Exness is a CFDs liquidity provider based in Limassol, Cyprus. The broker made its foray into the trading industry in 2008 and received regulation licenses from legit bodies such as the FSC of BVI. It claims to serve over 145K clients that speculate on its asset classes with competitive spreads and fast order executions. Exness also prides itself as a market leader, citing to offer leverage from 1:2000 up to unlimited depending on the client’s equity.

Pros

- Offers multilingual customer support

- Serves both retail and corporate traders

- Holds funds in segregated accounts

- No deposit and withdrawal fees

- Provides negative balance protection to all sorts of traders

- Multiple payment options

- Low minimum deposit capped at $10

Cons

- Clients may incur fees when using some payment options like skrill

- Exness charges trading commissions depending on the account type

- Additional brokerage fees such as account management and inactivity may be imposed

- Clients might also face overnight fees

A team of skilled professionals in finance and information technology brought their ideas together and founded the Exness Group Ltd in 2008. Their goal was to provide CFDs trading to institutional and retail traders in a wide range of markets, fueled by fast executions and competitive spreads.

Over time, Exness grew, expanding across the globe, and is now noted to have reached a trading volume of $673.6 Billion. It claims to serve over 145K clients that trade its asset classes guided by 24/7 multilingual customer support. Nonetheless, the broker also confirms to operate under a legit regulation framework.

The asset classes include:

- FX pairs

- Stocks

- Indices

- Metals

- Energies

- Cryptos

The clientele trades these products with a leverage of up to 1:2000 but the range widens to unlimited depending on the client’s equity and level of experience. Exness provides the MT4 and MT5 to the clients to access and speculate the available instruments as CFDs.

This allows them to go long and short and have the hedge even when the markets go down. The trading platforms integrate with cutting-edge tools, making sure Exness users have an effective trading environment.

Some of the integrated tools include:

- Currency converters

- FX calculators

- Economic calendar

- VPS Hosting

- Market analysis tools

- Web TV

Although, each user must fund the minimum required amount depending on the account type to start trading. The lowest amount accepted for the standard account traders is capped at $10 but increases to $500 for the pro-account traders.

However, Exness also promises to provide neutral incentives to all clients such as negative balance protection, zero deposit and withdrawal fees, and segregation of funds. Although, some payment options may charge transaction fees depending on the amount funded or withdrawn.

Exness payment options include:

- Bank wire transfer

- Bank cards

- E-wallets

- Cryptocurrency options such as BTC and USDT

Regulation

Having spread across many regions, the Exness Group Ltd falls under an array of regulation bodies led by reputable agencies like the FCA and CySEC. Generally, the broker’s registrations and licenses include:

- Exness UK holds the registration license number 730729 issued by the Financial Conduct Authority (FCA).

- Exness (Cy) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). License number 178/12.

- In South Africa, the broker is regulated by the Financial Sector Conduct Authority (FSCA) with license number 51024.

- The Mauritius subsidiary holds license number 176967 from the Financial Services Commission (FSC) in the country.

- The British Virgin Islands branch operates with license number 2032226 issued by the FSC in the state.

- Exness is also authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025.

Pros

- Multi-regulated broker

- Holds a top-tier regulatory license making it relatively safe to trade with.

- Over a decade in the trading industry.

Cons

- It does not offer its services to USA clients.

