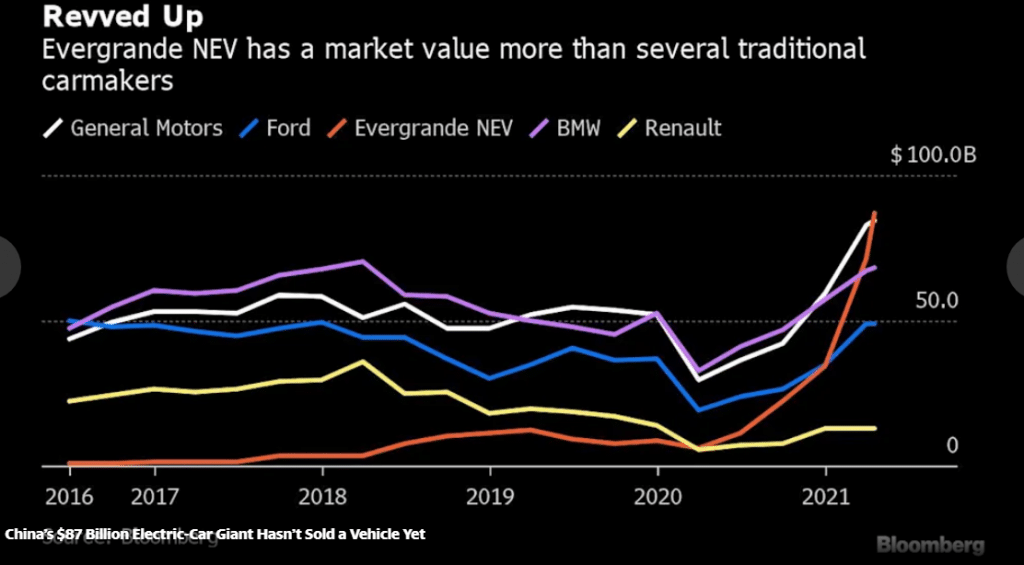

China’s largest property developer Evergrande New Energy Vehicle Group’s entry into electric cars has caught investor’s imaginations. According to Yahoo! Finance, the company, now with a market value of $87 billion hasn’t sold a single car under its brand.

Evergrande NEV’s stock has gained more than 1,000% over the past months, allowing it to raise billions of dollars in fresh capital.

The surge and market capitalization, which is now greater than Ford Motor Co, and General Motors Co., has left analysts wondering when it will mass produce cars

Evergrande planned to begin trial production of cars at the end of this year, a delay from an initial timeline of last September,

The company does not expect deliveries to start until 2022

Evergrande expectations of an annual production capacity of 500,000 to 1 million EVs by March 2022 were also pushed back until 2025

Analysts raise concerns of 5 million cars a year by the 2035 forecast of Evergrande, with rivals such as Volkswagen AG having delivered 3.85 million units in China in 2020.

Analysts also raise the concern that Evergrande has been pouring money but hasn’t returned anything amid entering an industry they have very limited understanding.

At its production bases, Evergrande doesn’t have a general car assembly lineup while equipment and machinery are being adjusted.

Analysts now say Evergrande’s stock-market run could be in for a reality check as it needs to provide its viability in the EV industry.

China Evergrande NEV stock is currently declining. 0708: HKG is down 1.30%