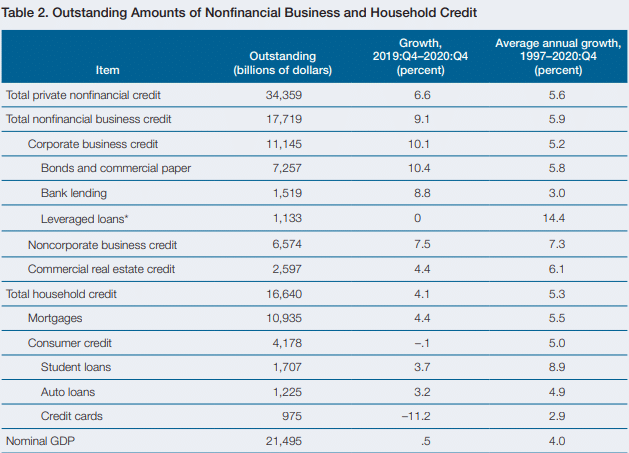

U.S Federal Reserve has warned of heightened vulnerabilities from business debt despite the risk falling since mid-2020. Currently, businesses owe $17.7 trillion, after the debt rose 9.1% or about $425 billion in 2020.

The Central Bank has lauded low interest rates and recovery earnings in enabling businesses carry debt and lower risk vulnerabilities.

Business debt rose slightly in the second half of last year relative to nominal GDP which jumped 10% in the same period.

Some small businesses continue to face major financial strains amid government support programs through the Paycheck Protection Program.

The ratio of nonfinancial debt to GDP is above its trend.

Households owe $16.6 trillion debt after the debt-to-GDP ratio fell sharply in late last year to reach the pre-pandemic range.

Risks relating to household debt are modest although borrowing is concentrated to high credit score borrowers.

Government support programs have supported household incomes and balance sheets, with more holdings of liquid assets rising.

SPY is up 0.14% on premarket, QQQ is up 0.22% on premarket, EURUSD is up 0.10%