- US dollar strengthens near 16-month highs.

- EURUSD sell-off persists.

- USDJPY retreats on safe haven demand.

- Oil prices tank on the dimming demand outlook.

- Cryptocurrencies sell-off persists.

The US dollar was upbeat Monday morning, holding firm near 16-month highs and sending the majors lower. The greenback has received a boost on the Federal Reserve, signaling an earlier interest rate hike next year.

Surging cases of Omicron variant worldwide is another factor fuelling dollar strength across the board. Market participants are increasingly shunning riskier currencies in favor of safe havens amid concerns that the new variant could affect economic growth amid the ongoing tightening.

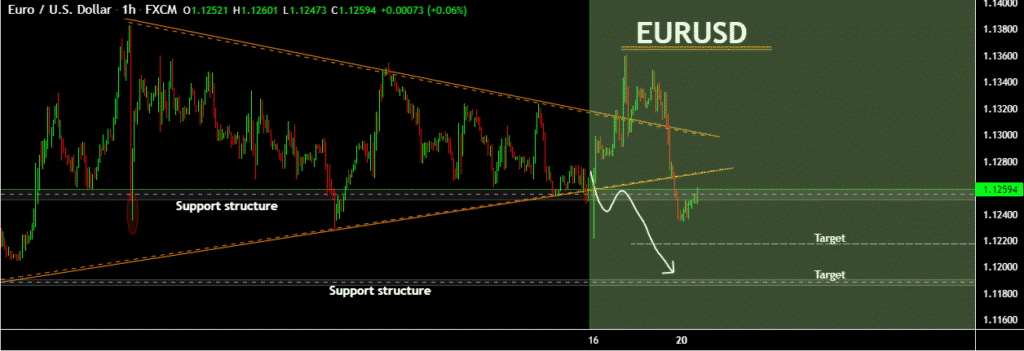

EURUSD under pressure

EURUSD is one of the pairs under immense pressure amid the escalating Omicron situation in Europe. A slide below the 1.1300 has left the pair susceptible to further slides as it continues to flirt with key support at the 1.1233 level.

A break below the support level could result in EURUSD sliding to 17-month lows of 1.1188 on the flip side, and the pair needs to find support above the 1.1270 level to affirm a probable bounce to the 1.1300 psychological levels.

EURUSD remains susceptible to dollar strength amid the uncertainty triggered by the Omicron variant. Traders shunned European Central Bank hawkishness last week, opting to focus on safe havens amid the uncertainty triggered by the variant.

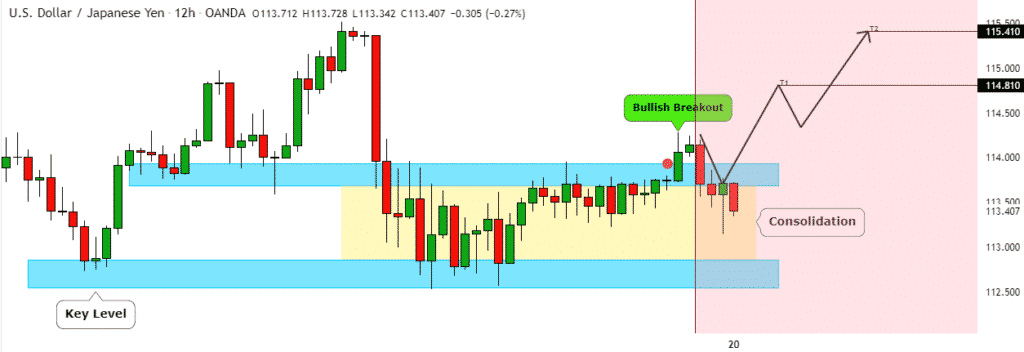

Yen strengthens

Meanwhile, the rush to safe-haven is the catalyst behind a strengthening yen against the dollars. USDJPY has since slid below the 113.55 level as traders flock yen as a safe haven amid the global uncertainties. Failure to find support above the 114.00 level has put bears in control, likely to fuel further downside action.

The omicron variant is why the yen is holding firm against the dollar following a dovish stance from the Bank of Japan. The Central bank kept its overnight call rate at -0.1% for the sixth year. The dovish stance comes when most central banks have turned bullish, easing most of the accommodative policy to curtail runaway inflation.

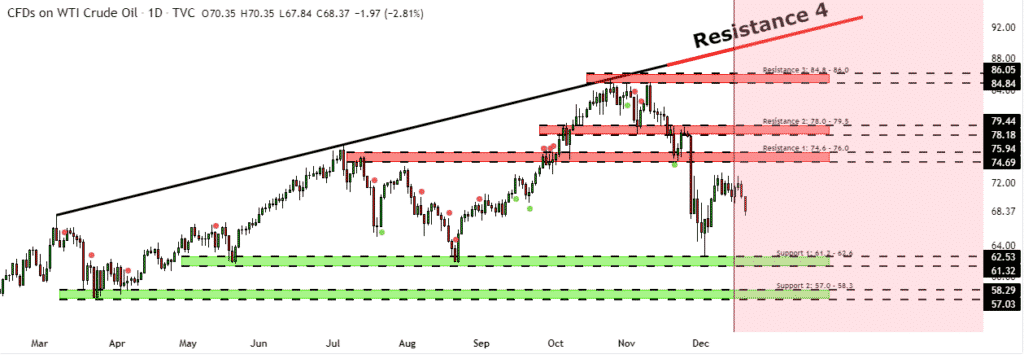

Oil prices slide

A slide in oil price gathered pace in commodity markets on Monday morning as a rapid Omicron spread continues to dim demand outlook. After struggling to find support above the $70 a barrel level, US oil has slid to two-week lows at $67 a barrel.

The slide in oil prices comes amid concerns that new restrictions to combat the spread of the virus are likely to hurt oil demand. The Netherlands is one of the countries that have already gone into lockdown. In addition to the Omicron variant, US energy firms adding oil and natural gas rigs for a second week continues to stoke glut in supply concerns.

US indices sell-off

In the equity markets, caution is the central theme amid the turmoil triggered by rising global omicron infections. Futures were lower Monday morning, continuing from Friday’s sell-off. The Dow Jones Industrial Average fell 1.48% as the S&P 500 fell 1.03% and tech-heavy NASDAQ slipped 0.07%.

The sell-off in the equity market has also been sparked by the move by central banks to ease monetary policy that has been the catalyst behind rallies to record highs. Chatter around rate hikes to clamp down on runway inflation also continues to spark fears amid concerns that borrowing costs amid the uncertainty of COVID-19 could edge higher.

Cryptocurrencies under pressure

In the cryptocurrency market, Bitcoin and Ethereum are struggling for direction after a recent slide below key levels. BTCUSD remains under pressure after sliding to lows of $46,320 level. The pullback comes on traders taking profits.

ETHUSD is also struggling below the $4,000 level after tanking to lows of $3,820 level. The pair is staring at strong support near the $3,500 level below, which a drop to the $3,000 level could be on the cards.