billion.

Is Nike stock a buy?

Nike has excellent fundamentals. The company has a leading market share in an industry that is expected to grow robustly in the coming years as more people embrace sports and athleisure. The firm also has enough resources to boost its brand image around the world.

Nike also has an opportunity to boost its net income margin. The company has a gross margin of 43.36% and a net income margin of about 8.90%.

The stock is not cheap. For one, it has a trailing price-to-earnings (PE) ratio of 60.80, which is bigger than the S&P 500 average of about 45. This valuation is justified because the company is seeing strong growth and has a strong moat in its business. It has a forward PE ratio of about 41.

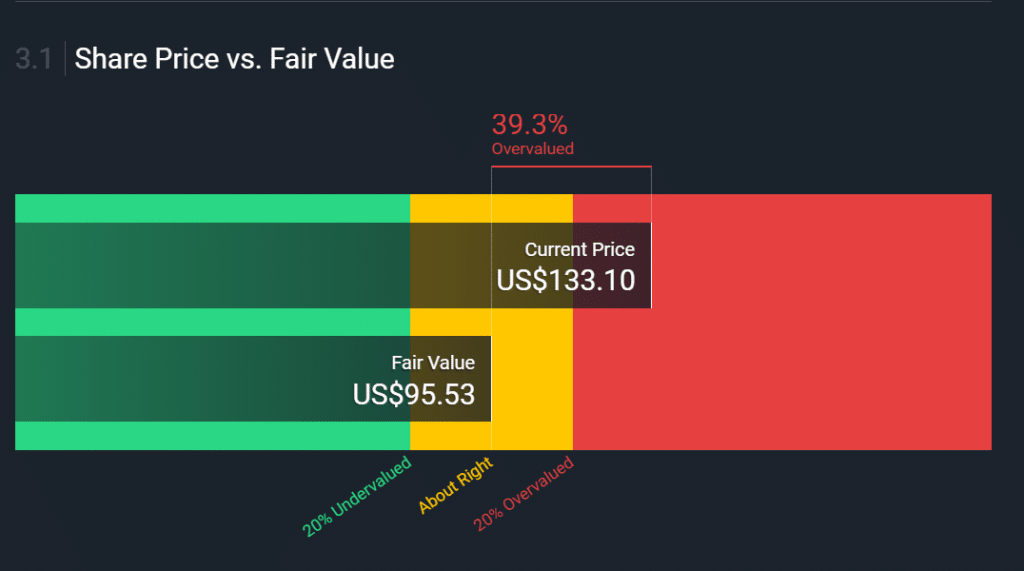

A Discounted Cash Flow (DCF) valuation shows that the company is also relatively overvalued. According to Simply Wall Street, the fair valuation for the stock is about $95.

Analysts are generally positive about Nike stock but have been cautious about its ongoing issues in China. In a report this week, analysts at BTIG lowered their target from $163 to $152. Similarly, those at Telsey Advisory Group lowered their target from $175 to $163, while those from Credit Suisse have a target of $164.

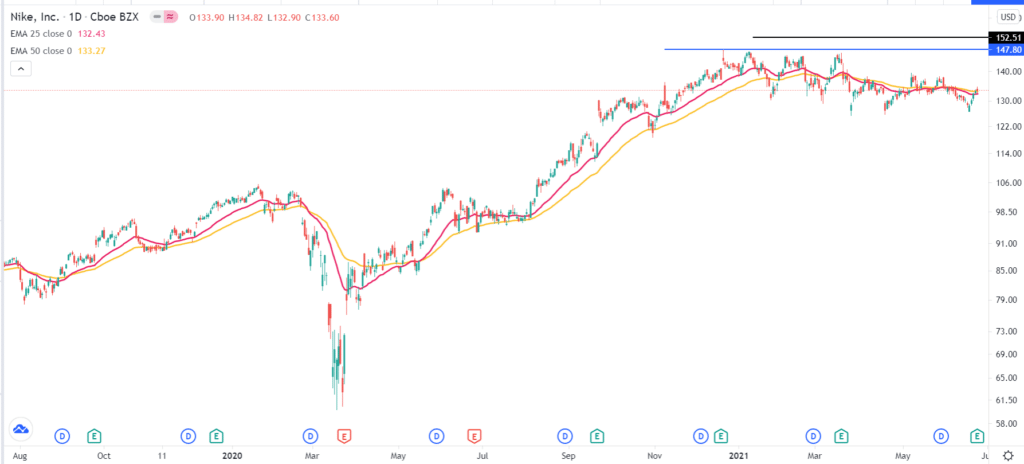

Nike stock price analysis

The daily chart shows that the Nike stock has been in a consolidation mode in the past few weeks because of concerns about China. The shares are expected to open at $155, which is a record high. By doing so, the stock will likely move above the important resistance at $147, where it struggled to move a few times before.

Consequently, the shares are still above the 25-day and 50-day Exponential Moving Averages, while the momentum oscillator has risen. Therefore, after the bullish breakout, the stock will likely keep rising as bulls target the next key resistance at $165.