- The US dollar strengthens amid rising yields.

- USDCAD bounces back amid dollar strength.

- GBPJPY rally stalls at 5-year highs.

- Oil prices touch multi-year highs amid strong demand.

- The Bitcoin and Ethereum bulls aim at record highs.

The US dollar started the week on a solid footing strengthening across the board as concerns about the Chinese economy drove investors to safe-havens. A spike in oil prices to seven-year highs also continues to fuel inflation pressures triggering chatter that the Federal Reserve will hike interest rates, thus sending the greenback higher.

The dollar index, which measures greenback strength against the basket of six currencies, powered through the 94.00 handles after a recent pullback well supported by rising yields. As the dollar strengthened across the board, the majors remained under pressure after last week’s gains.

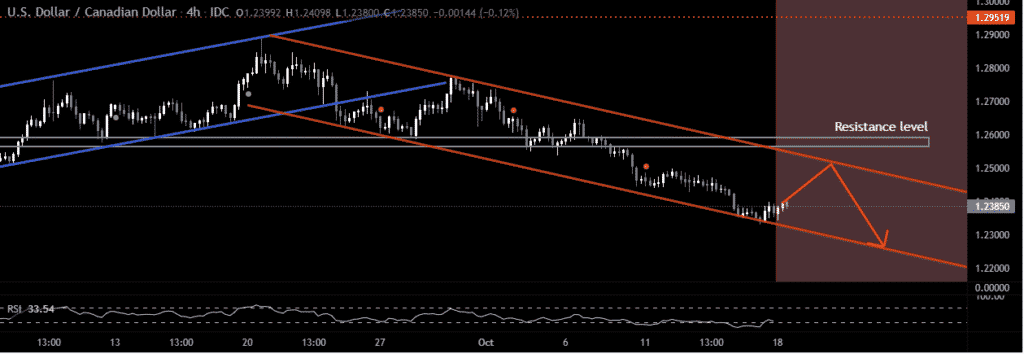

USDCAD renewed bullishness

The Canadian dollar is one of the majors on the defensive at the start of the week amid the dollar strength. The loonie has also been hurt by oil prices retreating slightly despite remaining elevated at seven-year highs. Consequently, the USDCAD pair rallied to four days highs above the 1.2400 level.

The Canadian dollar continues to lose some ground after strengthening to three and half months last week as oil prices rallied to seven-year highs above the $80 a barrel level. With the pair gaining some upward momentum amid the dollar’s strength, the next stop could be the 1.2460 level seen as the next substantial resistance level.

The likelihood of the pair rallying is high as the dollar continues to strengthen amid growing confidence that the FED will tighten monetary policy next month. The greenback is also receiving some support against the Canadian dollar on growing confidence that the FED will hike interest rates next month.

However, USDCAD upside action could be limited on oil prices, Canada’s main export, bouncing back after Monday Pullback.

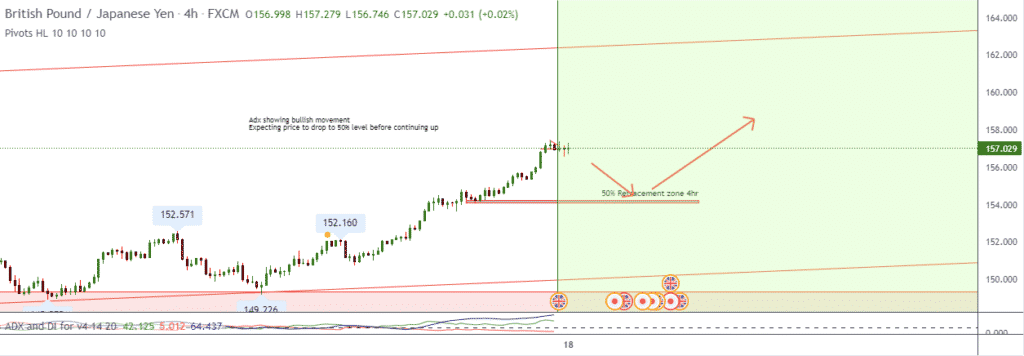

GBPJPY rally stalls

Meanwhile, GBPJPY gave up some gains Monday morning, pulling back from five-year highs reached last week as the pound continued to strengthen against the yen. The pair advanced 1.09% on Friday, touching highs of $157.1.

While the pair did pull back to session lows of 156.45, it has since bounced back to the 157.08 handle.

The rally came as investors bet on riskier assets shunning safe-havens of the likes of yen. Additionally, the pound received some support from the Bank of England Governor, touting the need for higher rates to contain inflationary pressures that have continued to edge higher amid higher energy prices.

