- BHP is riding on high pricing of iron ore and copper to increase sales into the second half of 2021.

- An increase in potash prices by the second quarter of 2021 will help BHP’s Jansen Potash project boost production.

- All BHP’s strategic developments are set to increase production in 2021 after a successful court ruling on Arizona land.

- BHP’s partnership with JFE will help boost trade with Japan.

Thesis

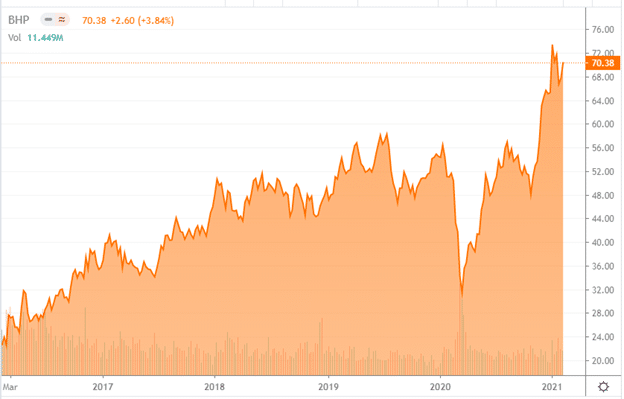

BHP Group’s (BHP) share price is testing its 5-year high, which is very remarkable given the group’s decline in petroleum production, Australian coal due to adverse weather, low volume of iron ore, and coal import restrictions into China. At the start of February 2021, BHP became (for the first time) the most valuable FTSE100 company with a market capitalization of £115 billion ($160 billion). The company’s ongoing developments are strategic for the growth of the company.

BHP’s share price has surged close to 35% in the past year despite the headwinds of the Covid-19 pandemic. In the last five years, the share price has risen by 209.77%, buoyed by rising iron ore and copper prices.

On-coming developments

In conjunction with Rio Tinto Plc (RIO), BHP got a reprieve when a federal court allowed the US Forest Service to transfer the Arizona government land to the two miners. Both companies had spent more than $1 billion on the Resolution Copper Project to boost production. It will end the 7-year wait the companies had endured with the timeline for acquisition set in 2014. With its stake at 45%, BHP is expected to boost copper production in the project.

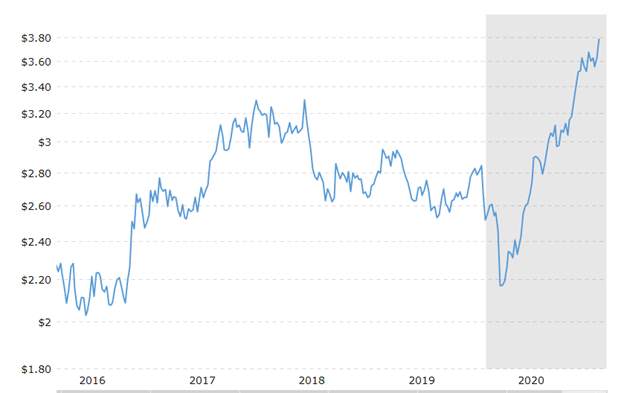

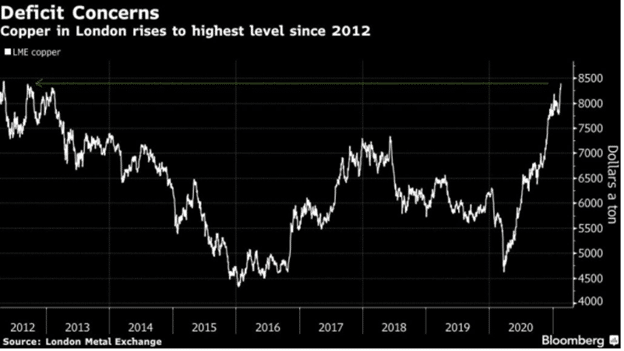

In the Comex market, copper prices rose to $3.6745 per pound on February 8, 2021 ($8,100 per tonne) due to the US stimulus optimism. Copper prices have hit their 5-year high at $3.79 per pound.

