For over 20 years now, FXCM has served its customers with transparency, agility, and integrity, allowing them to profit from the opportunities in the global financial markets. It offers an interactive workplace for FX and CFD traders from regions in six continents of the world. Since top-tier authorities strictly supervise it, FXCM is generally considered secure and ideal for safe trading.

Pros

- Innovative trading platforms

- Leading-edge technical analysis tools

- Comprehensive educational resources

- Easy account opening

Cons

- Few financial assets for trading

- No 2-step login authentication for extra account security

FXCM has been in existence since its launch in 1999 and has satisfactorily been providing its customers access to the most liquid financial markets on a global platform. It offers state-of-the-art trading tools, quality trading education, and strict online financial standards for an ultimate trading experience.

FXCM is now owned by Jefferies Financial Group Inc., which is known for its merchant banking business and global investment banking. It’s also listed for public trading on the New York Stock Exchange (NYSE: JEF), ensuring that the company complies with all the regulations imposed on it.

Having won numerous awards as a top FX and CFD broker, FXCM continues to offer innovative solutions, transparent pricing structure, and sharp trade executions to enable its customers to navigate the liquid markets.

Regulation

The FXCM Group is regulated as per jurisdiction by acclaimed regulatory bodies in each region. Here’s how FXCM companies are distributed and regulated in their areas.

- FXCM UK — Financial Conduct Authority (FCA), UK, License No. 217689

- FXCM Australia — Australian Securities and Investments Commissions (ASIC), Australia, License No. 309763

- FXCM EU — Cyprus Securities and Exchange Commission (CySEC), Cyprus, License No. 392/20

- FXCM South Africa — Financial Sector Conduct Authority (FSCA), South Africa, License No. 46534

FCA regulations require regular submission of financial reports for auditing and failure to impose fines on the broker for violating the rules. It also calls for client fund segregation to protect the client’s funds.

Account Types

FXCM has three account types for different types of clients. For example, an active client may need an account that favors their active trading, while a less active client can comfortably trade in a standard account.

Let’s look at their features.

Forex account

- Tradable assets — FX, CFDs

- Free live trading signals

- Fast execution

- Spreads as low as 1.3 pips on FX pairs

- Leverage at 30:1 on CFDs

- Trading platforms — trading station, MT4, Ninja Trader, Zulu Trade

- Base currencies — GBP, EUR, JPY

- Forex demo account

- Minimum deposit — any amount

Active Trader account

- Tradable assets — FX,CFDs

- The commission per 1M — $25

- Tier Pricing on spreads

- Access to multiple APIs

- Dedicated support

- Trading platforms — trading station, MT4, Ninja Trader, Zulu Trade

- Base currencies — GBP, EUR, JPY

- eFXplus access

- Market depth functionality

Spread betting account

- Tax-free for UK clients

- Spread betting assets — currency pairs, indices, commodities, shares

- Commission-free

- Maximum leverage — 30:1

- Bet sizes from 7p a point

- Free practice account

- Base Currencies — GBP, EUR, JPY

- Profits in both rising and falling markets

CFD trading account

- Tradable assets — CFDs on forex, indices, commodities

- Maximum leverage — 30:1

- No stamp duty

- Spreads as low as 0.03 pips

- Anonymous execution

- Trading Platforms — Trading station, MT4, Ninja Trader, Zulu Trade

- Base Currencies — GBP, EUR, JPY

Professional account

The professional account is available for elective traders. Their answer has to be yes in either two of the following questions.

- Have you engaged in leveraged CFD trading in large amounts in the last four quarters?

- Does your financial portfolio surpass EUR 500,000?

- Are you working professionally in the financial sector requiring CFD trading knowledge for at least a year?

Professional clients enjoy personalized support, negative balance protection, and high leverages for efficient trading. They can also trade cryptocurrencies.

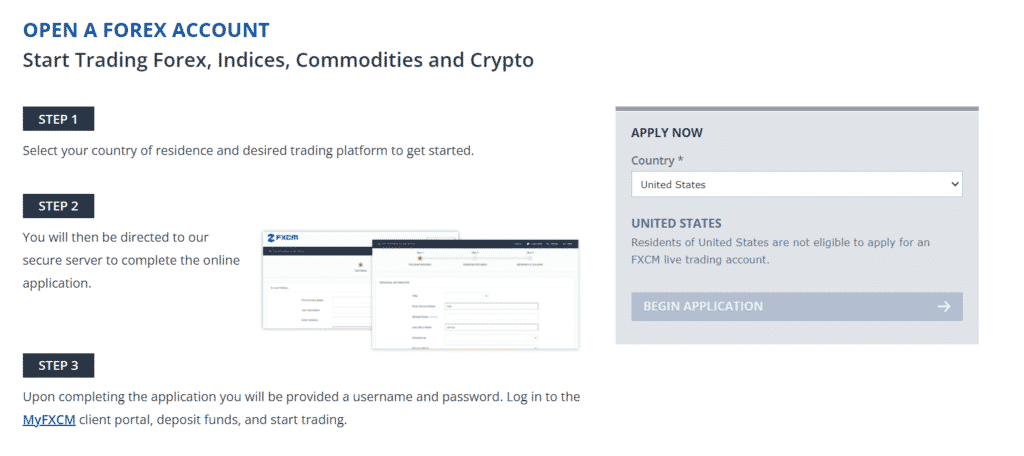

How to open an FXCM account

It will take only a few minutes to open an FXCM trading account. First, fill out the application form, entering the correct details only. You’ll choose a trading platform, the account’s base currency, and account type in your application process.