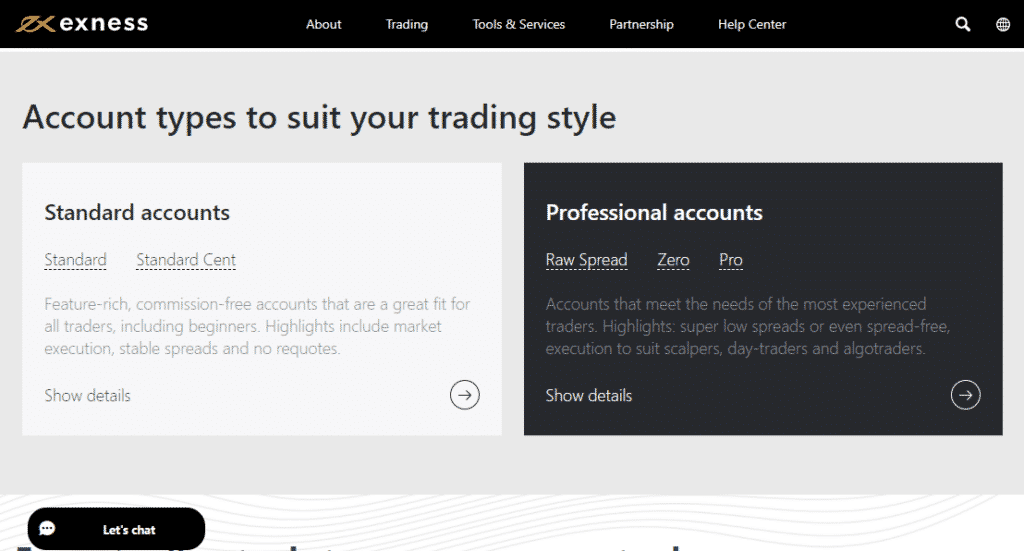

Account Types

Exness provides two account types to traders, depending on their experience level. Customers can register for the standard accounts and the professional accounts. The client’s trading platform determines the accounts at each level.

