- Dollar firms near one-year highs.

- NZDUSD bounced back on easing Covid restrictions.

- AUDUSD under pressure amid Evergrande pitfall concern.

- Oil prices retreat ahead of the crucial OPEC meeting.

- U.S. equities on the recovery mode.

- Bitcoin and Ethereum rally stalls.

A cautious outlook swept the financial markets at the start of the week, with the U.S. dollar finding support near one-year highs as a safe haven. Renewed concerns about China Evergrande Group’s debt woes continue to send jitters as focus shifts to the Non-Farm Payroll report on Friday.

The U.S. dollar index, which measures the greenback strength against the majors, has firmed above the 94.01 level. Expectations are high that the Non-Farm Payroll report on Friday will come better than expected, which should continue to fuel greenback strength after the recent softness.

NZDUSD bounce back

The New Zealand dollar is one of the majors trying to bounce back from one-month lows taking advantage of the dollar softness. The NZDUSD has since powered through the 0.6900 level to 0.6940 at the time of writing.

The rally faces strong resistance near the 0.7000 level above, which further gains should be expected. Below the critical psychological level, the pair remains susceptible to other losses, with the greenback strength elevated at one-year highs.

The New Zealand dollar is attracting some bids at the start of the week, with Prime Minister Jacinda Ardern reiterating that Covid restrictions in Auckland will be eased in steps starting Wednesday. However, renewed China Evergrande’s fears threaten to pile pressure on the NZD.

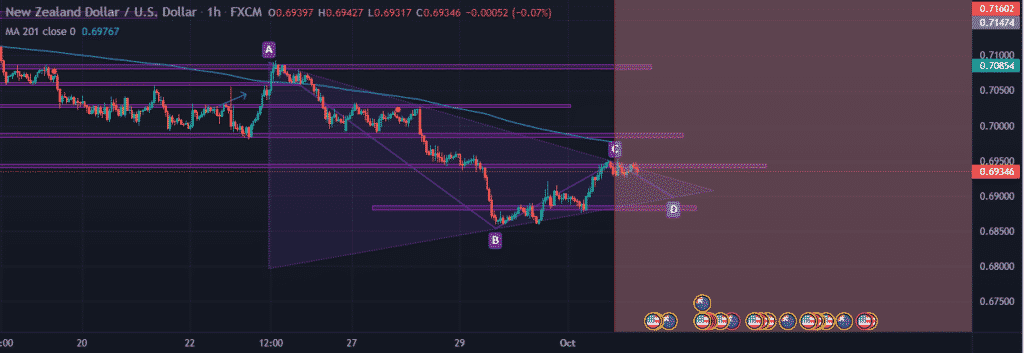

AUDUSD retreats

Meanwhile, AUDUSD remains pressured, struggling to power through the 0.7260 amid growing concerns about the Sino-American trade relations and Evergrande situation. However, U.S. stimulus hopes and U.S. treasury yields edging lower from three months highs are helping avert the pair’s accelerated sell-off.

Immediate support is seen at the 0.7250 level below which the pair could slide to 0.7200. A rally followed by a close above 0.7300 should reaffirm the bounce-back play.

The Evergrande Group debacle is a major development that should continue to weigh heavily on AUD against the dollar. This is because China is Australia’s biggest trading partner, and any turmoil is likely to have some ripple effect on the Australian economy.

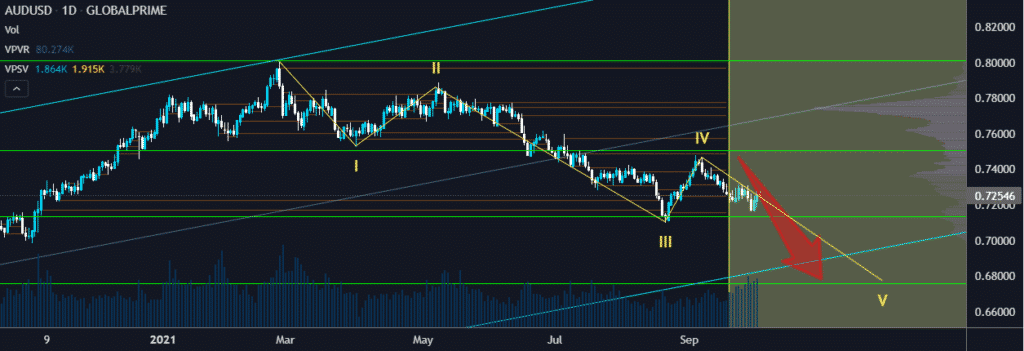

Oil prices tank ahead of OPEC

In the commodity markets, oil prices were lower early Monday morning as the focus in the oil markets turned to a meeting of OPEC and its allies. The meeting will seek to unravel whether a recent rally in oil prices amid supply shocks is sustainable.

