Overview

- FUTU stock gained 77% in the last three months of 2020, rounding off a year in which the stock managed to grow by a dizzying 428% in the full year. In the same year, Futu Holdings’ earnings per share (EPS) grew by a whopping 327% to 0.38 (diluted).

In 2020, EPS expanded by a magnitude that is far lower than the growth of the stock price. The difference implies that the market is highly optimistic about Futu’s growth potential.

- Nonetheless, the stock seems a little undervalued for two reasons. The company’s underlying business is strengthening, and the financial figures that Futu is reporting deserve more attention. From a fundamental perspective, FUTU is just getting started in the direction of growth.

Futu posted impressive figures in Q3 2020

The three months ended September 30, 2020, were Futu’s most impressive from an operational and financial standpoint. According to the quarter’s financial report, Futu grew its paying client list to 418,089, a 136.5% increase year-over-year, while the registered clients list expanded to 1,173,242, a 17.7% growth YoY.

A few things changed to the upside following the onboarding of new clients. First, Futu’s daily average client assets increased to HK$180.3 billion ($23.25 billion), a 152.0% jump from the same quarter in 2019. The second significant change was Futu’s total trading volume, which jumped 381.1% YoY to HK$1,014.7 billion ($130.87 billion). US stocks accounted for the lion’s share of the trading volume.

That is why Futu’s plans to expand into the US should be on the radar of any investor interested in FUTU. Could you imagine that the company could manage to earn a higher trading volume from US stocks while operating from half a world away? Futu’s entry into the US and Singapore should launch the company’s trading volume to a higher stratum.

The pivot to the US for Futu is a monumental decision that investors should not take lightly. Hitherto, the company has been relying on Interactive Brokers, a third-party service provider, to run its show in the US. Already, Futu has a US license, and it is building a proprietary clearing channel to launch this year.

Additionally, Futu’s executive management team has a great vision. Leaf Li Hua, Futu’s founder, and CEO, told the South China Morning Post in an interview that Futu is aiming to become “version 2.0 of the Chinese version of Charles Schwab.”

About Futu holdings limited and its products

Futu Holdings is an Admiralty, Hong Kong-based company founded in 2011 by Leaf Li Hua. Li Hua is a former Tencent employee, and coincidentally, Tencent is Futu’s largest backer. Futu employs advanced technology to digitize wealth management and brokerage services. Smaller companies that fold into the Holding company offer investing services in China Connect, US, and Hong Kong stocks.

Futubull is Futu’s flagship product. The product is a digital platform on which users can find services such as margin financing, market data and information, wealth management, and stock trading and clearing, all in one place. Aside from Futubull, Futu operates an extensive network of companies, Futubull users, investors, media, and analysts. This way, the company has delivered remarkable success in its other services such as IPO distribution and ESOP solutions.

Futu went public on Nasdaq in March 2019, and the ride so far is impressive. During this period, the company has met remarkable success, such as its inclusion into the MSCI Hong Kong Small Cap Index beginning November 30, 2020, as well as a US$260 million cash injection by a leading global investment firm.

Market conditions are reinforcing FUTU growth

FUTU saw its best performance during a year that witnessed interesting developments in finance. On the one hand, a pandemic threatened to bring global finance to its knees, and governments reacted swiftly to tame the recession. For example, the US Federal Reserve bought assets worth more than $4 trillion.

On the other hand, increased money supply due to massive relief packages has sent markets soaring. All major US stock indexes touched record highs in 2020. In Asia, the Shanghai SE Composite Index just reached a record peak early this year, while the Hang Seng Index is still miles away from 2018’s record high. Perhaps this explains why Futu’s trade volume was higher in the US than in both China and Hong Kong combined.

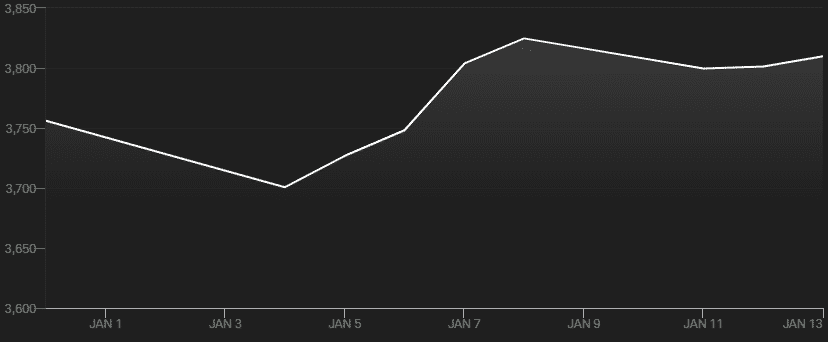

There is no sign of US stocks letting go of the momentum gathered in 2020. For example, the S&P 500 is up 1.43% year-to-date, and it could push higher in the short-term.

FUTU has the strength to hold onto the current uptrend

FUTU has been rallying since late December 2020 on the back of strong financial figures in Q3 2020. Many other things also happened that sustained the price action, such as the $260 million cash injection and the upcoming expansion into the US.

Early this week, FUTU was trading at the highest price level since its IPO, but the number of buyers seems to have been exhausted. The MACD in Figure 2 below shows buyers declining progressively. Simultaneously, the RSI indicates that the stock is overbought, although the declining buying activity is ushering price action below the 70-point mark.

But a closer examination of FUTU’s price chart exposes a pattern that is just repeating. On two previous occasions (marked by red rectangles), the stock touched a record high, and as buyers declined, traders moved to cover their profits. This activity deprived the stock of its strength of continuing climbing and made it turn in the direction of a downtrend.

As it is clear in the price chart, the decline in both of the two instances was short-lived, and buyers struggled to turn the trajectory upwards. Likely, a similar scenario is underway, and it is only a matter of time before FUTU resumes its upward march. After all, the underlying business is stronger than ever.

Conclusion

FUTU has reached a third record peak since the 2019 IPO. The previous price action pattern tells us that FUTU is in a momentary pullback, which could be followed by another and probably a steeper uptrend. Therefore, FUTU is a BUY.