Standard account

- Available to both MT4 and MT5 users

- The minimum deposit depends on the payment system but averages around $10

- Leverage — 1:unlimited

- Trading instruments — FX crosses, metals, cryptocurrencies, energies, indices

- The commission per lot/ side — no trading commission

- Spread from — 0.3 pips

- Minimum lot size — 0.01

- Maximum number of positions — unlimited

- Hedged margin — 0%

- Margin call — 60%

- Stop out — 0%

- Order execution — market

- Swap-free — available

Standard Cent account

- Available only to MT4 users

- Perfect for novice traders

- The minimum deposit depends on the payment system but averages around $10

- Leverage — 1:unlimited

- Trading instruments — FX crosses, metals,

- The commission per lot/ side — no trading commission

- Spread from — 0.3 pips

- The minimum lot size — 0.01

- The maximum number of positions — 1000

- Hedged margin — 0%

- Margin call — 60%

- Stop out — 0%

- Order execution — market

- Swap-free — available

Professional accounts

Raw Spread account

- Available to both MT4 and MT5 users

- It offers the lowest raw spreads and a low fixed commission

- The minimum deposit — $500

- Leverage up to — 1:unlimited

- Trading instruments — all

- Commission per lot/ side — up to $3.5

- Spread from — 0.0 pips

- The minimum lot size — 0.01

- The maximum number of positions — unlimited

- Hedged margin — 0%

- Margin call — 30%

- Stop out — 0%

- Order execution — market

- Swap-free — available

Zero Spread account

- Available to both MT4 and MT5 users

- Get 0 spreads for 95% of the trading day on 30 pairs

- The minimum deposit — $500

- Leverage up to — 1:unlimited

- Trading instruments — all

- Commission per lot/ side — from $0.1

- Spread from — 0.0 pips

- The minimum lot size — 0.01

- The maximum number of positions — unlimited

- Hedged margin — 0%

- Margin call — 30%

- Stop out — 0%

- Order execution — market

- Swap-free — available

Pro account

- Available to both MT4 and MT5 users

- The Instant execution account with no trading commission

- The minimum deposit — $500

- Leverage up to — 1:unlimited

- Trading instruments — all

- Commission per lot/ side — from $0.1

- Spread from — 0.0 pips

- The minimum lot size — 0.01

- The maximum number of positions — unlimited

- Hedged margin — 0%

- Margin call — 30%

- Stop out — 0%

- Order execution — instant, market

- Swap-free — available

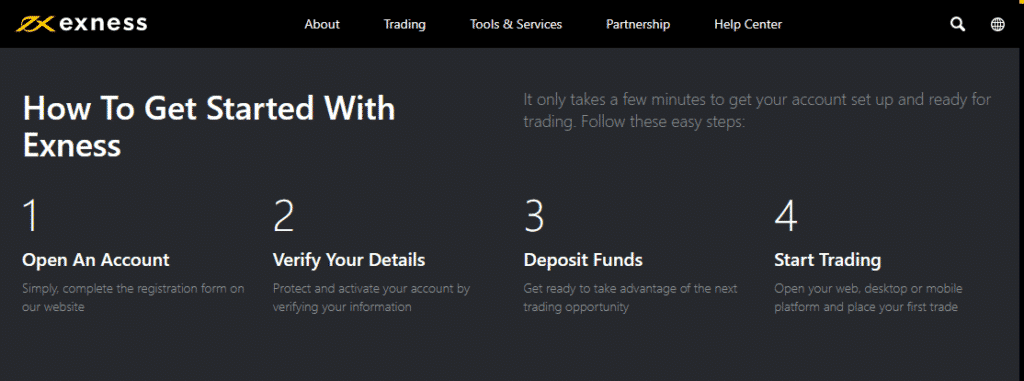

How to open an Exness account?

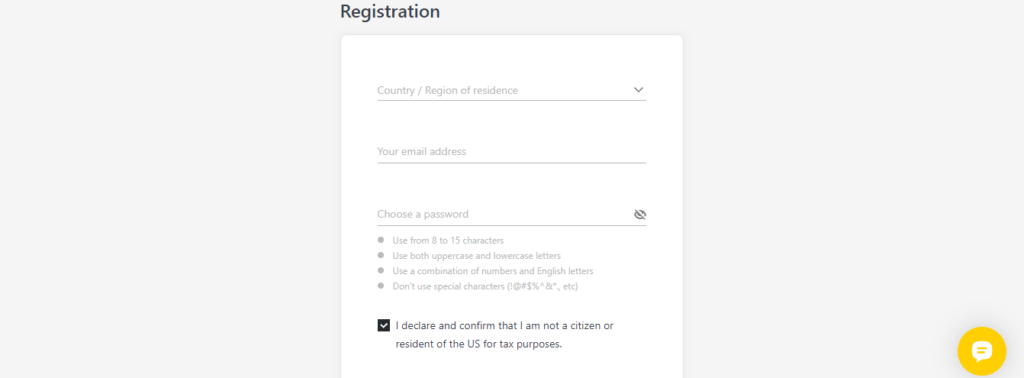

Step 1. Click the “start now button” on their official website.

Step 2. Fill in your registration details.

Step 3. Verify email and other details.

Step 4. Fund the account.

Step 5. Start trading.

Fees and Commissions

Traders incur fees added to the market spread and commission depending on the traded asset and the account type. The trading commission per lot extends up to $3.5, and the minimum spread starts from 0.3 pips. Clients also face overnight fees, and inactivity fees may also be imposed. In addition, some payment options charge traders transaction fees when funding and withdrawing funds.

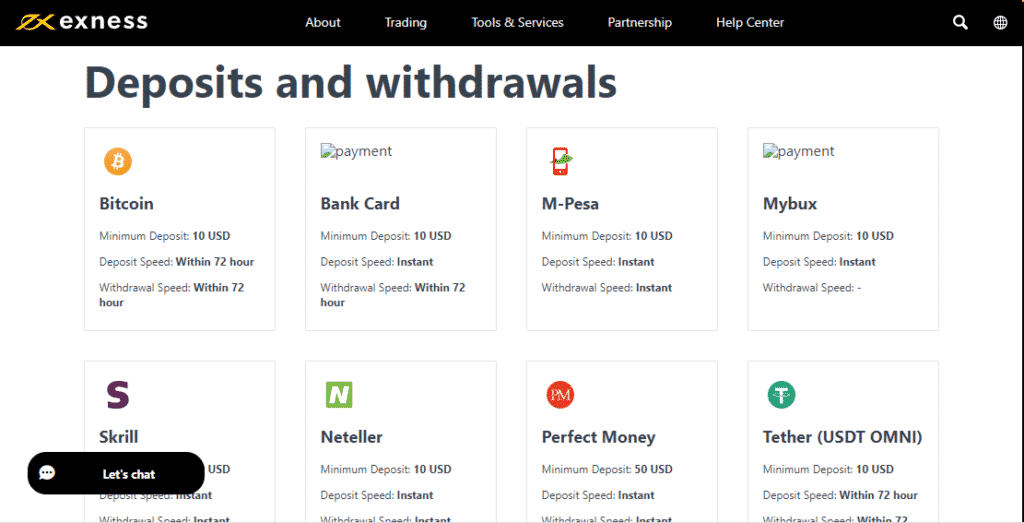

Payment options

Exness offers users multiple real-time payment options. Although some payment options may charge transaction fees, the broker waives all deposit and withdrawal fees for clients.

