FXChoice Limited is an ECN/STP FX and CFDs brokerage company established in 2010 to transform the brokerage space through state-of-the-art technology, unconquerable trading conditions, and user-friendly customer support.

The company claims to execute at least 150,000 digital transactions daily due to its ultra-fast execution models with competitive and trustworthy trading conditions and user-friendly customer support operating 24/5 a week. The broker offers an array of trading instruments tradable on its popular meta quote platforms.

Pros

- True STP/ECN broker

- Allows both scalping and hedging

- Offer zero commission trading

- Allow social trading

- Offers MT4 & MT5 trading platforms

Cons

- A limited number of educational resources

- Does not offer stock exchanges

FXChoice Limited is a Belize headquartered FX and CFDs brokerage company offering an array of trading instruments ranging from FX, indices, cryptocurrencies, commodities, and shares. Since its inception in 2010, the company has maintained a mission of transforming the brokerage space by offering cutting-edge technology and favorable trading conditions to clients around the globe.

FXChoice operates as an ECN/STP broker giving direct access to global markets at competitive spreads starting from 0 pips and maximum leverage of up to 1:200 to private and institutional clients. The broker offers popular trading platforms MT4 & MT5 integrated with analytical tools meant to provide a seamless customer experience on the website.

The asset classes include:

- Forex pairs

- Cryptos

- Indices

- Commodities

- Shares

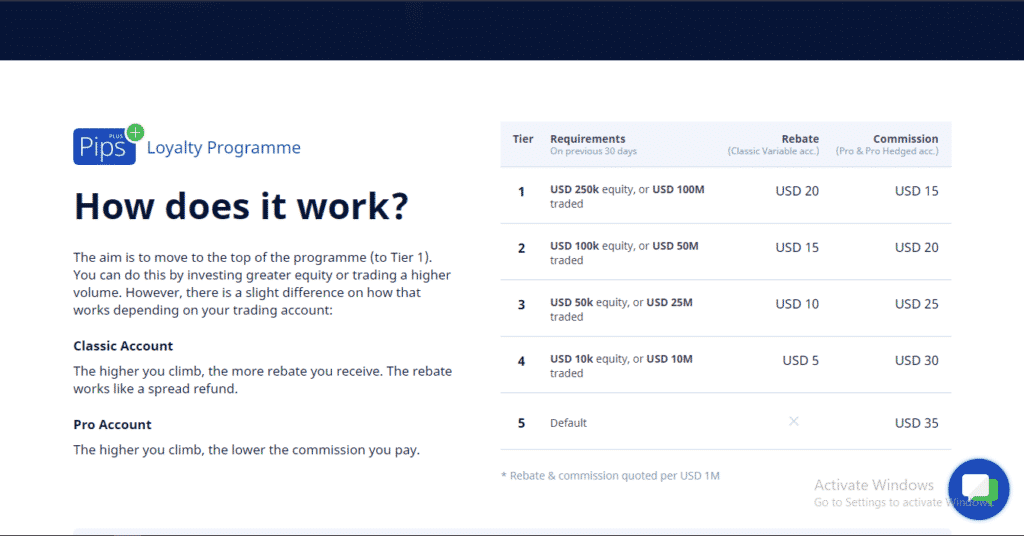

The broker offers two live account types alongside a demo account. However, fees and commissions vary depending on the type of account chosen. For a Classic account, spreads start from 0.5 pips with $0 commission rates, whereas for a Pro account, spreads start from as low as 0 pips, but the commissions are capped at $3.50.

The array of accounts include:

- Classic

- Pro

- Demo

Both the Classic and Pro accounts allow a minimum deposit of $100 with zero to minimal commission rates. The accounts support a spectrum of base currencies such as USD, EUR, GBP, AUD, CAD, and cryptos, as ETH, XRP, DOGE, and USDC.

FXChoice payment options include:

- MasterCard

- Visa

- Cryptos

- Bank wire

- e-wallets

Clients must fund their accounts to access the unique features integrated into the trading platforms offered. These features are responsible for enhancing clients’ experience on the website.

Integrated tools include:

- MyFXbook’s Autotrade

- Virtual Private Server (VPS)

- Expert Advisors (EAs)

- MQL5 signals

- Zulutrade copy trading

Furthermore, the company promises full protection of client funds through segregated bank accounts utterly separate from broker’s corporate accounts and offers negative balance protection. However, the broker is regulated by a non-top tier regulator International Financial Services Commission (IFSC).

Regulation

FXChoice is regulated by the trusted regulator International Financial Services Commission (IFSC) in Belize under license number 000067/96.

