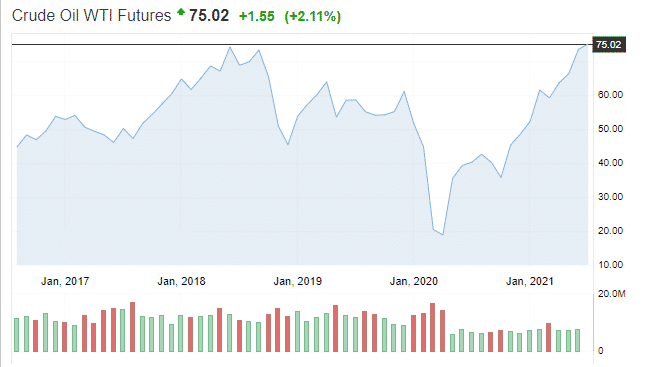

- Crude Oil futures topped $76 per barrel, reaching a 3-year high.

- OPEC meeting agreed to maintain oil production to less than 0.5 million b/d but promised to increase production to 2 million b/d in Q4 2021.

- US manufacturing PMI beat estimates at 6.47%.

WTI Crude Oil gained 3.51% on July 1, 2021, from the previous day’s close. The August 2021 contract opened trading at $73.53 per barrel and rose to an annual high of $76.10. It has reached a 1-year rate increase of 87.17%, with the settlement date expected on August 18, 2021. OPEC, which is responsible for up to 40% of the global oil supply, is scheduled to meet on July 1, 2021, to discuss the production output in Q3 2021.

Production cuts

It is expected that the OPEC meeting will allow additional cuts to oil production as of August 2021. The global oil body may settle at an output of 500,000 barrels per day in August as it waits for the April supply to run out. Investors have responded to the supply-shortage anticipation, thereby increasing the buying momentum of the commodity. However, increased production could still have a positive impact on the price as the ease of restrictions continues worldwide.

The OPEC meeting report for August 2021 was released on July 1, 2021, at the time of this writing. It admitted that the global economy has grown from a contraction of 3.4% in 2020 to an increase of 5.5% as of May 2021. Analyst estimates at the oil alliance have put the world’s oil demand at 6 million barrels/day. In 2020, the demand had declined by 9.3 million b/d due to travel restrictions. It is expected that pre-pandemic oil demand will be attained in Q4 2021, with the second half (H2) of 2021 proving a pivotal point in demand growth.

While the OPEC meeting agreed to maintain oil production to less than 0.5 million b/d, it also agreed to slowly increase the output to 2 million b/d from August to December 2021. This increase is seen as a recovery from the demand destruction that occurred in 2020 and the Q1 of 2021.

Manufacturing prices

Manufacturing PMI data in the US, as released on July 1, 2021, for June 2021 (MoM), indicated an increase to 92.1 from a low of 88.0 in the previous month. This index beat estimates by 6.47% that had envisioned a decrease to 86.5. The increase in this index suggests a subsequent rise in orders (export and import), production, decline in inventories, and quicker supplier deliveries. It goes hand-in-hand with the oil consumption levels due to the rising demand.

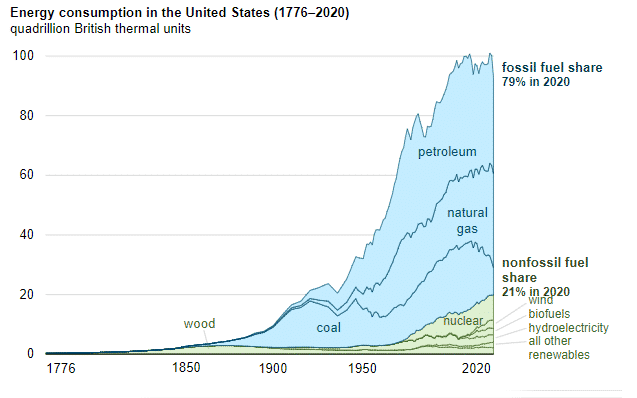

Oil use in the US

As the US celebrates the rise of non-fossil fuel share in the energy market to 21%, fossil fuel (inclusive of petroleum) boasts of the remaining 79%. Consumption of primary energy in the US fell 7% to 93 British thermal units (Btu) from 100 Btu in 2019. However, as it has been shown, the consumption levels have continued to rise since the US attained independence.

In topping $76 a barrel, crude oil hit the highest price since 2018, indicating increased consumption into 2021. Suffice to say that crude oil is riding in its pre-pandemic levels.

A 5-year analysis of WTI Crude Oil

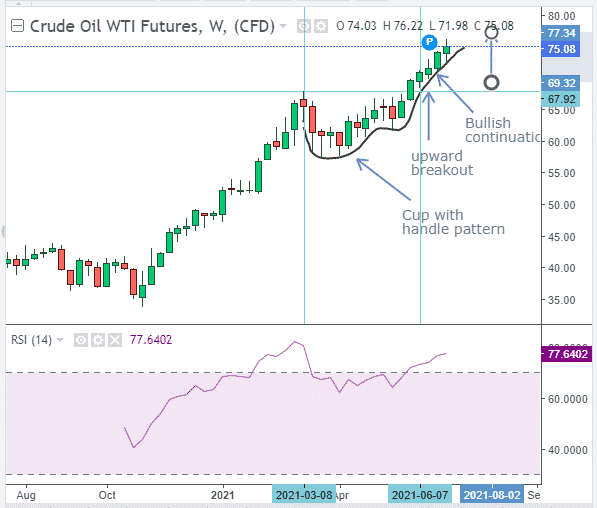

Technical analysis

The WTI Crude Oil futures (W) formed a cup-with-handle pattern beginning from March 8, 2021. It formed an upward breakout on June 7, 2021, confirmed at $67.92. In response to the pattern, the price action proceeded with a bullish continuation (in the short term). This price movement may reach highs of $77.34 per barrel as it looks for resistance.

The 14-day RSI indicates price action is above the overbought zone and may reverse towards $69.32.