- US dollars rallies to ten-month highs.

- EURUSD consolidates at one-month lows.

- EURGBP posts biggest price gain in six months.

- Oil prices retreat from multi-year highs.

- US benchmark edge lower on rising yields.

- Bitcoin and Ethereum are trying to bounce back.

The US dollar is standing tall at a ten-month high against a basket of other major currencies. The global de-facto currency has been in a fine form in recent days, helped by US Treasury yields surging to three-month highs.

Investors and traders’ nervousness that the US Federal Reserve will start withdrawing monetary policy soon has helped strengthen the greenback case in the forex market. A strengthened dollar continues to pile pressure on the majors, with the euro emerging as one of the biggest casualties.

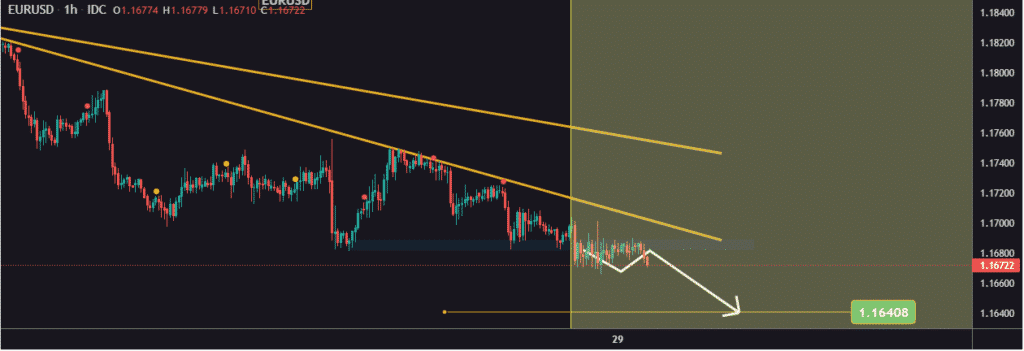

EURUSD at 1-month lows

EURUSD has since plunged to one-month lows after sliding below the 1.1700 level on rising US Treasury yields and strengthening dollar. While the pair is trading near the 1.1680 level, it could slide to the 1.1640, seen as a KEY support level.

On the flip side, bulls fuelling a rally past the 1.1700 level should reignite hopes of a bounce back after the recent sell-off. However, the pair remains bearish amid a string of developments working against the common currency strength.

The European Central Bank’s indecision on the next moves on tapering and asset purchases has weighed significantly on the euro against the dollar. Council members have only tried to defend the easy money policies at a time when the US Federal Reserve has reiterated tapering will begin before year-end and end the mid-next year.

Additionally, the looming Evergrande coupon payment and the push by the US to cut China’s oil imports from Iran threaten a risk-off mood in the market. Consequently, EURUSD sellers can remain hopeful.

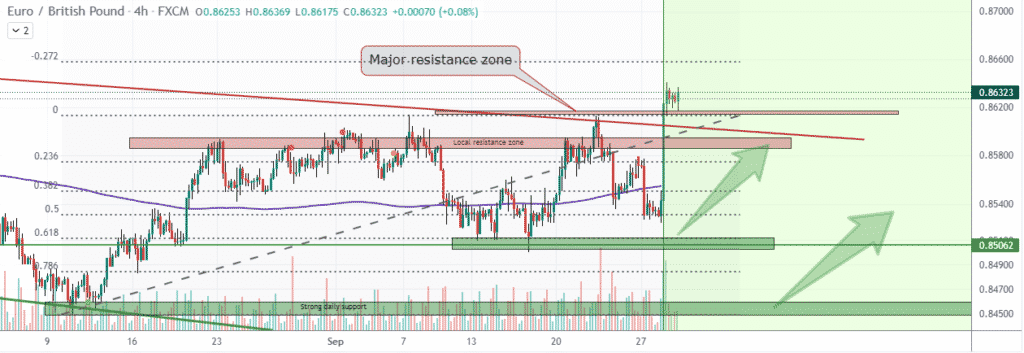

EURGBP explodes

While the euro continues to struggle against the greenback, it is not the case against the British pound. The EURGBP pair has since posted its biggest single-day gain in more than six months, coming at the back of pound weakness across the board.

The pair rallied by more than 100 points powering through the 0.8600 level and into two-month highs of 0.8623.

Renewed euro strength against the pound came after ECB member Peter Kazimir reiterated that the central bank might not have to increase bond buying via its APP program. Additionally, strong economic data from Germany with Gfk Consumer Climate Indicator jumping 0.3% also offered support to the shared currency against the sterling.

In contrast, Brexit woes continue to pile pressure on the pound, with the latest being rival unionist parties in Northern Ireland forming an alliance to fight the Brexit Protocol.

Oil prices retreat

Oil prices were down early Wednesday in the commodity markets as investors remained wary of a surprise buildup in US crude oil supplies. Data from the American Petroleum Institute showed a buildup of 4.127 million barrels for the week ended September 24, while forecasts predicted a draw of 2.33 million barrels.

Consequently, Brent crude fell 1.47% to $77.20 a barrel after initially rallying to $80 a barrel. US oil fell 1.53% to $74.14 a barrel. Oil prices have been on a fine run in recent days, rallying to three-year highs amid growing optimism of a spike in demand.

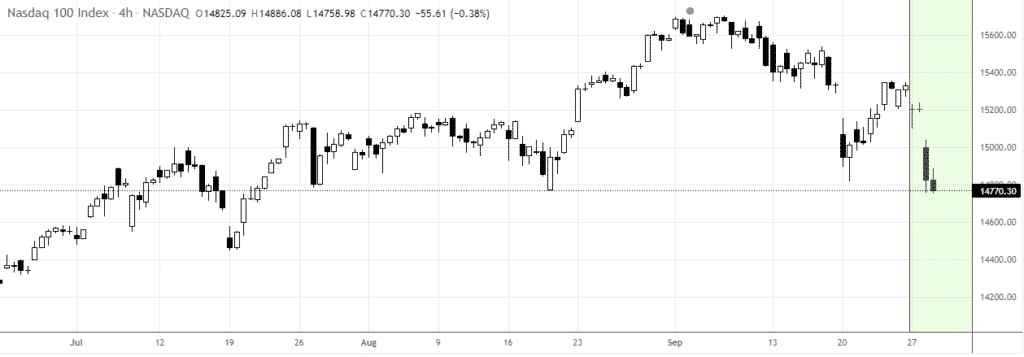

US equity sell-off

In the equity markets, major equity benchmarks posted their biggest loss in six months as a retreat from record highs gathered steam. The NASDAQ dropped 2.83% as the S&P 500 shed 2.04% and the Dow fell 1.63%.

The sell-off in the equity markets comes as investors shifted their attention to raising US treasury yields that have touched three-month highs. Rising bond yields continue to hurt growth stocks, including tech stocks, as they increase the prospects of lower future earnings.

Bitcoin and Ethereum waning sell-off

In the cryptocurrency market, a sell-off wave that had pushed Bitcoin and Ethereum below the critical support level is losing momentum. BTCUSD has bounced back, with bulls retaking the $42,000 handle amid dollar strength across the board.

Ethereum is also in a recovery mode, with the ETHUSD closing in on the $3,000 psychological level on renewed buying pressure.