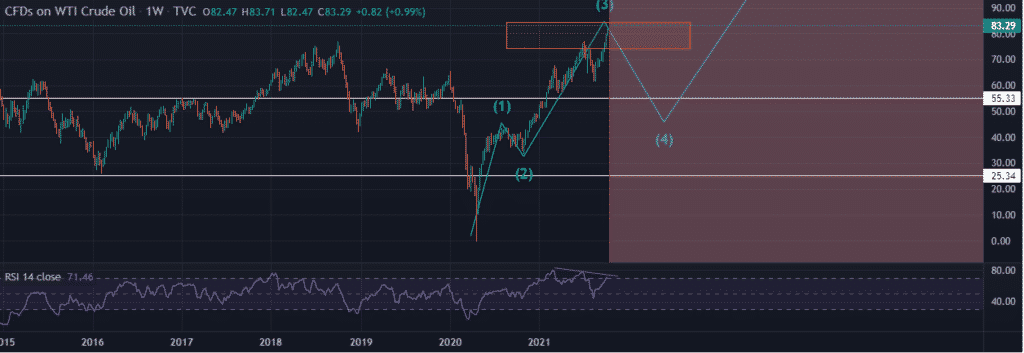

Oil at multi-year highs

In the commodity, market oil hit the highest levels in years after gapping higher early Monday morning. The spike in US oil to highs of $83 a barrel came as bullish momentum built up amid strong demand recovery from the COVID-19 pandemic.

Oil demand has edged higher in recent days as power generators turn away from expensive gas and coal in favor of crude oil. Easing restrictions worldwide should continue to fuel demand for the commodity, which could see prices edging even higher. Additionally, cold temperatures in the northern hemisphere are likely to worsen the current oil supply deficit.

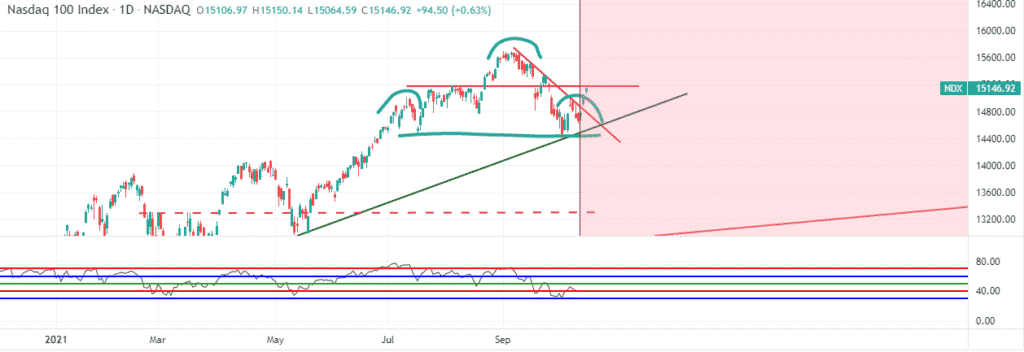

US indices eye earnings

Major benchmark indices are in for a pivotal week as the earning season heats up. Last week the major benchmarks finished stronger than expected. The Dow Jones Industrial ended the week up 1.58%, its best weekly gain since June as the S&P 500 rose 1.82% for the best week since July. Tech heavy NASDAQ added 2.18%.

The rally came at the back of solid earnings results from major banks, which once again affirmed the health of the US economy. The earning session is now in full swing, with a number of big names expected to report, which should shake the indices.

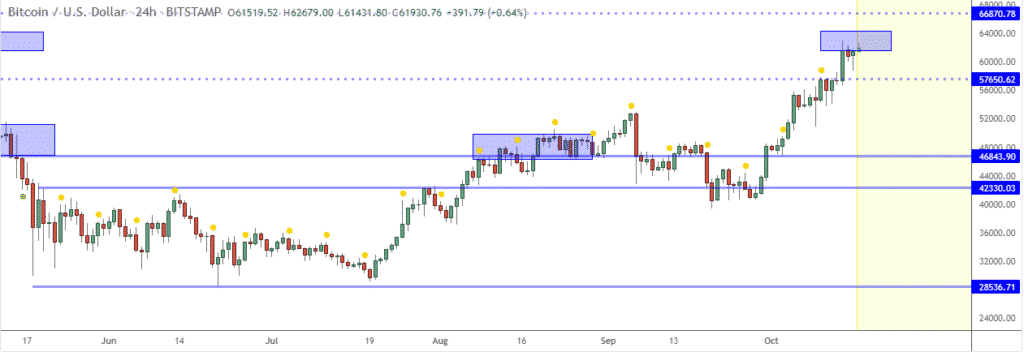

Bitcoin & Ethereum rally persists

Meanwhile, in the cryptocurrency market, Bitcoin is on the cusp of powering to its all-time highs after powering through the $60,000 level and onto $62,381. Going by the strength of the upward momentum, $64,000 looks like the next probable stop.

BTCUSD has been in fine form in recent days, having emerged as an alternative hedge against rising inflation as gold continues to falter. ETHUSD is also closing in on the $4,000 level after powering through the $3,800 level.