ETX Capital brokerage company provides personal and tailor-made trading services to millions of retail traders across Europe, Asia, and Russia. The broker claims to offer direct expert support, instant execution of over 5,000 markets, tight spreads, sophisticated trading technology, and other unique trading services. It’s regulated by the Financial Conduct Authority (FCA), and its head office operates in London, Britain.

Pros

- Top tier regulated broker

- Instant execution of trades

- Negative balance protection

- Award-winning trading technology

- Offers tailor-made trading services

- Access to over 5,000 markets

- Tight spreads starting from 0.6 pips

- Chance to have your manager for premium and professional traders

- Free deposits, withdrawals, educational trading tools

- Fast account opening

- Minimum deposit of 100 euros or its equivalent

- Access to real-time market trends for all traders

- Multiple payment platforms to choose from

- Offers a demo account

- Over 50 years operating in the trading industry

Cons

- Only regulated by one top-tier agency — the FCA

- High CFD fees

- The minimum spread varies across FX pairs, and all assets

- Offers only five base currencies

- Basic for clients using the MT4 trading platform as compared with the TraderPro — the broker’s platform

- No social trading

- Not accepted in the US and a few other nations

- Charges a $25 inactivity fee every month after six months of account dormancy

ETX Capital operates as a retail derivatives trading subsidiary under the wings of the Monecor (London) limited company. Monecor launched in 1965, specializing in mortgage bonds but later diversified its portfolio into stocks and derivatives. After decades in operation, Monecor decided to explore retail trading in a wide range of markets.

It established a retail derivative arm dubbed TradIndex in 2002, aiming to offer simplified retail trading of Forex and CFD instruments. TradIndex later rebranded into ETX Capital and now serves millions of retail traders around Europe, Asia, and Russia, offering access to over 5,000 markets, including significant markets like:

- Forex

- CFDs

- Spread betting

- Commodities

- Indices

- Cryptocurrencies

The broker prides itself with over 50 years of experience in the trading industry with the imprint from its parent company. It’s also authorized and regulated by the FCA, and the Financial Sector Conduct Authority (FSCA) of South Africa as the parent company (Monecor) holds trading licenses issued by both agencies.

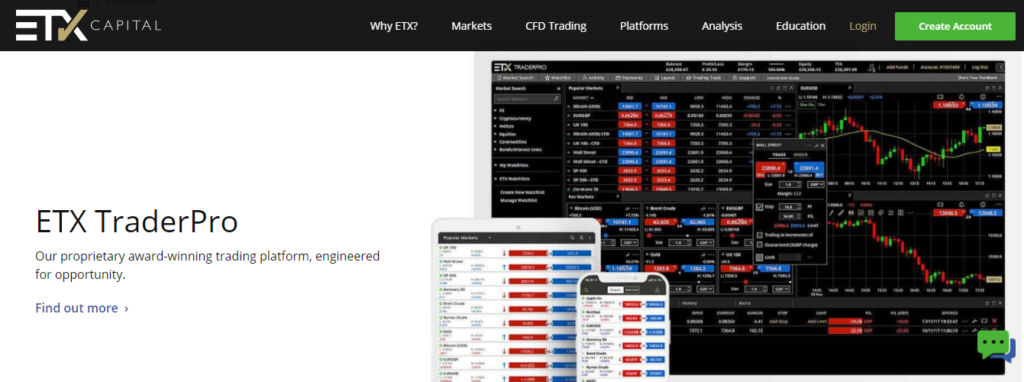

ETX Capital’s head office operates in London, linking traders to the liquidity markets through its trading platforms. The broker provides traders access to the MetaTrader 4 trading platform and its award-winning proprietary trading platform, the ETX TraderPro. Both platforms integrate with sophisticated plugins and tools for effective trading.

