HotForex Group Limited operates as a unified entity of brokerage companies located in different sections of the globe, serving both retail and institutional clients in the trading industry. The firm provides forex and CFDs trading on a spectrum of asset classes such as indices, energies, shares, among others. The conglomerate claims the asset classes hold more than 1200 instruments available through its state-of-the-art trading platforms.

Pros

- Low spreads capped at 0.0 pips

- Leverage of up to 1:1000

- More than 1200 instruments to trade

- 100% bonus offerings

- Offers negative balance protection and segregation of funds

- Multiple payments options

- No fees on deposits

- Six account types to meet the objectives of different clients

- 27 supported languages

- 24/5 expert support

- Rich educational resources

- Autochartist tool

- VPS hosting

- Scalping and hedging allowed

- One-click trading

- Access to market trends and analysis

- Over ten years of experience

- Low trading cost and commissions starting from $0.03 per 1k lot

Cons

- Charges a monthly inactivity fee of $5 after six months of account dormancy

- Deposit and withdrawal fees may depend on the bank institution the client uses

- Does not provide services to clients in the US, Canada, North Korea, and a stream of other nations

- Min. deposit increases for some clients depending on the account type chosen

- Trading conditions depend on the account type

- It’s an off-shore based broker

Brokerage giant HotForex Group Limited operates as a stream of brokers based in different pockets of the globe. The financial conglomerate’s head office, the HF Markets (SV) Ltd, is headquartered in St. Vincent and the Grenadines and holds an International Business Company (IBC) license 22747 IBC 2015. That grants HotForex the imprint as a worldwide financial trading company.

It provides forex and CFDs trading services worldwide with just a few nations such as the US, Canada, and North Korea, substituted from the client target equation. However, the broker’s roots penetrate worldwide, giving traction to the 2.5 million+ opened live accounts. HotForex notes serving these clients with extremely low spreads capped at 0.0 pips, lightning-fast executions, innovative trading platforms, and low trading costs and commissions.

These features, coupled with trading merits like scalping, hedging, and smart trading, provide a good trading experience of the broker’s instruments.

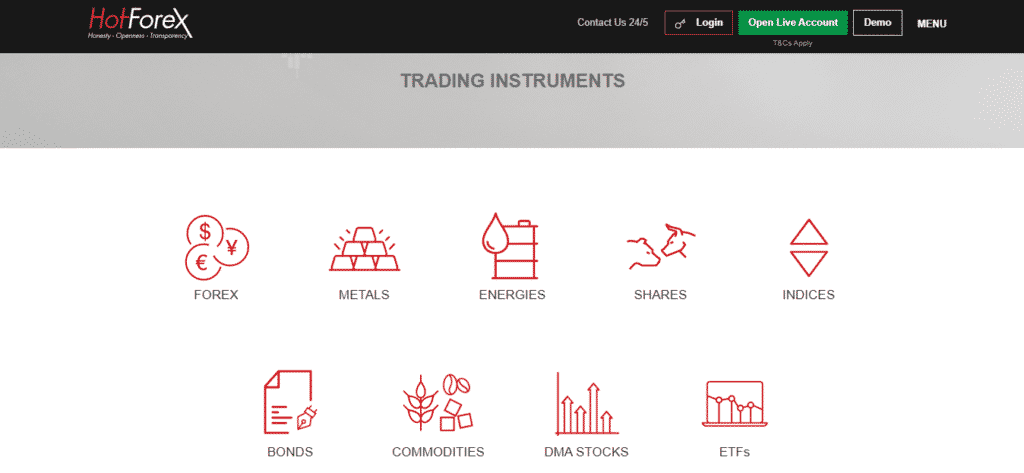

HotForex claims to offer 1200+ trading instruments from asset classes such as:

- Forex

- Metals

- Energies

- Indices

- Shares

- Bonds

- Stocks DMA (Direct Market Access)

- ETFs

Traders access these assets through the broker’s trading platforms that integrate with sophisticated tools like calculators, APIs, economic calendars, Autochartist, among others, to provide a good ambiance for trading. The platforms come in diverse versions to operate on different interfaces meeting the objectives of many clients.

Its platforms include:

- The MetaTrader 4

- The MetaTrader 5

- HotForex Fix API

With these platforms imbued with unique trading tools, clients trade available assets through the broker’s range of account types. HotForex provides six account types tailored to serve different criteria of clients. However, the trading conditions differ from one account to another, with micro clients only allowed to deposit a min. Amount of $5 while premium account traders’ minimum deposit is capped at $100.