BHP is looking to complete its Jansen Stage 1 Canadian project and present it to the board before Q3 2021. The project will help to revamp BHP’s potash supply around the world. The company had invested up to $8.5 billion to develop petroleum, potash, and iron ore production in FY 2021-2022. Potash is the main ingredient of fertilizer, with Canada being the world’s largest producer and exporter of the commodity. Other uses of potash include detergents, pharmaceutical products, ceramics, and water conditioners.

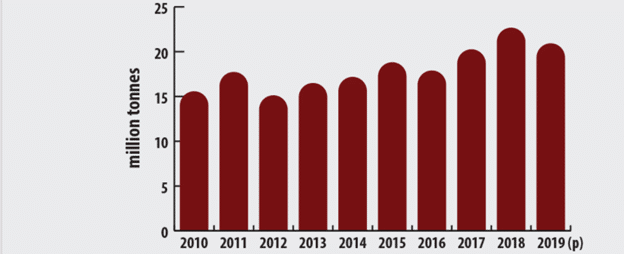

Canada’s reserves of potash exceed 1.0 billion tonnes. As of 2019, potash production in Canada declined 8.734% to 20.9 million tonnes from 22.9 million (-2.0 million tonnes).

Canada’s potash production as of 2019 represented up to 31.6% of the global output, followed by Russia – 13.052 million tonnes (19.7%). Belarus is third at 18.2%, while China is fourth at 11.3%. The global production at the time was 66.168 million tonnes.

BHP’s Jansen project is 89% complete, with the total investment at $2.972 billion. The company aims to take advantage of the rise in potash prices. Market leader Intrepid Potash Inc. (IPI) has increased its potash pricing by $50 a tonne. This increase puts the cost at approximately $140/t above the summer-fill value of 2020. The company aims to incorporate the new order pricing in the second quarter of 2021.

A five-year analysis shows that Intrepid’s shares jumped 54.33% and 43.30% in the past year.

Potash price increases for IPI reflect a solid growth for the company into 2021. Agricultural commodities are currently on a rally that is also affecting fertilizer companies. Corn prices have increased to $5.3875 per bushel, while soybeans are at $13.72 per bushel. CF Industries Holdings (CF) share price in the past year hiked by 6.61%, while Nutrien Ltd (NTR) was solid at $56.01 on February 15, 2021, an increase of 28.82% (YoY). The Mosaic Company (MOS) traded at $29.27, representing an increase of 43.83% YoY.

The Spence Growth Option project in Chile is also on a course to commence the whole operation in 2021 after production began in December 2020. BHP spent up to $2.46 billion to install the 95 ktpt copper concentrator. In the first ten years, the project is supposed to increase the level of payable copper in production by 185 ktpa. Additionally, BHP’s mining operation under the project will be extended by 50 years owing to successful concentrate production.

BHP’s copper production into 2021 decreased by 5% to stand at 841 kt. The half-year ending in December 2020 saw reduced production at Chilean mines in Escondida and Pampa Norte. Restrictions in the latter site caused copper production to decline 22% to 97 kt. The supply worries may cause the price of copper to increase substantially in 2021.

Copper contracts are up 8.8% since the start of 2021. They are on course to hit a 20% increase by the second quarter of 2021. The base metal has been increasing in the 11 months leading up to February 2021 due to deficit concerns. At $3.8265 per pound ($8,436 per tonne), the copper price is nearing the highs of 2012.

This year Lunar New Year has seen the Chinese factories operate above board, with more industries expected to remain open. Continual industrial activity means that copper demand is riding on elevated levels. This Chinese holiday was expected to dip copper prices due to reduced factory activity but instead propelled positive guidance into Q2 2021.

China’s stimulus is heavily reliant on a commodity that has made prices of metals such as steel soar to multi-year highs. Further, the Covid-19 vaccination has made investors upbeat about the global economy’s recovery, especially commodity trading.

Dividend and financial outlook

February 2021, BHP announced an interim dividend increase of 55.38% to $1.01 a share, up from $0.65 a share in 2020. Profit in the six months ended December 31, 2020, buoyed to $6.04 billion from the previous reading of $5.19 billion. This increase is significant even though it missed on analyst’s consensus by $0.29 billion at $6.33 billion. Half-year profits increased by $0.85 billion, which is outstanding considering that Covid-19 restrictions hampered mining.