Some of the tools include:

- Price alerts

- Watchlists

- Interactive charts

- EA advisor robots

- Virtual private servers

The broker offers traders both a demo account and a live account. The demo account helps traders improve their trading skills before creating a live account. However, ETX Capital also allows direct creation of a live account as it offers personal and tailor-made trading services to clients depending on the type of account. Its array of live accounts includes:

- Standard account

- Premium account

- Professional account

The trading conditions vary depending on the trading account. The minimum balance and the quality of tailor-made services differ through the accounts. However, the broker caps its minimum balance and minimum spread at 100 euros and 0.6 pips respectively. For deposits and withdrawals, ETX Capital offers diverse payment methods. They include:

- Debit & credit cards

- Online bank wire transfers

- E-wallets such as Skrill & China’s UnionPay.

Regulation

The broker operates under top-tier and two-tier regulations. The mother company, Monecor, holds the trading license number 124721 issued by the FCA and 50246 from the South African FSCA. Both agencies ensure the broker provides transparent and genuine trading services to clients. It also follows stringent rules imposed by the MiFiD on CFD trading.

Pros

- Regulated by a top-tier and a two-tier regulatory body.

- Follows the MiFiD laws on CFD trading.

Cons

- Unavailable in some nations like the US, Belgium, Canada, Singapore, among others.

Account Types

As slightly introduced in this review, ETX Capital attends to different types of traders. Traders choose different accounts depending on their trading goals, and the broker offers personal services within their selected criteria.

The accounts offered include:

- Standard account

- Premium account

- Professional account

However, if the trader specializes only in trading equities and Options, ETX Capital provides a “High net worth service account.” But it also offers a demo account for clients with a vision to grow their trading skills to start trading.