Pros

- Multiple payment options.

- Accepts deposits in cryptocurrency, BTC, and Tether.

Cons

- Some payment options like skrill charge transaction fees depending on the amount.

Deposit

Exness accepts deposits from these methods:

- Bank wire transfers

- Credit cards

- Bitcoin

- Tether

- Webmoney

- E-wallets like Skrill and Neteller

Withdrawals

Deposit methods apply to withdrawals.

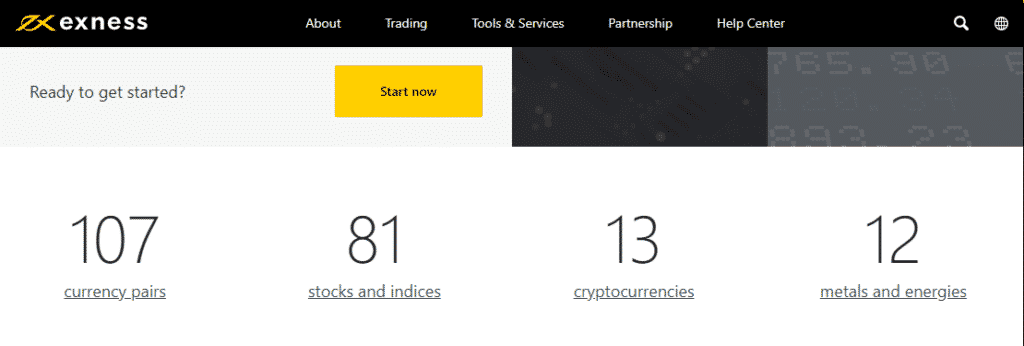

Available Markets

Exness traders access multiple asset classes as CFDs with competitive spreads and market order executions. They can go long or short when trading the broker’s instruments and as a result, they have the hedge when the markets go down. Generally, they trade about 107 forex crosses, 81 stock instruments, 13 digital currencies, and 12 commodities.

Forex

Exness users trade 107 FX pairs encompassing majors, minors, and exotics. They speculate these products as CFDs 24/5 fueled with instant and market order executions, with meager spreads starting from 0.3 pips and unlimited leverage.

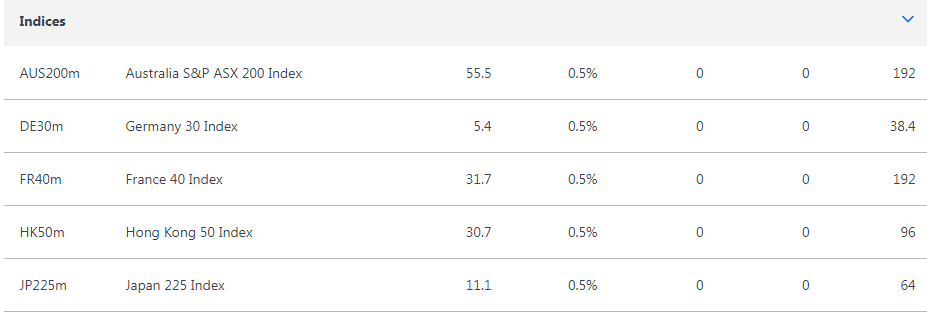

Indices

The index market holds renowned liquid stock indices that clients trade as CFDs. The market opens 24/5 and supports instruments such as AUS200, UK100, US500, and many more. The products also trade with a margin of 0.5%, fast executions, and competitive spreads.

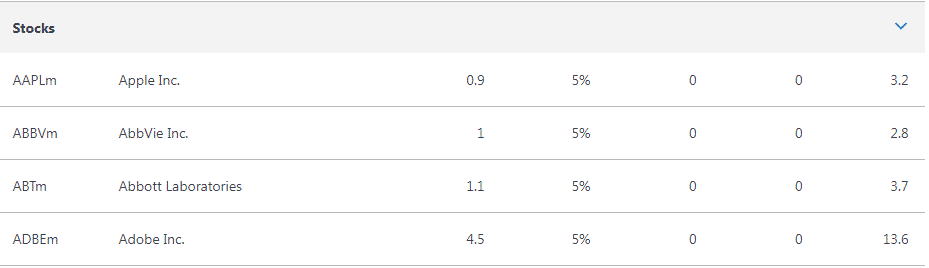

Stocks

CFDs stock trading allows traders to speculate on the prices of stock products such as AAPL, BABA, and many others. Exness offers several of these products as CFDs with a margin of 5% 24/5.

