- AUDUSD bounce back from nine-month lows gathers pace

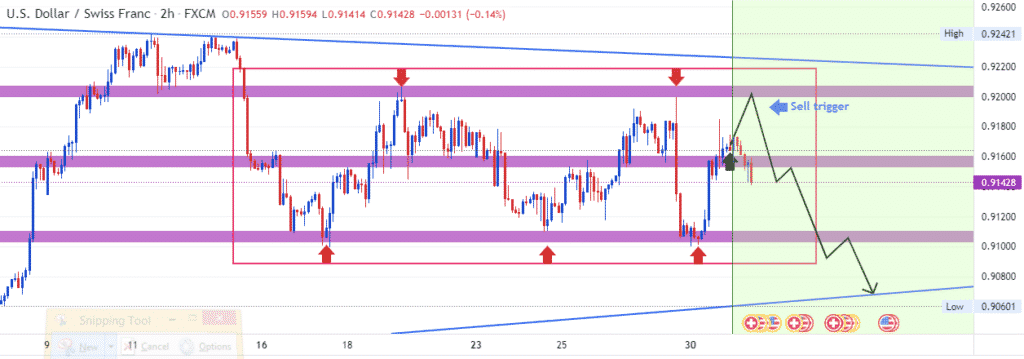

- USDCHF in consolidation mode despite dollar weakness

- Oil price rise despite production ramp concerns

- US equity benchmarks poised to finish the month at record highs

- Bitcoin remains range-bound after rejection at $50,000

The positive traction on AUDUSD is gathering steam in the aftermath of the US dollar turning bearish and weakening to two-week lows against the majors. The pair has since bounced back from nine-month lows powering to near two-week highs amid a strengthened bid tone on the Australian dollar.

AUDUSD bounce back

After eroding the accelerated downtrend last week, more upside action is expected on AUDUSD powering through the 0.7300 psychological levels.

Standing in the way of the pair powering to one-month highs of 0.7423 is 0.7380, which is the immediate resistance level. On the flipside, key support remains at 0.7062 on any correction lower.

A build-up on bid tone on AUDUSD stems from COVID-19 cases in Australia declining in recent days, all but helping fuel risk-on-mood on the AUD. Daily coronavirus numbers in hard-hit states have started falling.

However, it is the weakness of the US dollar in the aftermath of Federal Reserve Chairman Jerome Powell pushing back on tapering till year-end that continues to fuel the upward momentum. With the US 10-year Treasury yield dropping for a third consecutive day, more weakness on the greenback is likely, which should offer more support on AUDUSD price gains.

USDCHF in consolidation mode

Despite the broader dollar weakness, the USDCHF continues to hold firm, failing to edge lower. The pair remains in consolidation mode, well supported above the 0.9100 level. A plunge to the critical support level at 0.9100 was followed by intense buying pressure resulting in the pair stabilizing above the 0.9140 level.

USDCHF bulls have continued to hold firm despite US Treasury yield plunging to 1.27%, consequently triggering dollar weakness. The dollar resilience on the pair was also evident in the US, pending home sales dropping for the second straight month in July, all but piling pressure on the greenback.

The consolidation mood on the pair was further affirmed by the KOF Economic Barometer in Switzerland, easing to 113.5 in August, well below market expectations of 125.

Oil prices rise

Oil prices continue to edge higher, powering to more than two-week highs on Tuesday as US Gulf Coast platforms, refineries, and pipelines were thrown into uncertainty following Hurricane Ida. However, the gains remain limited after the recent swing high amid concerns that global producers are planning to raise output.

US oil was closing in on the $70 barrel level, trading at $69.12 at the time of writing. Brent crude also remains well supported above the $73 a barrel. In addition to growing concerns about producers ramping up production, there are growing fears about weakening manufacturing data out of China.

China is one of the biggest consumers of black gold. Therefore, any economic downturn in the country is known to impact demand, which negatively puts pressure on prices. As it stands, the oil market remains on watch mode as investors assess demand and supply in the aftermath of hurricane Ida.

The US benchmarks at record highs

US stocks started the week on the front foot and on course to end the month at record highs. US equity benchmarks hit all-time highs on Monday, helped by Powell pushing back on rate hikes. The S&P 500 was up 0.43% and on course to finish the month having gained more than 3%.

NASDAQ gained 0.9%, helped by renewed buying tone on technology stocks as fears of rate hikes dissipate. The Dow Jones remains elevated at record highs despite dropping 0.16% on Monday.

The rally in the stock is supported by impressive quarterly reports as well as easing fears of a spike in borrowing costs on FED chair insisting rate hikes is not a factor of tapering.

Bitcoin range-bound

In the cryptocurrency market, Bitcoin remains in consolidation mode above the $47,000 level after a recent pullback from four months’ highs of $50,000.

The BTCUSD remains well supported above the $46,493 level, the immediate support level. A breach of the support could accelerate sell-off to the $44,000 level.