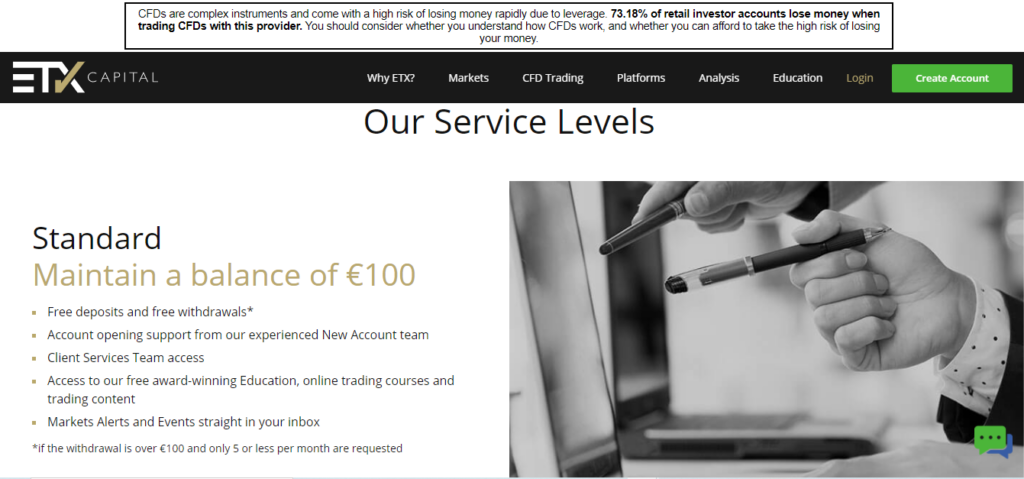

Standard account trader

- Minimum deposit/ balance — 100 euros or its equivalent

- Fast execution

- Negative balance protection

- Free deposits and free withdrawals

- Client services team access

- Access to account opening support from the brokers support team

- Access to free education, online trading courses, and content

- Real-time market trends direct into your inbox

- Trade over 5,000 markets

- Tight spreads — starting from 0.6 pips

- Leverages of up to 100:1 on Trader pro and 200:1 on MT4

Premium account trader

- Minimum deposit/ balance — 10,000+ euros or its equivalent

- Fast execution

- Negative balance protection

- Personal manager

- Access to 3rd party technical analysis

- Access to new products first

- Access to lower trading costs

- Trade over 5,000 markets

- Tight spreads starting from 0.6 pips

- Leverages of up to 100:1 and 200:1 on TraderPro and MT4, respectively

- Delivery of market news and data

- Have priority access to the support team

Professional account trader

- Minimum deposit/ balance — 10,000+ euros or its equivalent

- Access to highly tailored services and products to meet your trading needs

- Access to higher leverage as compared to other traders

- No negative balance protection

- Trade over 5,000 markets

- Fast execution

- Tight spreads — starting from 0.6 pips

Eligibility for a professional account

- A trader must have over 500k euros of liquid assets

- Relevant experience in financial services

- Made at least ten significant trades in the last financial year

High net worth equities account trader

However, the broker offers an account specialized for those services for clients interested in trading equities and options. Clients trading these assets through the High net worth equities account offered by the broker benefit from the following services:

- Minimum deposit/ balance — 10,000+ euros or its equivalent

- Fast and efficient global equity order execution

- Competitive margins rates, financing, and commission rates

- Highly tailored personalized service by equity options experts

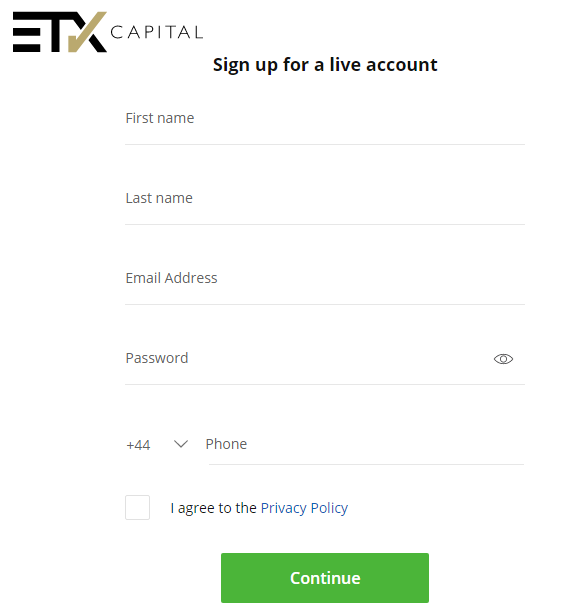

How to open an ETX capital account?

Account opening takes a few swift steps. Once a trader submits the application and the required documents, the broker verifies the account within 24 hours.

Step 1. Log into their website at https://www.etxcapital.com/ and press the “open live account” button.

Step 2. A form asking for your nationality pops up. Fill in the next form asking for your full details.

Step 3. Verify your email address.

Step 4. Choose the account to start with. Most traders prefer the standard account.

Step 5. Deposit the required amount and choose the trading platform (the broker advocates for ETX TraderPro).

Step 6. Start trading.

Fees and Commissions

EThe broker operates as a market maker offering ECN executions. Therefore, the broker charges fees on a markup spread and other trading fees depend on the trading platform the trader uses and the asset being traded.

In general, the spreads fluctuate depending on the instruments being traded and the platform in use. For example, the floating spread for AUD/USD starts from 0.8 pips on the TraderPro, while for the MT4, it’s capped at 1.1 pips (minimum). ETX Capital also imposes a ten euros withdrawal processing fee for any withdrawal made after five consecutive withdrawals above 100 euros within a calendar month.

