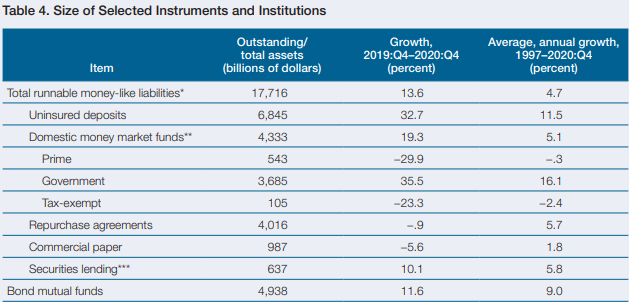

Amounts of liabilities vulnerable to defaults, including those of nonbanks, increased about 13.6% to $17.7 trillion last year, according to the Federal Reserve press release. The vulnerabilities amount is now about 85% of GDP although they remain low at large banks.

The increase in vulnerable liabilities reflect an expansion in uninsured deposits and state MMF assets under management.

Structural vulnerabilities are elevated at NBFIs including some types of MMFs, bank loan mutual funds, and bonds.

Structural vulnerabilities are also persistent at tax-exempt and prime money market funds.

Regulators are seeking options to address the structural vulnerabilities.

Domestic banks control large amounts of liquid assets and have access to stable financing.

Bonds and bank loan mutual funds have been supported by net inflows but remain exposed to risks relating to large holdings of low liquid assets.

Central counterparty collateral requirements are high compared to expected levels of market volatility.

Life insurers have recorded increasing liquidity risks that are now post-2008 highs.

SPY is up 0.20% on premarket, QQQ is up 0.24% on premarket, EURUSD is up 0.08%.