Last week was marked by the correction across most of the risk assets such as stock indices, risk currencies, and commodities, although the latter recovered aggressively on Friday as Brent oil gained 1.98%.

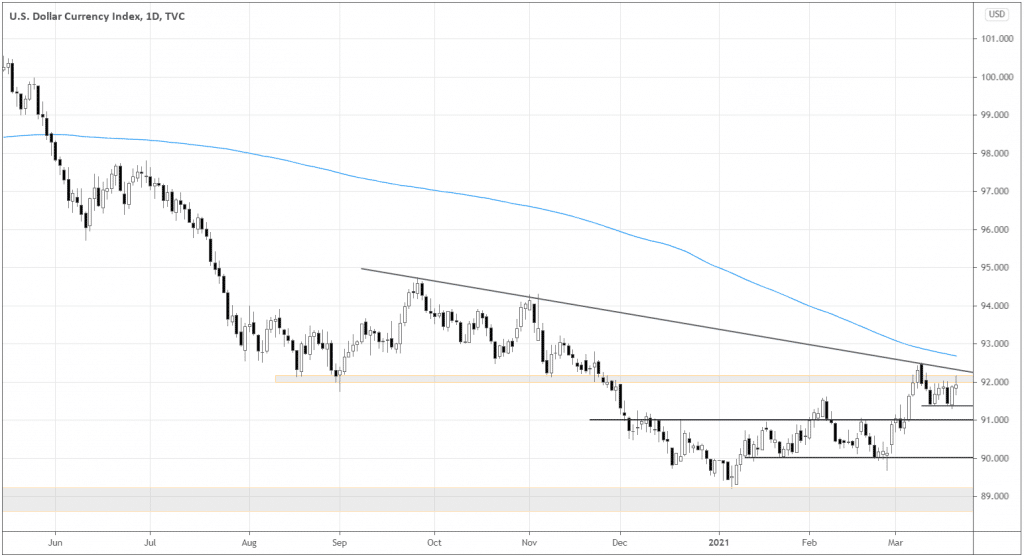

The US dollar remained strong, staying in the range of 91.35-92.00. In the DXY chart below, we can see that the correction of the long-term downtrend keeps developing.

The DXY found new local support around 91.35. If the index is above 92.00, we may expect an upward momentum move as the market breaks the short-term trendline (see the inclined black line) and the 200-day Moving Average.

The move under 91.00 would suggest the continuation of the USD’s range mode and the return of the risk-seeking sentiment.

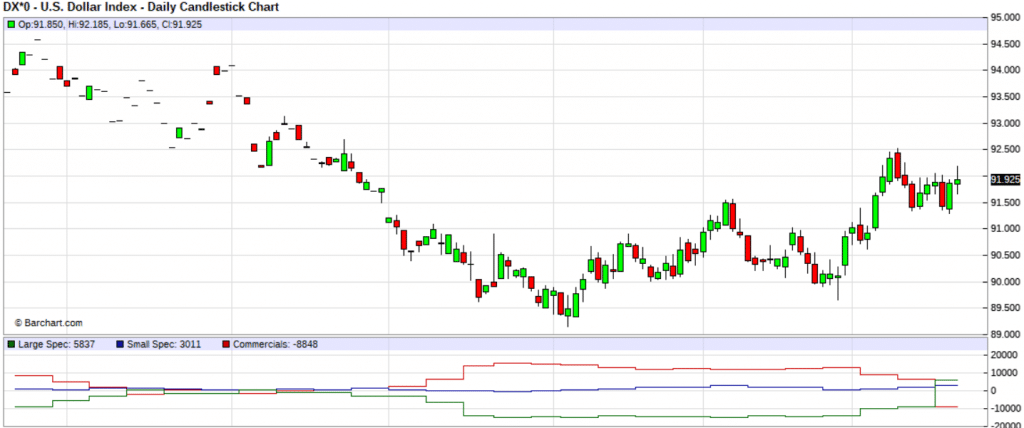

The COT report also gives some bullish prospects for the USD, at least in the short term. Large speculative positions finally got net positive last week, hinting that more traders agree on the downtrend’s change.

What happens if the downtrend eventually continues? Well, those “large” guys may add to the fuel of the down move as they’d close their longs.

A good reason to look into GBP

As the world is persevering to recover from the COVID-19, the spread of vaccines has a significant impact on the markets. The UK is a leader in vaccine rollout in Europe, reaching 42,235 vaccinations per 100,00 – almost three times more than the biggest EU economies, such as Germany (12,252), France (11,880), Italy (12,142), or Spain (12,906).

Such a distinction of the UK is a good reason to look into GBP. Due to the recent strength in the USD, the GBP/USD pair wouldn’t be the best option to express a bullish outlook on the pound. Knowing the differences in pacing of the vaccination among the European countries, let’s analyze EUR/GBP for potential trades.