Pros

- Segregation of client funds

- Negative balance protection

Cons

- Not available in the US

Account Types

The broker offers two live accounts alongside a demo account through which clients can speculate on the wide range of assets offered.

| Classic account | Pro account |

| Minimum deposit — $100 Spreads start from — 0.5 pips Execution type — NDD/Market Margin level — 50% Forex CFDs — 36 currency pairs Minimum lot size — 0.01 lots Leverage — up to 1:200 Expert advisors — yes Commissions — no | Minimum deposit — $100 Spreads start from — 0 pips Execution type — NDD Margin level — 50% Forex CFDs — 36 currency pairs Minimum lot size — 0.01 lots Leverage — FX, metals up to 1:200 Expert advisors — yes Commission — 3.50 per side |

How to open an FXChoice account?

The broker offers a user-friendly and straightforward account opening process for clients to create live accounts. To open an account, an individual is required to follow the steps indicated below:

Step 1. Log in to their website and fill in your details (name, email, password, and contact number).

Step 2. Select the type of account (live or demo account, account currency, and leverage).

Step 3. Fill in your details as well as the login password.

Step 4. Verify your details by submitting proof of identity (ID or Passport) and address.

Step 5. Download a trading platform of your preference i.e MT4 or MT5.

Step 6. Find your account and start trading.

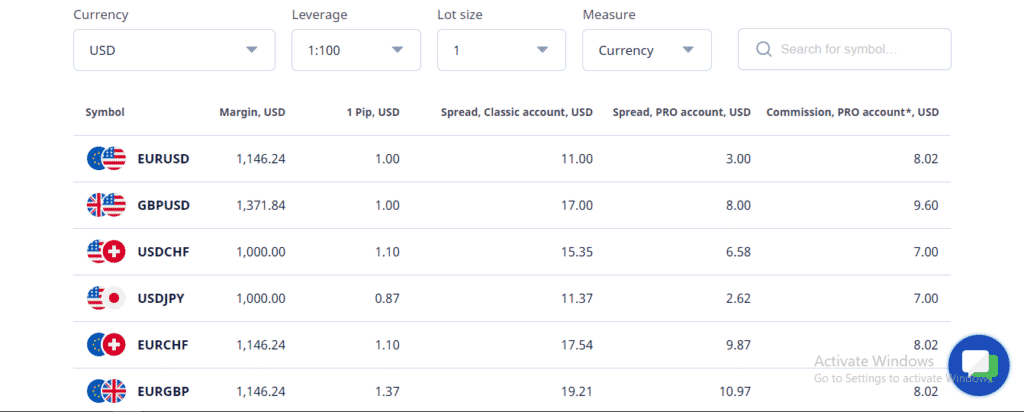

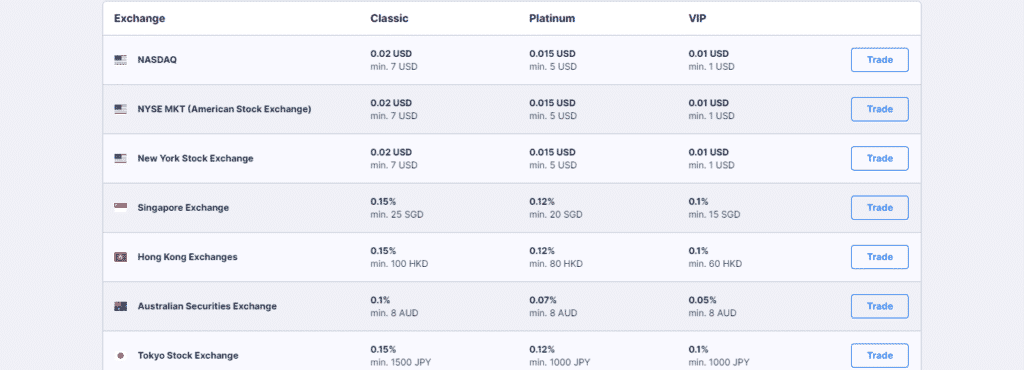

Fees and Commissions

The broker’s fees and commissions vary depending on the type of account and market traded. The broker charges no commissions on the Classic account and spreads start from 0.5 pips. On the other hand, Pro account holders incur a commission of 3.50 per side, but the spreads start from as low as 0 pips. The broker does not, however, charge any inactivity account fees.

Payment options

FXChoice offers an array of payment options, as mentioned above. They include debit/credit cards, bank wire, Skrill, Neteller, Perfect Money, and cryptocurrencies. Account currencies offered include USD, EUR, AUD, GBP, CAD, Gold, Bitcoin, Litecoin, Bitcoin Cash, Ethereum, XRP, DOGE, and USDC. The broker further allows a minimum deposit of $100. Payment options such as Skrill, Neteller, and debit/credit card incur some deposit fees.

Pros

- Multiple payment options

Cons

- Some payment options may not be available in some countries.

Deposit

FXChoice allows deposits from methods such as:

- BankWire

- e-wallets

- Visa

- Master cards

- cryptocurrencies

Withdrawals

The deposit methods mentioned above can be used as withdrawal methods and are processed within 24/5 a week.

Available Markets

The broker offers a wide range of tradable instruments with tight spreads and ultra-fast execution models. The company also offers two main account types bolstered by multilingual and user-friendly customer service operating 24/5 a week. Clients can speculate on the asset classes, thereby diversifying their portfolios. The range of markets offered includes FX, cryptocurrency, indices, commodities, and shares.