Alongside the Jansen potash project, BHP has outlined the Scarborough natural gas mine located in Western Australia as a vital component of its projects. BHP will invest between $1.4-1.9 billion in the project.

Iron ore average prices set by BHP increased 33% YoY while copper soared 28%. The high sale of consumer goods in China, especially freezers, automobiles, washing machines, and other related goods, indicates that copper consumption is growing in Asia. China’s export of refrigerators in December 2020 was up 45%, while microwaves also surged 35% compared to 2019. After the 1.3% decline in global copper consumption in 2020, we expect it to rise to 6% in 2021. A total of 24.76 million tonnes of copper will be consumed by Q3 2021.

Green outlook

Copper’s reliability in the manufacture of electric vehicles (EVs) is due to the metal’s high conductivity status, durability and malleability. Various automakers, states, and countries have promised to phase out diesel and gas-powered vehicles by 2035. At the time, 17% of all light-duty vehicles are expected to be EVs, with annual sales occupying 41%. This 17% fleet share translates to an increase of 39 million EVs from 275 million to 314 million.

President Biden intends to put up 500,000 charging stations for EVs to support the green campaign against emissions. While higher sales of EVs may affect the oil demand, we still feel that the latter will always be in use due to its mechanical advantage in electricity generation. However, BHP is preparing itself to digress from oil while embracing decarbonization.

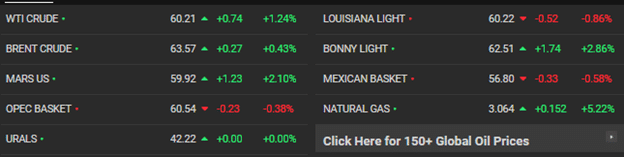

Oil crossed the $60 threshold with Brent Crude headed to the $65 mark. Global trade is recovering due to the increasing vaccination programs around the world. We expect to see higher prices as countries regain their hunger for oil and petroleum as a whole. However, BHP is still focused on attaining carbon neutrality. Further sustained tension between Australia and China has reigned havoc on BHP’s coal industry.

BHP’s climate investment initiative set aside $400 million, which will help the company’s R&D in reducing emissions. On February 10, 2021, BHP signed an agreement with the Japanese steel company (JFE) to study the steel decarbonization process. Through its climate program, BHP will reduce CO2 emissions by adopting a cohesive utilization technology for raw material processing and developing mines. Japan will also benefit from this partnership as it set its target to achieve carbon neutrality by 2050.

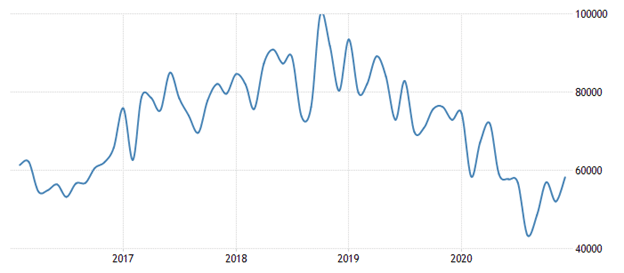

The following graph shows Japan’s steel imports from 2016.

Japanese iron and steel imports reached an all-time high in 2018 at JPY 99.972.85 billion from a low JPY 72,294.16 billion in 2014. As of August 2020, steel imports had declined 56.59% to JPY 43.398 billion. BHP’s partnership with JFE is strategic in regards to creating a market for decarbonized steel in Japan.

Bottom line

Substantial gain in iron ore and copper prices in the first half of 2021 will see BHP’s share continue to soar. BHP will need to off-load coal assets quickly to ensure they do not weaken profits in the second half of the year. In the long-run, BHP’s dependence as a major revenue source will continue to wane. Planned development projects such as the Spence Growth Option will boost copper and iron ore production in mines that had a decline. The strong growth of agricultural prices for crops like corn and soybeans has laid grounds for greater potash adoption. BHP’s Jansen Potash is a strategic project that is aligned to the global agricultural future. The forward positive outlook of BHP shows that the stock is a solid buy.