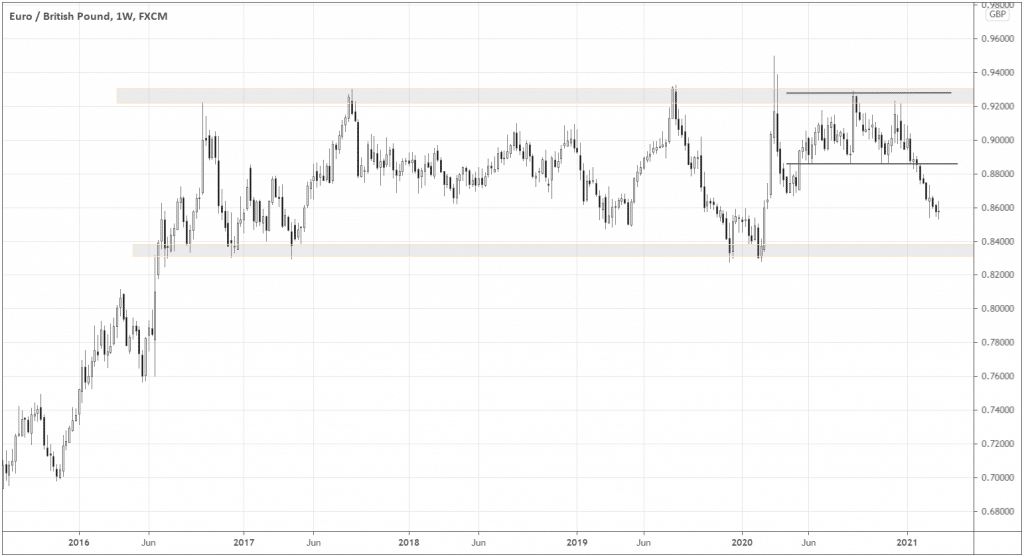

EUR/GBP big picture

Since the beginning of the Brexit talks in March 2017, the pair have been bound between 0.83 and 0.93. In the weekly chart below, you can see the long-term range boundaries marked in grey. Several weeks after the UK and EU have agreed on the Brexit trade deal, EUR/GBP broke the down boundary around 0.8860 of the local range (see the black horizontal lines) and had been declining since then.

Even before the leadership in vaccines, the market had already believed that the UK economy would benefit from Brexit, thus, supporting GBP.

EUR/GBP setup tactics

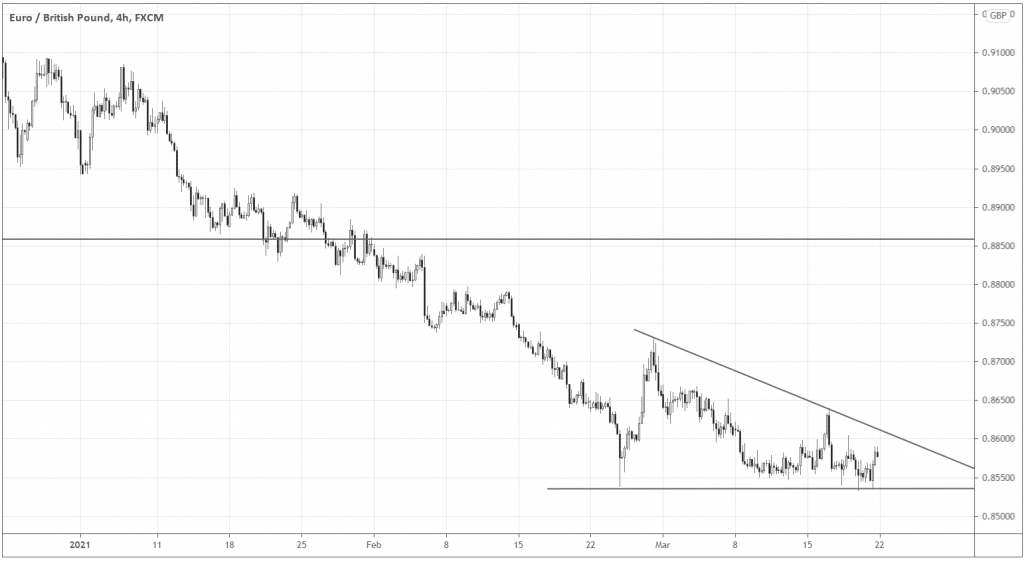

As the market is heading to 0.83 long-term support, let’s zoom in and find out what to expect for the pair in the near term.

In the daily chart below, the price formed a descending triangle. The classic way to trade the pattern is to sell at the breakout of the down boundary. Typically we’d sell at the close of the breakout candle. We have our bullish GBP bias in place, so the trade seems appealing.

In this case, the short-term move potential is limited as the market is approaching 0.83. The pair would likely start bouncing up well before the actual resistance as impatient short-sellers are eager to lock-in profits from the preceding move.

One way to sell is to base the entry on a 4-hour timeframe, decreasing your pip risk and improving your risk-to-reward ratio.

Traders should be patient with a short-trade timing, as the pair shows signs of strong demand as it found another local support at 0.8550.

A short-sell entry may occur if we see a full-body black candle closing below 0.8530, and the stop-loss above 0.8550 would make so much sense. Depending on your entry, you may expect an over 1:2 risk-to-reward ratio for the trade.

The next reasonable short setup would most likely come up when the long-term range breakdown occurs below 0.83.

Conclusion

The current bullish momentum of the GBP may be fueled by the UK’s leadership in the vaccine rollout in Europe. GBP has been strong since the Brexit resolution, confirming bullish sentiment for the currency. The current price action formed a descending triangle pattern offering short-sell opportunities in EUR/GBP.