Brent crude was down 0.2% to $79.14 after rallying 1.5% last week. U.S. oil was also down 0.2% to $75.73 a barrel.

Oil prices have risen to near the $80 a barrel level, three years high. However, they have struggled to grind higher as supply has inched higher on the U.S. oil, coming back into the fold with renewed production at the Gulf of Mexico.

OPEC has come under immense pressure in recent days to produce more in a bid to help lower prices as demand has recovered more than expected.

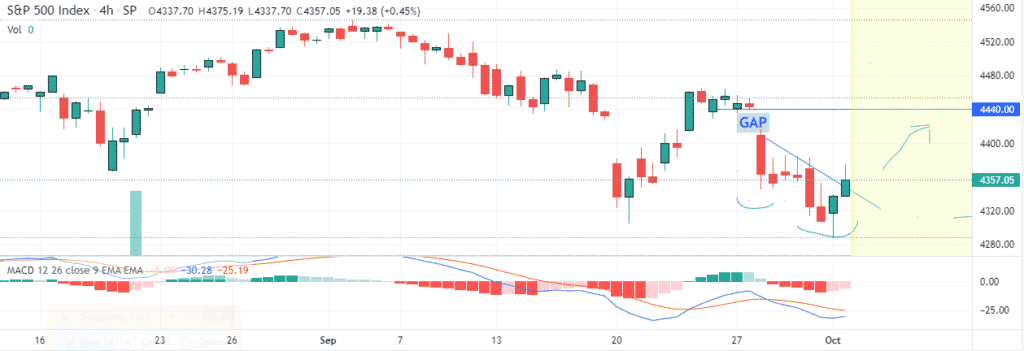

U.S. indices recover

U.S. stocks finished higher on the first day of trading in October in the equity markets, but major indices still posted weekly losses. The Dow Jones Industrial Average rose 1.43%, S&P 500 up 1.15%, and NASDAQ up 0.82% on Friday. However, the Dow was down 1.4% for the week, S&P 500 down 2.2%, and NASDAQ 3.2%.

The rally in the equity markets comes amid a batch of mixed economic data. Personal spending and incomes data provided further evidence that the cost of goods and services is rising. Focus now shifts to the NFP report on Friday, which could provide clues on whether tapering will come into play sooner than later.

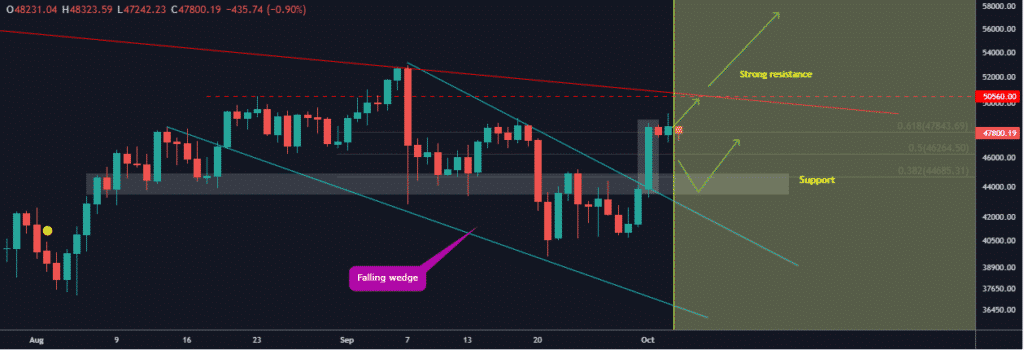

Crypto rally stalls

Bitcoin and Ethereum are yet again on the defensive at the start of the week. BTCUSD has struggled to hold on to gains above the $49,000 level, pulling down to the $47,700 handle. The pullback might as well be a minor correction on traders taking profits after the recent spike higher.

ETHUSD is also under pressure after rejection at $3,400, and the pair has slid to the 3,300 level with immediate support seen at the $3,260 level.