Gold fell as much as 4% to a four-month low in Asian trading, extending losses from Friday’s close, on better-than-expected non-farm payroll employment.

The plunge in gold happened amid low liquidity due to holidays in Singapore and Japan, underlying strong sentiments that investors expect the Fed to scale back monetary stimulus.

The fall in the safe haven commodity happens amid strong job data that showed that NFP payrolls rose by 943,000 while unemployment was down by 0.5%, advancing the idea of Fed’s stimulus tapering.

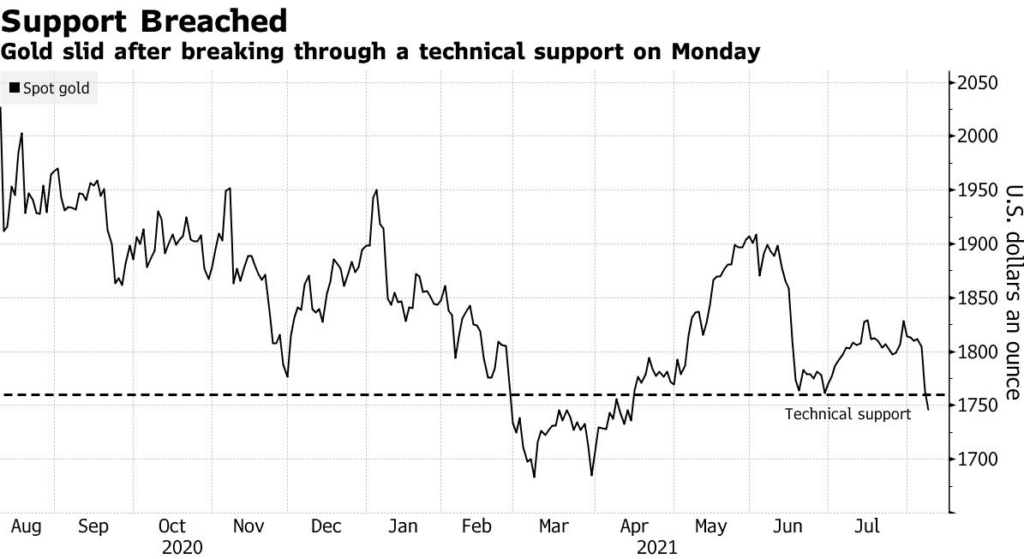

Although gold recovered some losses on Monday, it remains under pressure below the support, which could now turn into resistance, at around $1760.

Investors are now keen on consumer prices data on Wednesday to gauge the next moves by the Fed, even as they expect it to show that inflation only rose marginally from the previous month.

XAUUSD is down -1.23%.