The GBPUSD is under intense pressure as the delta vaccine dents the country’s recovery efforts. The pair has dropped to 1.3866, which is about 1% below the highest level last week.

UK lockdown

The UK has made great strides in its battle against the coronavirus pandemic. Data compiled by Google shows that the country has already fully vaccinated more than 32 million people. In total, 44 million people have received at least a dose of the vaccine.

However, the country is also battling the new variant of the vaccine that is said to be more dangerous than the first one. This variant forced the government to postpone the complete reopening process by about two weeks. This, as a result, has dented the strong recovery seen in the country.

In a statement on Monday, Sajid Javid, the new health minister, reiterated that he wants life in the country to return to normal as soon as possible. He insisted that the government will start easing the current curbs in the third week of July.

The new restrictions come at a time when data points to a strong recovery of the UK. Retail sales have risen, more people are traveling, and many businesses have reopened. This has helped push the unemployment rate to 4.8%, while inflation has risen to the Bank of England’s (BOE) target of 2.0%.

In its decision last week, the BOE left interest rates unchanged and provided no hints of tapering of its asset purchases. However, many analysts expect that the bank will start signaling about this in the coming meetings.

UK housing data ahead

On Tuesday, the GBPUSD will react to the latest housing data from the UK. The Nationwide Society will publish the House Price Index (HPI). Economists expect the data to show that the HPI rose by 0.7% in June as demand continued to outpace supply. The prices increased by 1.8% in the previous month. On a year-on-year basis, the HPI is expected to increase by 13.7%.

The average UK house price has jumped by more than £20,000 since the pandemic started. This is according to data by both Nationwide and Halifax. The growth is mostly because of the country’s low interest rates and the government’s temporary removal of stamp duty. As such, analysts believe that the housing sector will likely start cooling down as rates rise and as the government returns the stamp duty.

The Bank of England will publish the latest mortgage data on Tuesday. The numbers are expected to show that mortgage approvals increased by more than 85 thousand in May, while the total rose to more than 4.58 billion.

Looking ahead, the GBPUSD will also react to the latest US consumer confidence data by the Conference Board. The overall confidence is expected to rise from 1117.2 to 119.0. Later this week, the biggest catalyst for the GBPUSD will be the official US non-farm payrolls data.

GBPUSD forecast

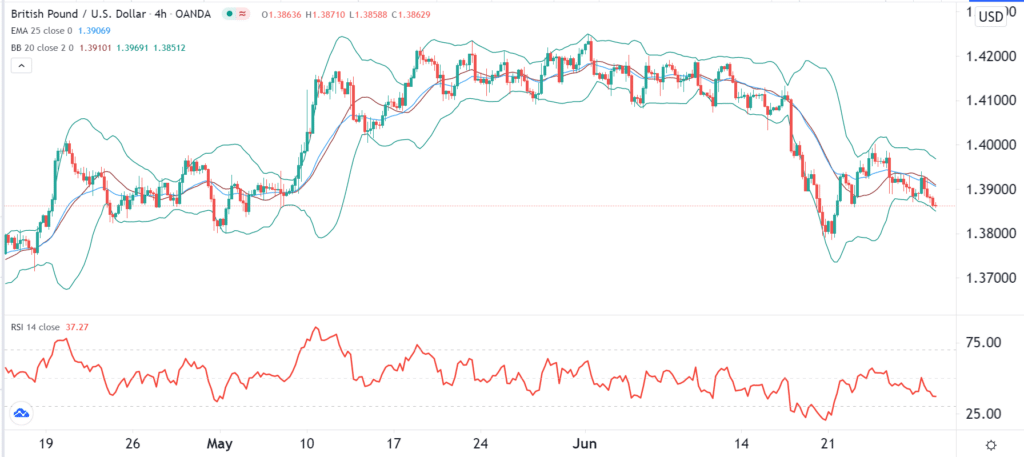

The four-hour chart shows that the GBPUSD pair has been in a deep dive in the past few days. That has seen it drop below the short and longer-term Moving Averages. The pair is also between the lower and the middle line of the Bollinger Bands. It has dropped below the Ichimoku cloud, while the Relative Strength Index (RSI) has also retreated.

Therefore, the pair will likely keep falling as investors target this month’s low at 1.3786. However, a move above 1.3940 will invalidate this trend.