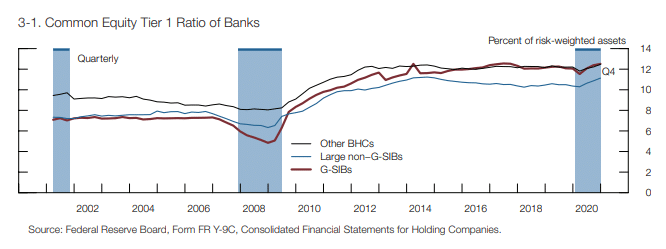

U.S banks have sailed the coronavirus pandemic well, according to the Federal Reserve press release. Bank and broker dealers have maintained low leverage, as life insurance companies and hedge funds continue to have high leverage.

Banks have raised their capital ratios above pre-pandemic levels despite credit risks remaining elevated.

Tier 1 ratio which measures capital adequacy increased in the last year for most banks.

Banks had profitability recoveries in the second half of last year and curtailed capital distributions which helped to improve credit quality.

Rapid expansion in low-risk assets such as Treasuries, central bank reserves, and PPP loans raised banks’ total assets significantly.

Large banks recorded the ratio of tangible capital to total assets at below pre-pandemic levels in 2020.

Fed notes uncertainty on whether banks will maintain credit quality on its loans after expiry of government support programs and loss-mitigation programs.

SPY is up 0.27% on premarket, QQQ is up 0.25% on premarket, EURUSD is up 0.14%.