Overview

- Consumer-driven eCommerce is a new concept that a few entities are trying out, but Pinduoduo seems to have perfected it. PDD’s consumer to merchant (C2M) model has enabled it to grow the number of annual active buyers to 731.3 million and merchants to 5.1 million in less than four years.

- PDD also has a strong posture from a financial perspective. In the 12 months ended September 30, 2020, the company reported gross merchandise value (GMV) equaling $214.7 billion. This GMV amount is ridiculous considering that the company only managed $15 billion for the first two years of operation.

- Pinduoduo is the latest edition of China’s eCommerce innovation. The company follows in the footsteps of JD.com and Alibaba, but it seems to have far greater potential to set higher records. Even though the PDD stock grew by a whopping 335% in 2020, there exists enough goodwill in the market to push the price to higher highs this year.

Consumer to merchant/manufacturer (C2M) model gives Pinduoduo an enviable competitive strength

E-commerce is a global phenomenon, but the consumer to merchant/manufacturer (C2M) business model is a recent innovation. Traditionally, eCommerce platforms link up merchants and consumers, where consumers get to choose what they want from a catalog of available goods and services. C2M turns this model on its head, whereby consumers initiate production. Manufacturers only produce what consumers want.

The model originates from China, but no company has been able to perfect it more than Pinduoduo. In 2019 alone, Pinduoduo processed 7 billion products while serving 536.3 million annual active users. During the latest quarterly results, Pinduoduo revealed that its order volume is trending upwards due to the company’s addition of new interactive features and product selections.

Pinduoduo’s executive management has made it clear that it aims to improve efficiencies in the value chain and to aggregate demand in the short-term. In aggregate, PDD’s upside scenario is impressive, and prospects of faster-than-expected GMV growth is more probable. By extension, the company’s profitability is likely to rise further up.

About Pinduoduo and its products

Pinduoduo is the latest installment of Chinese eCommerce ingenuity. Founded in 2015, the Shanghai, China-based company revolutionized traditional eCommerce by shifting the focus from providing consumers with a catalog of products to let consumers choose the products they wish to have.

By 2019, Pinduoduo was servicing 1 million merchants against 530 million annual active users. The latest financial information from PDD says the annual active users climbed to 731 million against five million merchants.

Pinduoduo’s platform uses distributed AI technologies to drive more controlled sales. As a result, merchants can cut down on marketing expenses while consumers access products they need more seamlessly.

PDD Is in a phase of incredible growth

Today, Pinduoduo’s market cap ($210.79 billion) is only second to Alibaba’s ($699.68 billion) and ahead of JD.com ($144.19 billion). Pinduoduo has been able to attract so much wind in its sails by its ingenuity, where it gamified online shopping.

But PDD seems relentless in its quest to add more users and GMV to its books. Last year, the company participated co-sponsored a challenge aimed at helping the agricultural sector to surmount mounting challenges. Pinduoduo is committed to deploying smart agriculture solutions, such as cytogenetics, to help small farm-holders to boost humanity’s capacity to feed itself. The main sponsor of the challenge was the Food and Agriculture Organization (FAO).

Cytogenetics is at the center of a global drive to feed the world, and Pinduoduo happens to be one of the leaders in this cutting-edge technology. Interestingly, strong demand for cytogenetics has brought about a 34% growth in consumables. Overall, the cytogenetics market is expected to expand to $3.09 billion by 2025, registering a CAGR of 13.5% between 2018 and 2025.

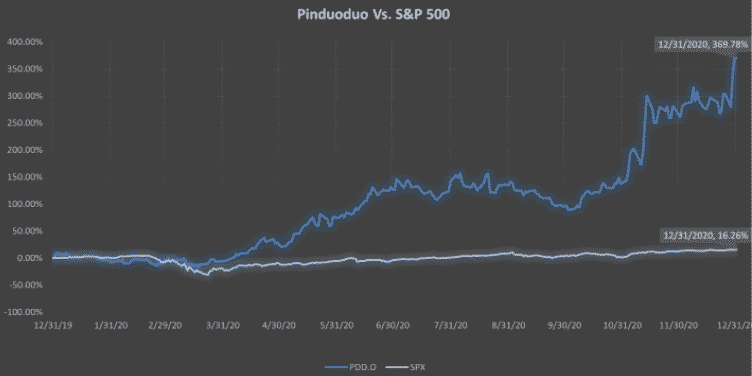

PDD outperformed the S&P 500 in the thick of the pandemic

The S&P 500 hitting several record highs is an unmissable highlight of 2020, aside from the ravaging coronavirus pandemic. Nevertheless, the PDD stock trounced the index hands down. Pinduoduo started the year on a weaker foot, but it began to build momentum after lockdowns, and sudden-stops in economic activity became a global norm.

For the entirety of 2020, the S&P 500 managed 16.26% against PDD. On the contrary, PDD grew 369.78% in the same period. The performance demonstrates Pinduoduo’s significance in an economic environment that experts feel could be the new normal going forward.

PDD has a bright future

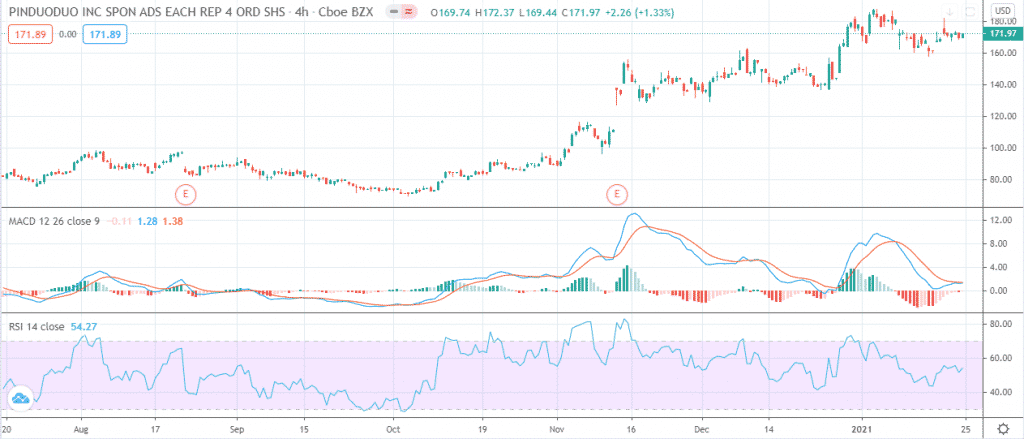

Impressive as it was, PDD’s 2020 performance could have been the taste of what the market should expect in the years ahead. With the stock trading 97.78% in the green over the last three months, one would expect that PDD is seriously overbought by now. One would also expect that a stock that has gained 360.34% in the last year should have spent all the strength necessary to maintain the current momentum.

Far from it, the figure below shows the strength in Pinduoduo’s price action is far from being exhausted. Particularly, the RSI (14) is dancing between 40 and 60, and the MACD is just turning bullish. A closer look at the price chart tells you that this setup is not new. At the end of last year, PDD behaved as if the stock was finally going to give up its growing streak, only to rebound stronger. Given the strong fundamentals, there is a chance that the next rebound – if it were to happen – would be far stronger.

Over the past two weeks, PDD has experienced heightened selling pressure, perhaps due to an anticipation of a return to normalcy. Be that as it may, Pinduoduo’s priorities are quite right, and enough catalysts exist to carry the stock’s current momentum to greater heights.

Conclusion

Enough evidence exists to show that Pinduoduo is not a pandemic stock. The fundamentals paint a picture of a company with a clear vision, one that could guide PDD to higher records in the coming months. For this reason, we believe PDD is a BUY.