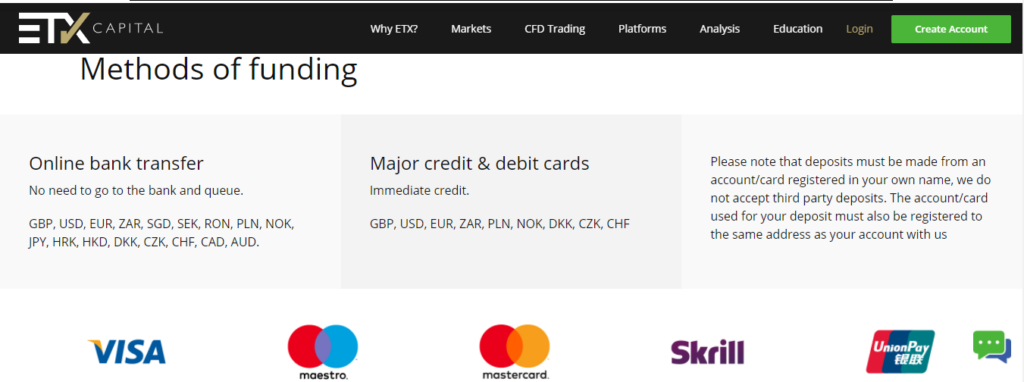

Payment options

ETX Capital offers clients access to several payment methods. Traders fund the accounts through methods such as online bank wire transfers, credit and debit cards, and E-wallets. It accepts deposits and withdrawals made through the following currencies: GBP, USD, EUR, ZAR, SGD, SEK, RON, PLN, NOK, JPY, HRK, HKD, DKK, CZK, CHF, CAD, AUD.

Pros

- Multiple payment options

- Deposit and withdrawal is free

- Accepts different currencies for deposit/withdrawal

Cons

- Imposes a ten euro fee for any withdrawal above 100 euros made after five other processed withdrawals of 100 euros and above done within the same month

Deposit

ETX Capital allows traders to fund accounts through:

- Online Bank wire transfers

- E-Wallet transfers like Skrill

- Credit/ debit cards such as Visa, MasterCard, Maestro, among others

Withdrawals

Clients receive payments through the same channels offered for deposits.

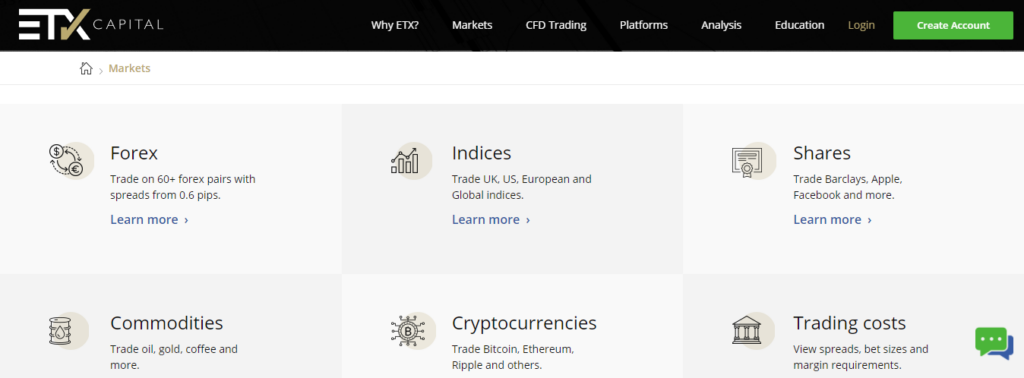

Available Markets

ETX Capital claims to offer access to over 5,000 markets, instant executions, and tailor-made services. Its asset basket holds over 60 forex pairs, 20 global indices, shares, commodities such as metals and energies, cryptocurrencies, among other valuable assets.

- Forex

The broker allows clients to trade over 60 currency pairs 24hrs from Monday through Friday. The trading costs depend on the currency pair and the trading platform in use, but the minimum available spreads start from 0.6 pips. The mode of execution is instant aided by advanced technical indicators offered through the trading platforms.

Max leverage is capped at 100:1 or 200:1 for the standard and premium account traders depending on the trading platform the trader uses. The broker offers five base currencies with significant pairs: EUR/USD, GBP/USD, and USD/JPY.

- Indices

Over 20 indices trade on ETX Capital with instant execution and tight spreads. The spread starts from 1pt and has a minimum size of 50p on the FTSE 100, DAX, Dow Jones, and Nasdaq. Indices traders also receive real-time trading news and updates direct to their inbox.

- Commodities

The broker allows clients to trade valuable physical instruments through its platforms with instant execution and low spreads. It also offers access to free education on commodity trading. However, the cost incurred on commodity trading depends on the type of instrument a client trades. Some commodities include precious metals like gold, copper, silver, etc., energies such as Brent Crude, and a stream of fibers like cotton and beverages like coffee.