Enter your contact, employment, and financial information as required by FXCM. Upload your documents to verify your identity and your location. You can now deposit funds and start trading.

Fees and Commissions

Trading fees on FXCM follow a commission-free pricing structure with leverages. It also charges competitive spreads on CFD assets and forex currency pairs.

The minimum Forex spread is 1.3 pips on EUR/USD and 0.1 pips on commodity CFDs. Leverages are different for every asset.

For example:

- Major FX pairs — 30:1

- Non-major pairs, gold and indices — 20:1

- Commodities — 10:1

- Cryptocurrencies — 2:1

- Individual equities — 5:1

Other fees include:

- Inactivity fee — $50 every inactive year

- Deposit fee — $0

- Withdrawal fee — $0

Payment options

FXCM accepts several payment options for both deposits and withdrawals.

Deposit

Fund your trading account using the following payment methods.

- Credit/Debit card — one business day to process.

- Bank Wires (SEPA, CHAPS, SWIFT, BACS) — 1-2 business days for UK clients, up to five business days for international clients.

- Skrill and Neteller — one business day to process.

Withdrawals

FXCM allows withdrawals to the method you use to deposit, but you can change once you surpass that amount. With credit/debit cards, you can only withdraw up to the deposit amount — any further withdrawals will require a different method.

Available Markets

FXCM has few financial markets, so traders can focus on a specified market and build their portfolios from there. The available markets include forex and CFDs of indices, shares, and commodities. Cryptocurrencies are only available in professional accounts.

Forex

You can trade the major currency pairs on a maximum leverage of 30:1 all through the week (24/5). The high market liquidity makes trade execution and quick profits.

Indices

Trade the world’s most popular indices, including SPX500, NAS100, and GER30, at no commission. Grow your portfolio with less risk by trading with micro-contracts.

Shares

You can trade global shares from the UK, Europe, and the US with small margin requirements. The secret is to start small and then scale up your positions with increments of 1/10th share.

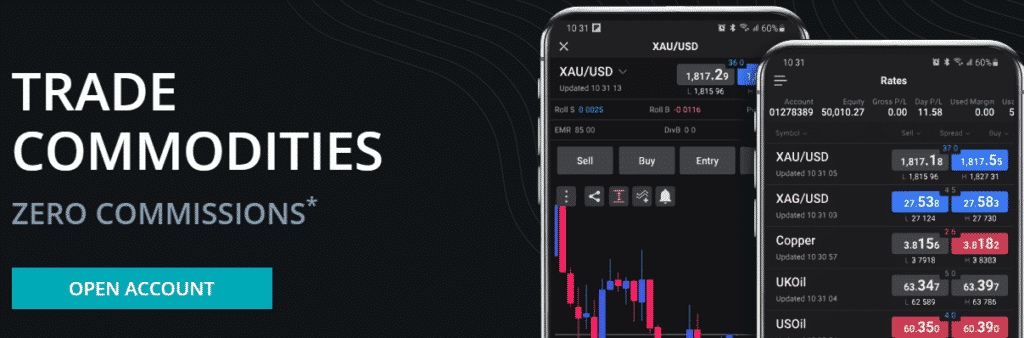

Commodities

FXCM allows you to trade silver, gold, and oil with enhanced execution strategies and no commissions on the trading positions. Use micro-contracts to risk less and grow your account balance flexibly.

Cryptocurrency

Professional clients can trade ETH, LTC, and BTC on leverages of 2:1 at no commissions. One can start with small contract sizes to mitigate the risk in the hyper-volatile crypto market.

