- US dollar retreats from three months highs against the majors

- Canadian dollar under pressure amid oil prices weakness

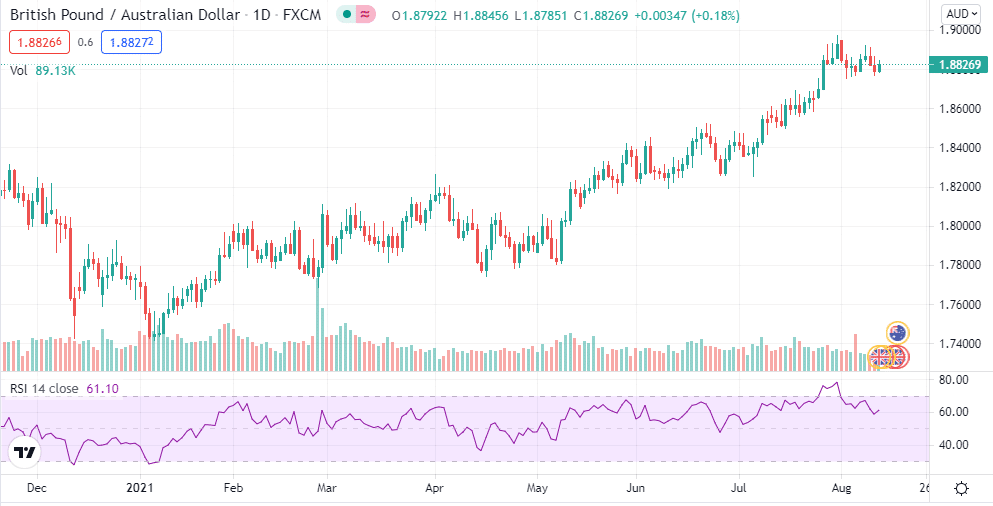

- British pound gaining ground against the Australian dollar

- Gold bounces back to $1750

- US stocks at record highs on easing inflationary pressures

The USDCAD is struggling for direction despite the US dollar coming under pressure on data showing US inflation might have peaked. The dollar index that tracks the greenback’s strength against the major currencies has retreated from three-month highs as signs of cooling inflationary pressure continues to avert concerns of the Federal Reserve easing monetary policy.

Despite the dollar weakness, the Canadian dollar has struggled to capitalize, depicted by the USDCAD pair remaining well supported above the 1.2500 level.

Above the 1.2500 level, USDCAD could make a run for the 1.2565 level. On the flip side, the pair closing below the 1.2500 level could result in further sell-offs to 1.2480 levels.

The pair’s bearish momentum has stalled as bulls continue to defend the 1.2500 psychological level. Amid the easing inflation pressure in the US, growing concerns about the Delt variant have continued to fuel demand for safe-haven, all but offering support to the greenback against the Canadian dollar.

The CAD, on the other hand, remains under pressure owing to weakness in oil prices weighed heavily by concerns about declining demand for the commodity. China imposing travel restrictions has triggered concerns that demand could edge lower, leading to an oversupply resulting in a decline in oil prices.

GBPAUD bounce back

On the other hand, the British pound continues to hold firm against the majors despite the dollar strength. Consequently, the GBPAUD appears to have regained its upward momentum after a recent correction below the 1.8800 level.

With the Australian dollar looking increasingly weak, bulls remain in control after a bounce back from the 1.8770 support level.

The Australian dollar sentiments have taken a significant hit amid the deteriorating COVID-19 situation in the country. A string of restrictions and stringent measures designed to curb the spread of the Delta variant has once again fuelled concerns about economic growth slowdown. In contrast, the British pound is holding firm as traders remain impressed by the country’s handling of the pandemic, resulting in the lifting of many restrictions.

Gold bottoms out

In the commodity markets, Gold has gained some positive traction after initially plunging below the $1700 an ounce level. XAUUSD has since retaken the $1750 level as bulls continue to fend off bears. A move above the 100-hour SMA has set the stage for additional gains.

The immediate resistance is seen near the $1760 level.

Some follow through followed by a close above the $1765 level could act as a trigger for bulls to push the precious metal back to the $1777 level above which bulls could reclaim the $1800 an ounce level.’

Supporting the gold rally is inflation data showing consumer prices are not increasing fast as initially feared to necessitate immediate FED action. The slow pace of increase has eased concerns of the US Federal Reserve beginning to taper bond purchases. The result has been dollar weakness across the board.

US indices at record highs

In the stock market, major US indices led by the Dow Jones Industrial Average and the S&P 500 continue to edge higher, closing at fresh highs on Wednesday. The rally has been supported by stocks poised to benefit from the $1 trillion infrastructure across the board.

Techy-heavy NASDAQ also powered to record highs on Wednesday as inflation concerns faded on data showing inflation might have peaked. The data eases fears of the FED hiking interest rates sooner, something that could hurt borrowing costs.

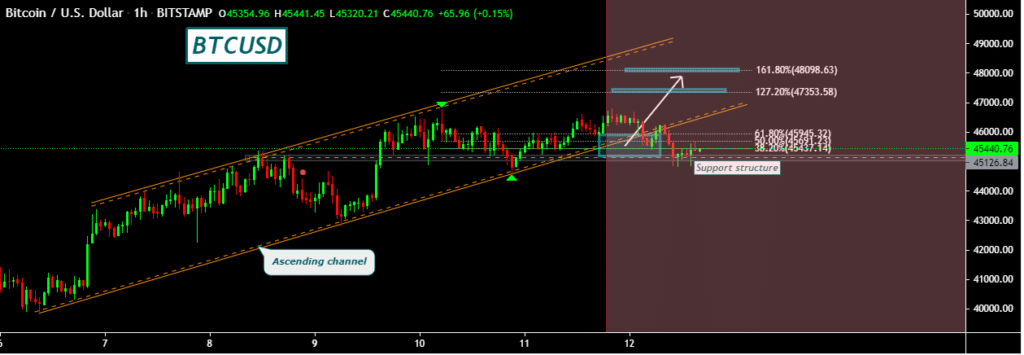

Bitcoin rally

Bitcoin and Ethereum continue to hold on to gains at four-month highs after the recent bounce back from six-month lows. BTCUSD is holding on to gains above the $45,000 level, well supported by positive rhetoric across the board and the winding down of bearish positions.

Ethereum has also regained its upward momentum following a recent network upgrade. The second-largest cryptocurrency by market cap has found support above the $3,000 level.