Forex

The broker offers 36 currency pairs, including the majors, minors, and exotics. The broker provides competitive spreads starting from 0 pips to an average of 0.5 pips with a leverage of up to 1:200.

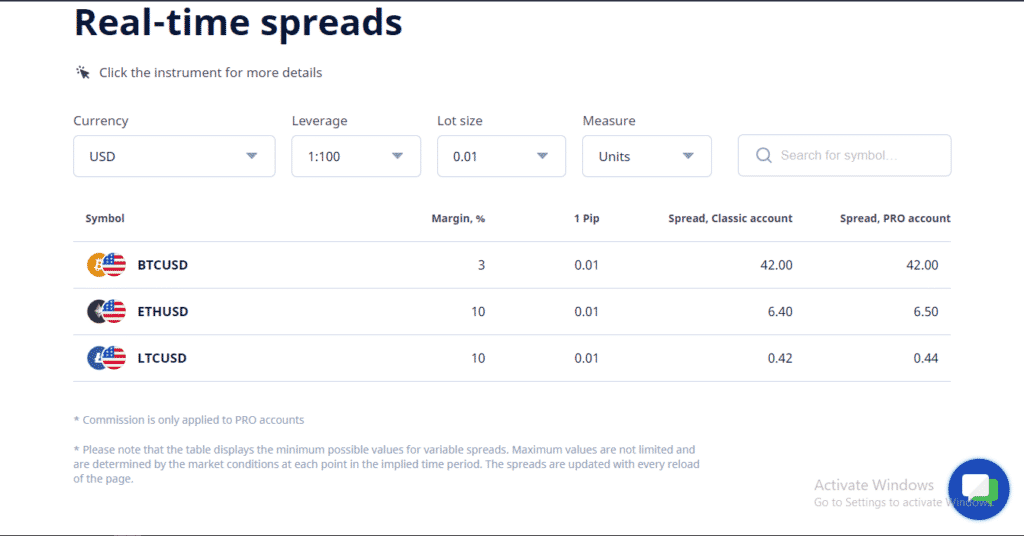

Cryptocurrencies

The broker offers an array of tradable cryptocurrency CFDs such as BTC, ETH, and LTC with light-first execution models and spreads of up to 1:200.

Indices

The broker offers a spectrum of index CFDs, allowing clients to diversify their portfolios. These indices trade with low spreads starting from 0 pips and a leverage of up to 1:200, and they include US30 and NASDAQ.

Commodities

FXChoice allows clients to speculate on commodities such as Brent oil, gold, and silver, which are tradable on their popular platforms at relatively low spreads starting from 0 pips with a leverage of up to 1:200.

Shares

FXChoice allows clients to speculate on Share CFDs such as Apple, Amazon, Tesla, and Google. The broker offers favorable trading conditions, including low margin levels and trading conditions with a leverage of up to 1:200.

Trading Platforms

As introduced in the review above, the broker offers a spectrum of trading platforms integrated with automated tools meant to provide a user-friendly interface. These platforms include MT4, MT5, Web Terminal MetaTrader, and mobile trading.

Analysis of the trading platform

MT4

- Pending order types — 4

- Market depth — no

- Technical indicators — 30

- Graphical objects — 31

- Time frames — 9

- Economic calendar — no

- Embedded MQL5 community — no

- Strategy tester — single thread

- Hedging — yes

MT5

- Pending order types — 6

- Market depth — yes

- Technical indicators_38

- Graphical objects — 44

- Time frames — 21

- Economic calendar — yes

- Embedded MQL5 community — yes

- Strategy tester — multithread

- Hedging — yes

Web Terminal MetaTrader

- Pending order types — yes

- One-click trading — yes

- Real-time quotes — yes

- Customisable charts — yes

- Time frames — 9

- Analytical tools

Features

FXChoice features include:

- MQL5 signals

- Myfxbook Autotrade

- Expert advisors

- Virtual Private Server

- ZuluTrade

Education

FXChoice offers several educational resources on its website. They include fundamental analysis, technical analysis, and trading platforms.

Customer Support

FXChoice offers multilingual 24/5 customer support via phone, email, and live chat. The broker has also availed the FAQ section containing various questions and answers covering a variety of topics.

Review Summary

As a true STP broker, FXChoice has emerged to be among the world’s leading brokerage companies, offering light-first executions, tight spreads, and relatively low commission trading conditions.

FXChoice offers over 100 tradable assets around the globe tradable on the popular MT4 and MT5 platforms with spreads starting from as low as 0 pips up to 0.5 pips and a leverage of up to 1:200 bolstered by multilingual 24/5 customer services.

Although not a top-tier regulator, the broker is regulated by the IFSC in Belize, a highly trusted regulatory body in the Belize region. The broker further defends its safety status by segregating client funds and a negative balance protection policy. However, the broker does not accept clients from the US and New Zealand.