Commodities

The commodities market at Exness supports 12 assets encompassing energies and metals. The energy products available trade with a margin of 0.5%, while precious metals like gold, silver, and platinum trade with a margin of up to 1%.

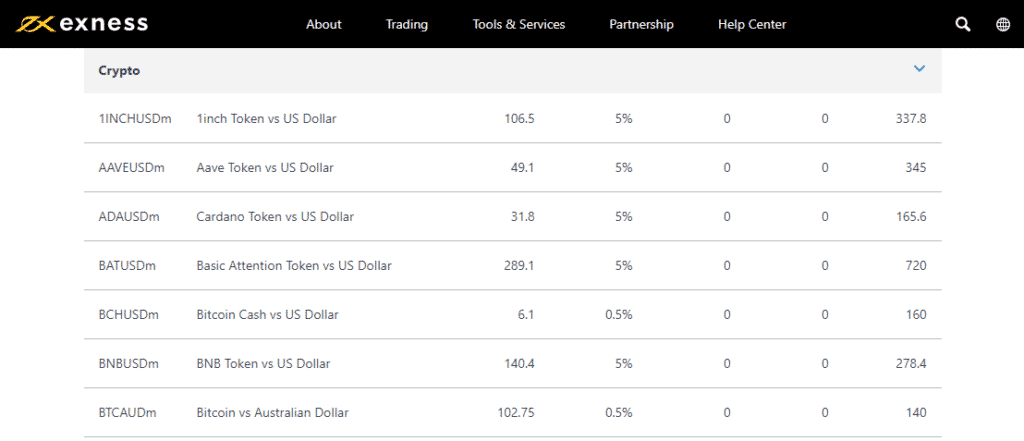

Cryptocurrencies

Crypto-assets such as BTC, ETH, LTC, etc., trade on the platform as CFDs 24/7 with a margin of 0.5% or 5%. However, the margin rate depends on the pair. Some crypto instruments are paired against the USD or the Japanese yen.

Trading Platforms

Exness offers the MetaTrader 4 and 5 trading platforms to traders. Clients have access to these platforms across several terminals such as mobile, Desktop, Web. Moreover, they integrate powerful trading tools to provide a profitable trading environment.

| MetaTrader 4 | MetaTrader 5 |

| Implement a variety of strategies — yes Multiple types of trading orders — yes Order executions — instant and market Perform technical analysis — yes Analytical objects — 23 Built-in technical indicators — 30 Integrated market watch tools and news plugins — yes Autotrading — yes, through EAs Client data encryption — yes | Open multiple positions for a trading instrument Create up to 21 charts in one minute Access a built-in economic calendar 35 inbuilt indicators 22 analytical tools 46 graphical objects Available to all account types Access all financial markets on the platform Order execution — instant or market |

Features

- Powerful trading tools, including forex calculators

- It is a multi-regulated broker

- It offers a wide range of deposit methods

- Allows traders to speculate on multiple products as CFDs

- Provides competitive spreads starting from 0.3 pips and leverage up to unlimited.

Education

The broker does not provide a furnished education platform when compared to other brokers. Clients only have a customer support section that offers articles detailing solutions to the most relevant trading questions.

Customer Support

The broker claims to provide 24/7 multilingual customer support that helps mitigate clients’ trading problems. It also offers a well-furnished customer support portal holding dozens of trade-related materials. In addition, traders can reach the support team through the live chat button, email, and phone calls.

Review Summary

Exness Group Limited operates as a CFDs provider allowing clients to trade CFDs in a wide range of markets with spreads starting from 0.3 pips, market order executions, and unlimited leverage. It claims to serve more than 145K clients from around the globe and positions itself as an industry leader for all sorts of traders. However, it fails to provide educational materials, which could challenge novice traders.