- The US dollar is in recovery mode after a pullback.

- AUDUSD and AUDJPY edge lower as RBA disappoints.

- Gold stays under pressure below $1770.

- The Bitcoin and Ethereum rally gathers steam.

The US dollar was on the front foot early Tuesday after coming under pressure on Monday. However, it remains slightly below one-year highs as investors await the release of the Non-Farm payroll report on Friday. The report is likely to provide hints on when the Federal Reserve is expected to begin asset tapering.

The US dollar index, which measures the greenback strength, is struggling to bounce back above the 94.00 level after hitting the highest level in a year of 94.50 last week. The softness has come at the backdrop of US treasury yields edging lower from three-month lows.

AUDUSD pullback

Amid the dollar softness, AUDUSD has failed to hold on to gains above the 0.7300 level. The pair has since edged lower to 0.7253 and remains under pressure on the Reserve Bank of Australia, keeping monetary policy steady.

Failure to find support above the 0.7300 leaves AUDUSD susceptible to further losses as it continues to flirt with support at 0.7250.

A sell-off followed by a close below 0.7250 could result in bears pushing the pair to the 0.7225 level. Bearish biasness on the AUD pair looks set to continue, especially on the RBA, leaving the official cash rate unchanged at record lows of 0.10%.

The RBA board has also decided to continue the purchase of government securities at the rate of $4 billion a week until February of next year, raising doubts about Aussie economic expansion.

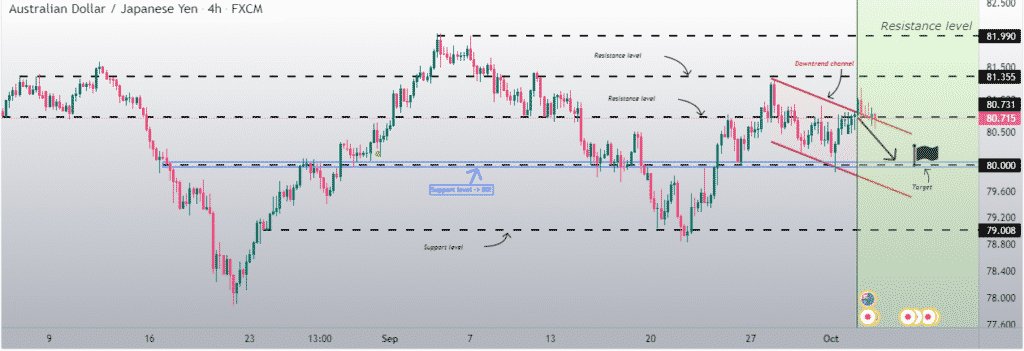

AUDJPY under pressure

Meanwhile, the Australian dollar also remains under pressure against the Japanese yen. The AUDJPY edged lower on Tuesday following the RBA decision after struggling to power through the 81.00 level. The pair has since dropped to about 80.63.

Investors continue to ditch the AUD against the yen in the aftermath of mixed economic data that continues to raise serious concerns about the country’s economy. The latest data shows that Job advertisements declined by 2.8%. While the country’s trade balance improved in August, imports and exports dropped.

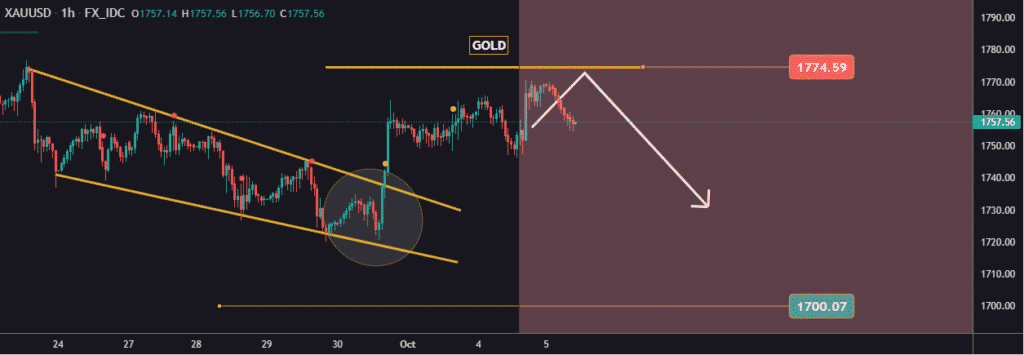

Gold tanks below $1760

In the commodity markets, gold remains under pressure after failing to power through and find support above the $1770 level. XAUUSD has since retreated, dropping below the $1760 level. Immediate support on the ongoing pullback is seen at the $1750 level.

Any drop followed by a close below the $1750 level could trigger renewed sell-off that could see XAUUSD dropping to the $1730 level. Improving risk sentiments continues to weigh heavily on the precious metal that investors often turn to as a safe-haven.

Additionally, XAUUSD price gains have taken a significant hit on Treasury yields recovering after the recent pullback. The precious metal is vulnerable going forward, especially on the NFP report coming in better than expected and fuelling tapering chatter.

US indices sell-off persists

Major equity benchmarks in the US remained under pressure at the start of the week as investors continued their rotation from technology stocks in response to rising yields. The Dow Jones Industrial Average fell 323 points as the S&P 500 fell 1.3%. Tech heavy NASDAQ was the biggest loser dipping 2.1% on Monday.

The losses at the start of the week is a continuation of a strong sell-off that started in September that saw all the major indices dip by more than 4%. Rising inflation and concerns that the FED will start asset tapering and push for higher interest rates continue to dent investors’ sentiments on equities.

Bitcoin and Ethereum turn bullish

In the cryptocurrency markets, the upward momentum is gathering steam again, with bulls eyeing crucial levels after the recent consolidation. BTCUSD is closing in on the elusive $50,000 level after rallying to highs of $49,390 on Tuesday morning.

Ethereum is also on the front foot powering through the $3,100 level on its way to the $3,400 level. However, the pair is facing strong resistance near the $3,500 level.