- US dollar steadies near two-week highs ahead of ECB report.

- USDCAD is trying to hold on to gains above 1.2700.

- USDINR steadies after three days of gains.

- Oil prices trend higher on supply concerns in the US.

- US equity indices trend lower as valuation concerns bite.

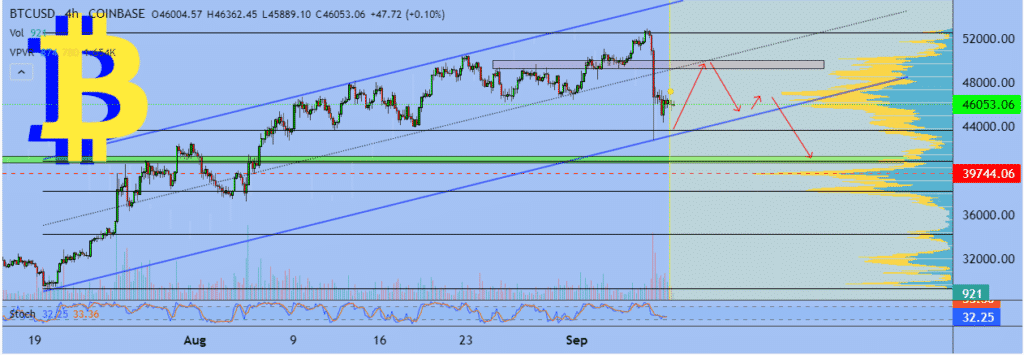

- Bitcoin is under pressure above $46,000.

The US dollar has steadied near two-week highs after three consecutive days of gains. The dollar index, which measures greenback strength against the majors, has found strong support above the 92.00 level as it closes in on the 93.00 level.

The renewed dollar strength comes at the backdrop of rising treasury yields that have shrugged off concerns about the disappointing job report last week. Additionally, growing concerns about the global economy’s health amid the delta variant have continued to offer support to the greenback as a safe haven.

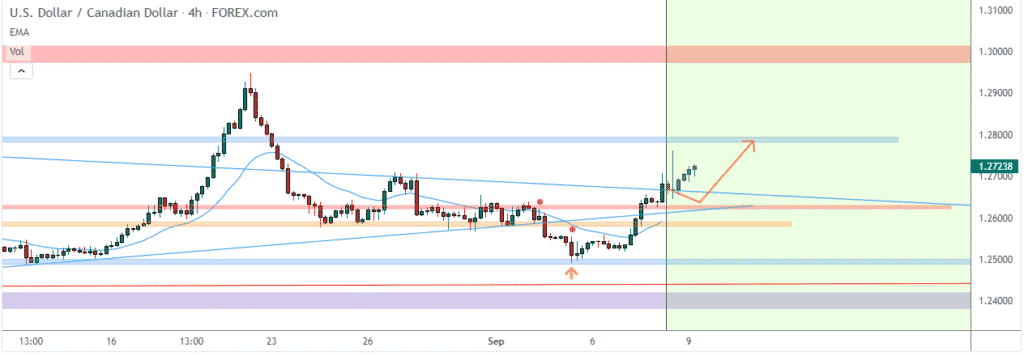

USDCAD turns bullish

Amid the dollar strength, USDCAD has recouped all the losses accrued last week, powering to two-week highs as the Canadian dollar remains on the defensive. The pair looks bullish above 1.2700 and is likely to continue edging higher.

Support on any pullback is seen at the 1.2700 psychological levels, below which the pair could tank to lows of 1.2630, the next substantial support level.

Fundamentally, the Canadian dollar remains under pressure, especially on the Bank of Canada conveying fears about the economy’s health amid the fourth wave of the coronavirus. The concerns have all but triggered a weakening of the CAD against the dollar, despite oil prices firming in recent days near the $70 a barrel level.

In addition, the CAD has been weighed down by the risk-off mood in the market as players rush to safe-havens such as the dollar to hedge against the risks posed by the pandemic.

