- Dollar strengthens across the board after solid NFP report

- Euro weakness against the dollar and British pound persists

- Oil prices tank below $70 a barrel level on demand concerns

- Bitcoin and Ethereum bounce back continues to gather steam

At the start of the week, the dollar is the center of attention, having rallied and steadied near four-month highs against the majors. The greenback strength stems from July’s blockbuster job report that has raised optimism of the US Federal Reserve tapering stimulus much earlier than anticipated.

Euro weakness on dollar strength

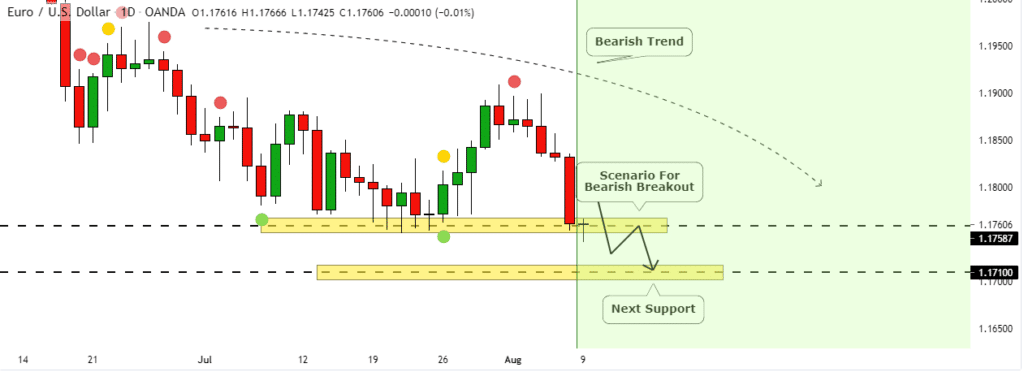

Amid the dollar strength, EURUSD has plunged to three-month lows and looks increasingly bearish. While the pair is trading near a critical support level at around 1.1760, the buying tone surrounding the greenback and rising US Treasury yields could fuel another leg lower.

The pair needs to hold above the 1.1750 level to have any chance of bottoming out after the recent sell-off.

On the flip side, a sell-off followed by a close below the critical support level could result in the pair plunging back to the 1.1710 level.

Pilling pressure on the euro against the dollar is a slate of disappointing economic data within the Eurozone that continues to elicit economic growth slowdown concerns. The HIS Markit Eurozone Construction Purchase Manager Index came in at 49.8, down from 50.3 the previous month.

The spread of the Delta variant is another headwind that should continue to pile pressure on the common currency against the greenback. Traders are increasingly flocking safe-havens all but sending the dollar higher against the majors.

EURGBP is under pressure as the pound steadies

With the British pound holding firm amid the dollar strength across the board, EUR/GBP is another pair under pressure. Increased euro weakness amid pound resilience against the major has resulted in the pair sliding to three-month lows.

After plunging below 0.8500 levels, EURGBP is looking increasingly bearish, with bears in control amid the sterling strength.

A sell-off to the 0.8390 could be on the cards on the pound holding firm against the euro.

The pound is strong against the euro on the Bank of England (BOE), sounding less alarmed about the Delta variant spread. So far, the BOE has remained hawkish against a dovish European Central Bank whose sentiments have weighed heavily on the euro.

Oil slide persists on demand concerns

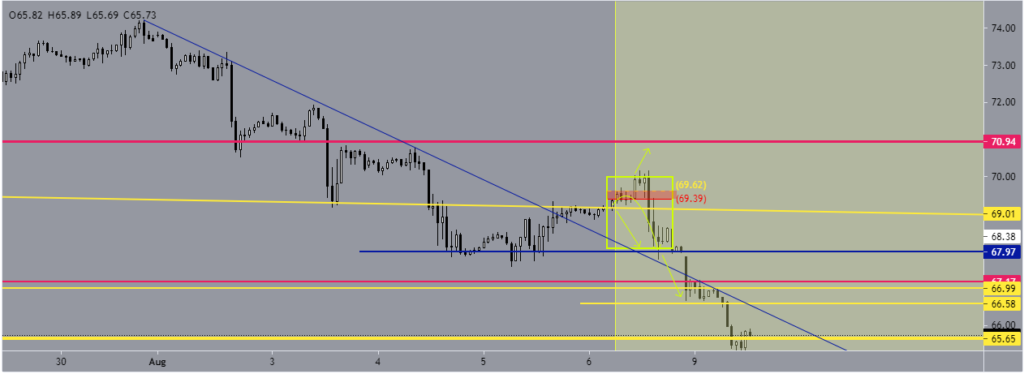

In the commodities markets, US oil plunged below the $70 level early Monday. A 2% slide in prices came amid a strengthening US dollar. However, the concerns about new pandemic curbs in Asia, especially China, continue to weigh heavily on prices.

US West Texas Intermediate has already slid to two weeks lows of $66.64 at the time of writing. Brent Crude was also down 2.2% to $69.17 after a 6% slide the past week.

The sell-off comes amid growing concerns of potential global oil demand erosion amid the worsening Delta variant situation. Traders are increasingly fearful of governments imposing travel restrictions in a bid to arrest the situation, a move that could hurt oil demand.

US indices struggling for direction

In the stock markets, US stocks remain under pressure, piling pressure on indices to hold on to gains at record highs. While the Dow Jones Industrial did rise 0.4% on Friday to close at all-time highs of 35,208 and the S&P 500 up 0.2% to close at a record high of 4,436.52, the NASDAQ fell 0.4% to close at 14,835.

The mixed sentiments stem from growing concerns that the Federal Reserve could start tapering monetary policy that has been the catalyst behind the rally in the stock market the past year. The US economy added 943,000 jobs in July, all but affirmed economic growth, fuelling the suggestion that the FED could hike interest rates to tame the runaway inflation.

Cryptocurrency bounce back continues

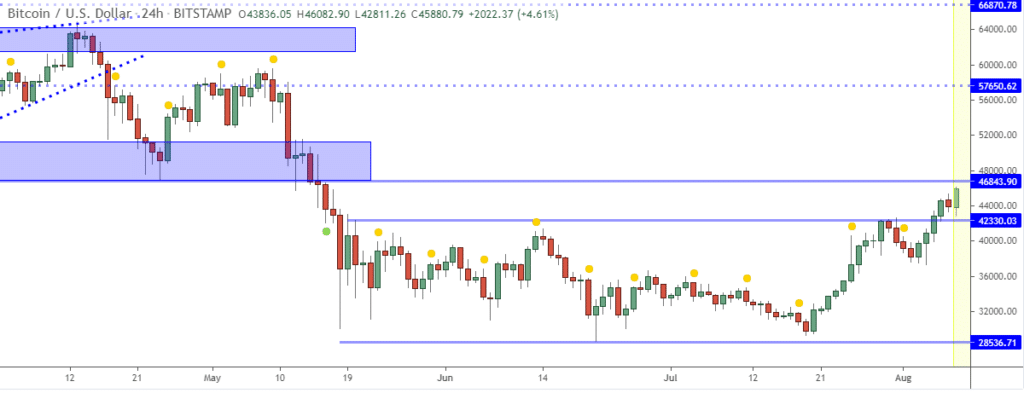

Bitcoin and Ethereum are on the front foot at the start of the week as a bounce back from five months lows continues to gather pace. BTCUSD and ETHUSD have reached the highest levels in more than two months.

BTCUSD touched highs of $45,328 over the weekend before pulling back on Monday. Ethereum, on the other hand, has taken out the $3,000 psychological level following the Ethereum network’s London upgrade.