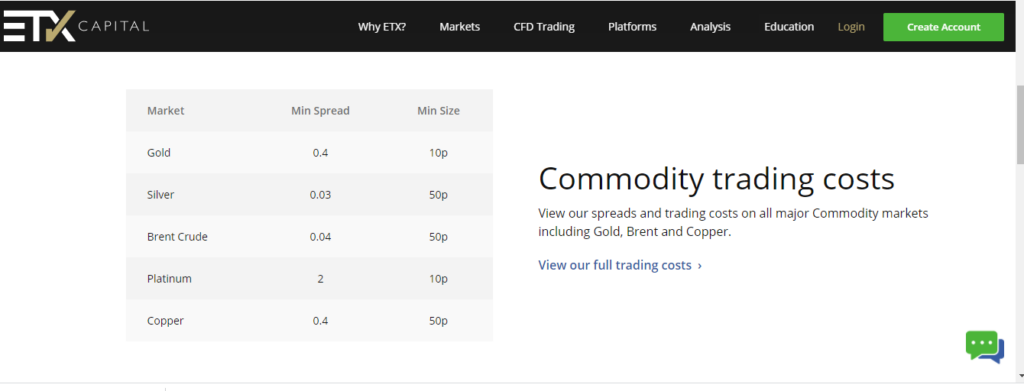

- Precious metals

As briefly introduced, ETX Capital offers the trade of precious metals such as Gold, Platinum, Silver, and Copper. The trading costs vary depending on the asset. For example, Gold trades with a minimum spread of 0.4 pips at a minimum size of 10p while Silver trades with at min. Spread of 0.03 and min. Size of 50p.

- Cryptocurrencies

ETX Capital allows traders to capitalize on the rising and falling prices of major cryptocurrencies through spread betting. The broker offers these assets through its platforms. Spread depends on the digital asset being traded but the min. The trading costs, such as the minimum size, trade at 10p for all cryptocurrencies.

Trading Platforms

| ETX TraderPro | ETX MT4 |

| It’s the broker’s proprietary trading platform with a good trading track record and awards. It’s offered as a web-based application and as a mobile app. Its features include: Trade over 5,000 assets Advanced research tools Lower fees as compared with MT4 Multiple chart types Easy to use trade tickets, making it simple to set stops and limits Calculate risks before execution with risk and profit calculators Offers customized workspaces Interactive charts | ETX Capital provides traders access to the world’s most accepted trading platform. The broker offers MT4 via the web and as a mobile app integrated with unique features. Perform advanced trading operations with EA advisors trading robots Experience fast execution speeds of up to 30 milliseconds Automatic trading with EA One-click through trading Trade micro-lots Hedging allowed Offers virtual private servers |

Features

ETX Capital features generally include:

Trading tools

- Expert advisors

- Trading calculator

- Profit calculator

- Charting tools

Analytical tools

- Market watch information tools

- Technical analysis tools

- Indicators

- Signals

Education

ETX Capital provides lots of educational resources to traders to help improve their trading skills. Traders access these materials on the broker’s website under the education button. They include:

- Webinars

- eBooks

- Platforms guides in video format

- Basic trading courses

Customer Support

ETX Capital provides an effective customer support team that deals with traders directly tailoring services to meet their needs. Traders access the customer support services on the website, where the broker offers an extensive FAQ section covering queries on all trading dimensions. The FAQ section answers clients’ queries on different topics like:

- Account opening

- Trading platforms

- Trading basics

However, clients contact the support team directly through a live chat section, a phone number provided at the “contact us” section, and through email ([email protected]).

Review Summary

ETX Capital holds trading licenses from reputable regulatory bodies giving it traction as a safe and legitimate brokerage company. The broker provides tailor-made services and products to both intermediate and pro traders through its personalized service accounts.

It also lays a foundation for beginners with its free demo account and educational resources available on its website. Currently, the broker serves millions of traders across three continents with direct access to over 5,000 markets and instant orders.