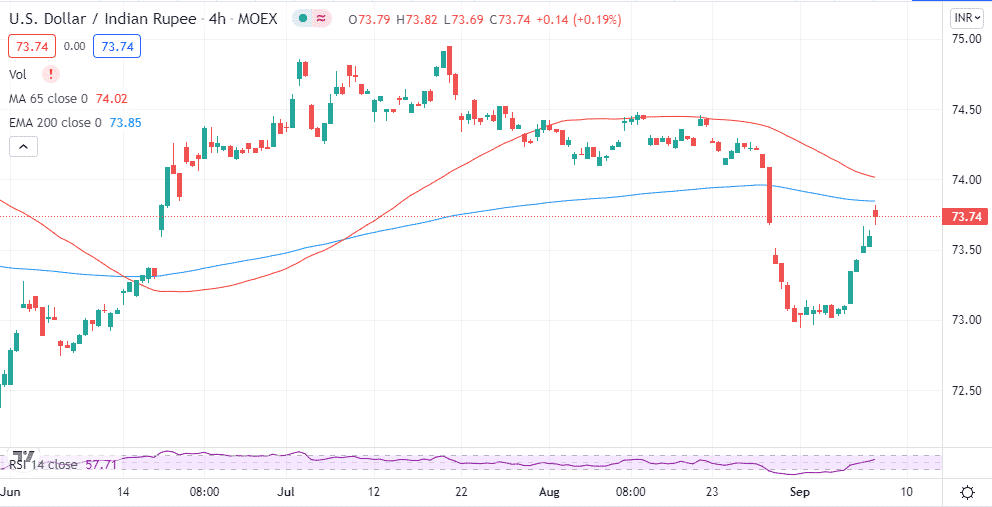

USDINR consolidates

The USDINR pair has also been in fine form, rallying for three consecutive days amid renewed dollar strength. However, the pair appears to have consolidated around the 73.77 level on treasury yields retreating after recent rallies.

Cautious sentiment in the market ahead of the much-awaited European Central Bank monetary policy market also appears to have eased the bullish tone on the greenback fuelling the consolidation. The dollar has been upbeat against the Indian Rupee on FED speakers fuelling tapering calls.

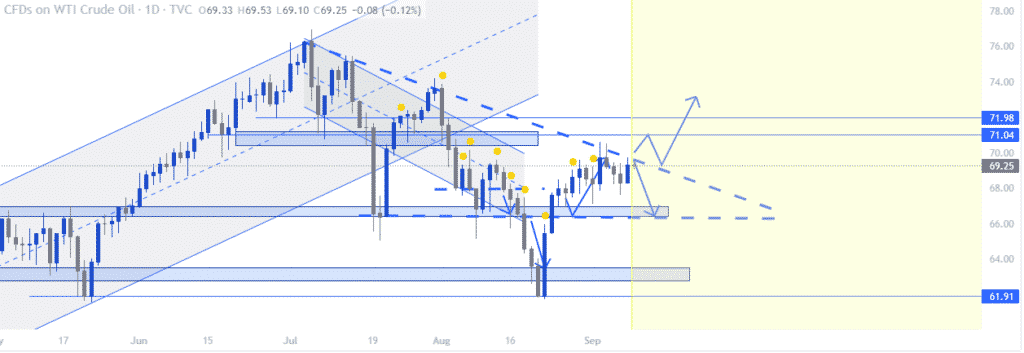

Oil prices rise on supply concerns

Meanwhile, oil prices edged higher on Thursday, boosted by the slow recovery in US production following hurricane IDA. The slowdown has helped shun concerns over an oversupply in the market amid waning demand in recent days.

Brent crude was up by 0.2% early Thursday to $72.75 as US WTI oil closed in on the $70 a barrel psychological level at $69.36.

Oil prices should remain bullish and trend higher as damage to infrastructure and power outages in the Gulf of Mexico knock off more supply into the market. As of Tuesday, as much as 77% of 1.4 million barrels a day out of the Gulf was offline.

Reports that protesters in Libya were blocking oil exports also continue to favor higher oil prices on suppressing supply in the market.

US indices retreat on valuation concerns

Major U.S benchmarks remain under pressure struggling to hold on to gains near record highs in the equity market. The S&P 500 fell for a third day as the NASDAQ composite index posted its biggest drop in two weeks on Wednesday. The Dow Jones Industrial Average also remained under pressure tanking by more than 1.5%.

The sell-off comes as investors continue to reassess valuation levels amid growing concerns about economic recovery due to the COVID-19 pandemic. A concern that the Federal Reserve could move to reduce monetary stimulus that has been fuelling the rally also appears to be fuelling portfolio realignments. Morgan Stanley has already cut its outlook for US stocks to underweight, citing the slow growth risks.

Bitcoin under pressure

In the cryptocurrency market, consolidation is the theme as Bitcoin and Ethereum remain range-bound after bouncing off two-month lows after a recent sell-off. However, BTCUSD is struggling to hold on to gains above the $46,000 level amid renewed selling pressure in the market.

A sell-off followed by a close below the $46,000 level could trigger an increased sell-off that could result in the pair plunging to two-month lows of $42,800.

Bitcoin sell-off from four-month highs of $52,000 came even as El Salvador resorted to BTC payments as a legal tender. The country’s government switching off key Bitcoin wallets appears to have fuelled the sell-off.