- Lumber prices remain subject to heightened volatility but may fail to hit a new record high.

- After hitting limit down and limit up in the past week, prices are down by 1.58% at $1,430.

- The US Housing boom continues amid low borrowing costs.

Homebuilders pause on new projects

The overwhelming rise in lumber prices has forced some homebuilders to pause on new projects. Like any other sector, there is a limit to the level of price hikes that buyers can handle before the ‘structure’ comes crumbling.

Tuesday’s housing data proved this concept. According to the US Census Bureau, single-family housing starts fell by over 13% in April compared to the prior month. The figure released on Tuesday represents the highest decline since April 2020 when the coronavirus pandemic hit the US economy.

According to the National Association of Home Builders (NAHB), construction materials for the residential building have had their prices rise by 12.4% since the same period in the past year. Notably, the surge in lumber prices has increased the price of establishing an average single-family house by about $36,000. Subsequently, about 15% of home builders in the US are said to be pausing on framing the project after putting up the concrete foundation.

Despite the soaring lumber prices and subsequent decline in housing starts, the US is still experiencing a boom in housing demand. For as long as borrowing costs remain low, the trend is likely to continue. In the recent FOMC meeting minutes, the central bank hinted at possible tapering talks in its upcoming meetings. Despite the hawkish tone, the Fed left interest rates are unchanged at near zero.

Not over yet

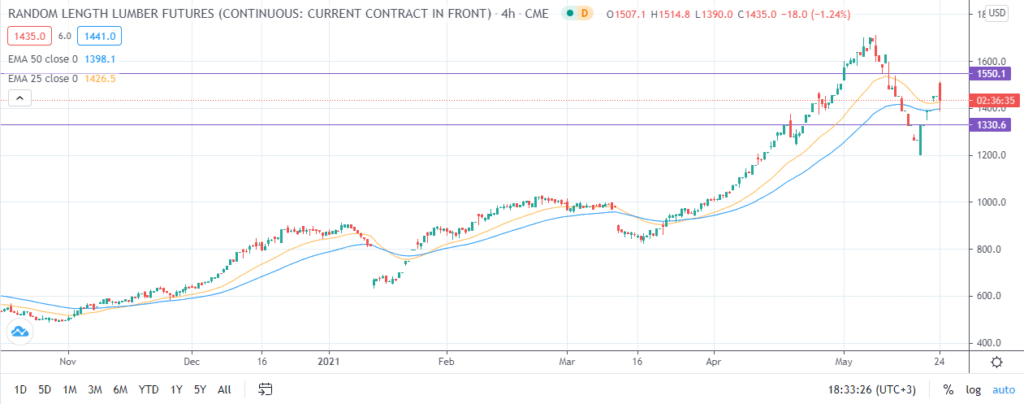

In spite of the recent decline in lumber futures, extreme volatility and an overwhelming rise in lumber prices is likely to continue in the foreseeable future. At its all-time high of $1,711 earlier in the month, lumber futures were in the overbought territory at an RSI of 85. Mid-last week, it entered the oversold zone at an RSI of 27.

In the Chicago Mercantile Exchange, there is a range that commodity futures contracts should trade within a session. This is the basis of the ‘limit up’ and ‘limit down’ terms. On Wednesday, lumber prices reached the limit down before rebounding to the limit up on the same day. On the next day, it hit the limit up again after surging by 4.75% to $1,390.

On the one hand, the spike in raw material prices has resulted in higher construction costs. Notably, builders can only handle the surge in costs to a certain level. Above that level, demand may start to dwindle as consumers pause on their projects. A similar trend is evident in the commodities market. Investors holding a buy position in lumber futures are trading cautiously lest they end up as bag holders of a 1,700 investment.

However, in the short term, bagholders, lumber prices are likely to remain high. Granted, lumber futures may not hit a new record high. The heightened demand for housing will continue to boost prices. Besides, an accommodative monetary policy is a bullish catalyst for lumber prices as it includes low borrowing costs.

Lumber prices technical outlook

Lumber prices are down by 1.58% at $1,430. Earlier on, it had risen to $1514.8 as it extended last week’s rebound. On a 4-hour chart, it is trading slightly above the 25 and 50-day exponential moving averages. I expect the prices to trade within a range of between $1,550 and $1,330.