The Nasdaq 100 index rose to a record high on Thursday even after the relatively hawkish Federal Reserve interest rate decision. It rose to $14,165, bringing the total gains from last year’s low to over 108%. The index is up 10% this year.

Fed decision

The Nasdaq 100 is a well-known American index that is focused on the technology sector. Some of its biggest constituent companies are Apple, Microsoft, Amazon, and Alphabet.

The index has been in focus this week after the latest Federal Reserve rate decision. In this decision, the bank decided to leave interest rates and quantitative easing (QE) policies intact.

At the same time, the bank signaled that it will start tightening soon. This means that it will start tapering its asset purchases in the next few months and then start hiking interest rates in 2023. This was a change in policy since the bank was signaling that it will maintain the easy money policy for a while.

The Nasdaq 100 index is highly sensitive to actions by the Fed because of the risky nature of some of its constituent companies. Some of these companies have strong revenue growth and high valuations. As such, they tend to do well in a low-interest-rate environment. For example, the index has grown around 220% in the past five years when interest rates have been relatively low.

The Nasdaq 100 index rose on Thursday, possibly because analysts were expecting the Fed to turn hawkish in the near term. This is because most economic numbers from the US have been relatively strong. The unemployment rate has fallen while inflation has risen to the highest level in years.

Infrastructure deal

The Nasdaq index also rose after it emerged that a bipartisan group of senators discussed another $1 trillion infrastructure package. The plan allocates more than $110 billion to build American roads and bridges and $65 billion to expand broadband access. It also allocates $45 billion to build transit systems. This plan will be funded by indexing the gas tax to inflation and increasing IRS enforcement.

While most companies in the Nasdaq 100 are tech firms that don’t deal with infrastructure, such a deal will be beneficial to the index. For example, some of the companies in the index, like Microsoft and Amazon would provide indirect services to firms that will implement the projects. Also, another $1 trillion addition to liquidity will lead to more demand for stocks.

The index has also renounced as some investors have rushed to buy its constituent companies on the cheap after they declined as the rotation from growth to value intensified.

Most companies in the index ended the day higher on Thursday. The best performers were firms like Atlassian, Advanced Micro Devices, Match Group, Nvidia, and Okta that all surpassed 4% in gains. Other top performers were Lululemon, Peloton, and PayPal.

On the other hand, the laggards were companies like Sirius XM, Biogen. Paccar, and Microchip Technology.

Nasdaq 100 technical analysis

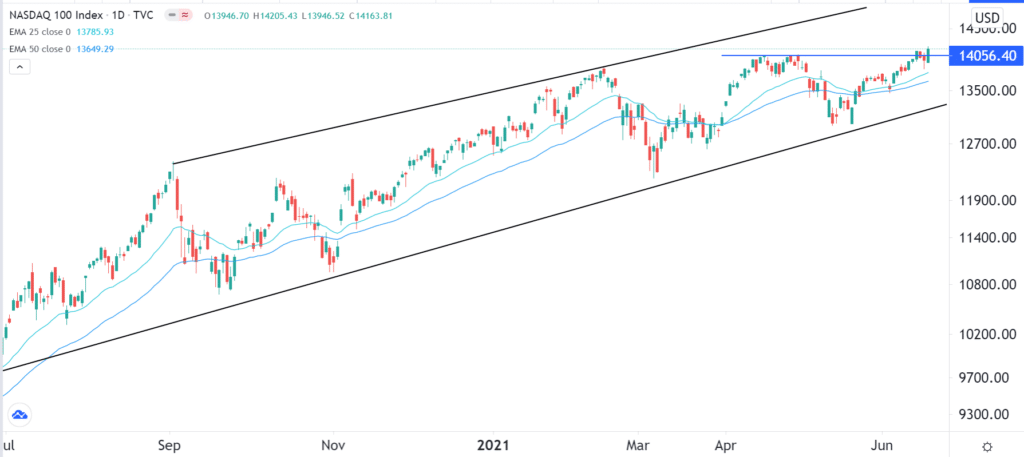

The daily chart shows that the Nasdaq 100 index has been in a strong uptrend in the past few months. The index has formed an ascending channel that is shown in black.

At the same time, the bullish trend is being supported by the 25-day and 50-day Exponential Moving Averages (EMA).

Most importantly, the index managed to move above the critical resistance level at $14,056, where it had struggled to reach before. Therefore, the pair will likely keep rising as bulls target the next key resistance at $14,500.