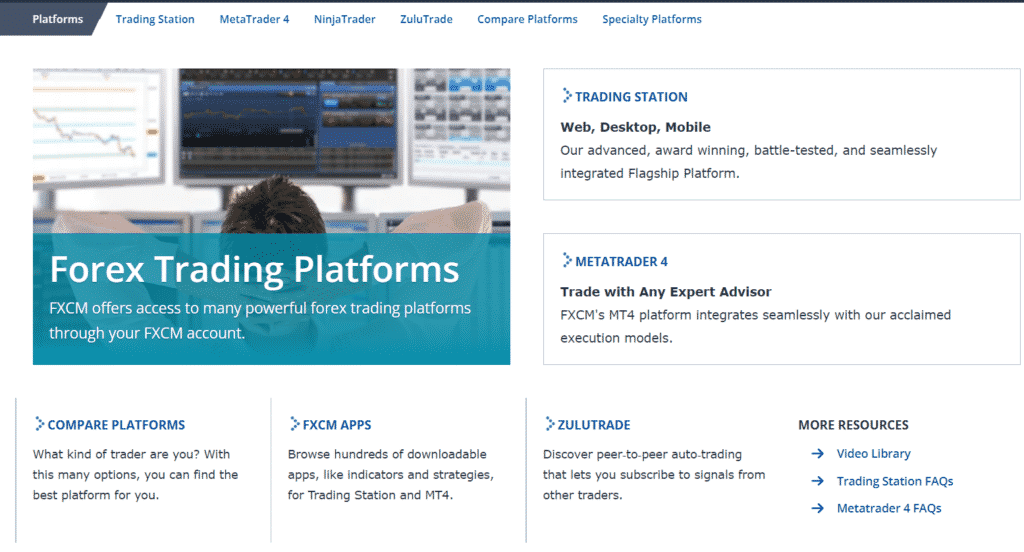

Trading Platforms

The different FXCM’s trading platforms allow clients to trade in the most powerful trading environments as they look to build their trading portfolios. These platforms include the proprietary trading station, MT4, ZuluTrade, and NinjaTrader 8.

Trading Station

- Available on Web, Desktop, and Mobile

- Real Volume indicators

- Speculative trader Sentiment Index (SSI)

- Customizable charts

- Price overlays for instrument comparison

- Access state-of-the-art technical analysis tools

- Fundamental data

- FXCM Cloud for data storage and sharing

- FXCM news and Economic calendar

Meta Trader 4 (MT4)

- Available on Web, Desktop, and Mobile

- Pre-execution Stop Loss/Take Profit

- Micro lots sizes of 0.01 to reduce risk

- Free MT4 Expert Advisors

- Copy-trading features

- 30+ built-in indicators

- 2,000+ custom indicators

- Alerts and Market news

NinjaTrader 8

- Suitable for Spread betting

- Pre-loaded and easily customizable chart designs

- Multiple time frames on one chart

- One-click order execution

- Advanced Trade Management (ATM) techniques for automated SL/TP

- Automated Trading

- Order-Cancel-Order (OCO) functionality

- Access to FxBoard for personalized trading

- Low latency order submissions

- Back-testing on historical data

- Free demo account

ZuluTrade

- Social and copy-trading platform

- Dedicated Trading Desk

- Tradable assets — forex, CFDs, shares, cryptocurrencies

- A monthly subscription fee of $30

- 25% profit sharing with the copied trader

- Available on mobile

- Free demo account

Features

- Live forex charts — easily customizable using FXCM charting tools and 50+ technical indicators.

- Trading ideas — FXCM offers trading signals and trading ideas in daily newsletters based on market analysis.

- Global market news — this section provides a quality newsfeed depending on your recent searches. You can also search your preferred news by category.

- Algo trading — clients have access to superior trading tools and services.

- API trading — APIs allow clients to build their trading platforms and connect to the FXCM trading server.

- Economic calendar — it helps traders keep track of upcoming events and their impact on the market conditions.

- Market scanner — it’s a faster way to screen the FX and CFD markets using your preferred technical tools.

- Heat map — it’s a feature that shows how the market is moving, categorizing the top movers.

Education

FXCM offers quality education services that work for new and experienced traders. These services include:

- Live webinars — FXCM organizes webinars every weekday, where traders interact with Rusell Shor (senior FXCM market strategist) and ask all their questions.

- Trading guides — these are organized guides that help traders hone their trading skills. An example is “Traits of Successful Traders” — a guide that reveals the profitable traits of a skillful trader.

- SMS trade alerts — FXCM sends trading signals as an SMS so that traders don’t miss viable trading positions.

- Demo accounts — they are loaded with virtual funds and synched with live markets so that clients can test their strategies and check out market conditions before trading live.

Customer Support

FXCM has invested much in customer support, as you can contact their support team in numerous ways. UK Clients can send a message or chat with the team on WhatsApp through the number provided on the website.

The email option is also available for general inquiries and other inquiries specific to the account. The response time for the emails can go for up to 24 hours.

Another way to reach the support team is through the Trading Desk. You can call in between Sunday 5.00 pm and Friday 4.55 pm Eastern Time. There’s also a live chat on the website for instant response.

There are also international numbers for different country offices where clients can get personalized help depending on their country of residence.

The robust FAQ section is a good start before contacting support. You can search your answers there and reach out to support if your queries are not fully solved.

Review Summary

FXCM has won many awards as a leading online FX and CFD broker, therefore setting standards in quality financial services. It’s also safe for trading, thanks to the strict regulations by top financial institutions in the world.

The ZuluTrade platform integrated into FXCM allows traders to participate in social and copy trading, which improves their overall trading outcomes. Clients in the UK enjoy tax-free spread betting and low charges on other trades.

On the downside, FXCM has a limited assets portfolio, with cryptocurrencies only limited to professional traders.