The array of payments options aiding depositing of funds include:

- E-wallet transfers such as Neteller and Skrill

- Credit/Debit cards such as Visa, MasterCard, and Maestro

- Bank wire transfers

Generally, HotForex prides itself on being a reputable broker with over ten years of experience in the financial marketplace. The company made its debut in 2010 and expanded to achieve its current size and value. As discussed, it runs a branch of offices worldwide and confirms to have added 50+ awards to its trophy cabinet. In addition, it holds trading licenses from legitimate regulatory agencies such as:

- FCA

- DFSA

- FSCA

- FSA

Regulation

HotForex operates under the surveillance of well-recognized regulatory bodies around the world. Albeit holding an international Business registration, it pockets licenses from the following regulatory agencies:

- License number 801701 from the Financial Conduct Authority (FCA)

- License number F004885 from the Dubai Financial Services Authority (DFSA)

- License number 46632 from the Financial Sector Conduct Authority (FSCA)

- License number SD015 and registration number 841917-1 from the Financial Services Authority (FSA) of Seychelles.

Pros

- Regulated by a top-tier agency, the FCA

- Well-regulated broker

Cons

- Only regulated by one top-tier agency

- Not available to US clients among an array of other clients from blacklisted nations.

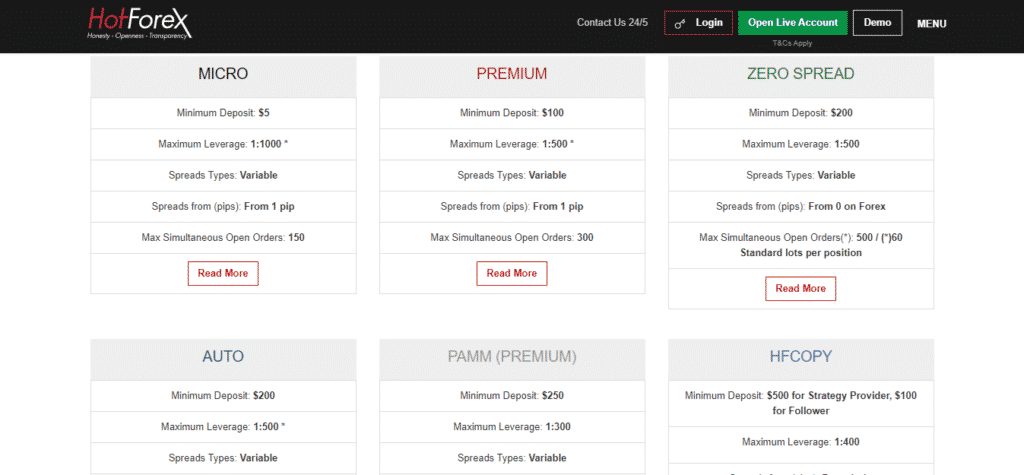

Account Types

HotForex boasts of providing clients with six account types tailored to satisfy different classes of traders. Each account comes with unique trading conditions that favor clients of that class. For example, some clients go for the micro account because of the shaved-down minimum deposit, while others choose the premium accounts to benefit from the integrated tools.

The accounts include:

- The Micro account

- The Premium account

- The Zero Spread account

- The Auto account

- The PAMM (Premium) account

- The HF copy account

Account analysis

Micro account

- Minimum deposit — $5

- Leverage up to — 1:1000

- Spreads type — variable

- Spreads from — one pip

- Max. open orders — 150

- Trading Platforms — MT4 & 5 on all interfaces

- Available trading instruments — all

- Execution type — market execution

- Min. trade size — 0.01 Lot

- Min. total trade size — seven standard lots

- Margin call / stop out level — 40% / 10%

- Telephone trading — yes

- Account currency — USD, EUR, NGN, JPY

- Personal account manager — yes

- Commission — yes

- Raw bonus — flexible bonus offerings

Premium account

- Minimum deposit — $100

- Leverage up to — 1:500

- Spreads type — variable

- Spreads from — one pip

- Max. Open orders — 300

- Trading Platforms — MT4 & 5 on all interfaces

- Available trading instruments — all

- Execution type — market execution

- Min. Trade size — 0.01 lot

- Min. Total trade size — 60 standard lots per position

- Margin call / stop out level — 50% / 20%

- Telephone trading — yes

- Account currency — USD, EUR, NGN, JPY

- Personal account manager — yes

- Commission — yes

- Raw bonus — flexible bonus offerings

Zero Spread account

- Minimum deposit — $200

- Leverage up to — 1:500

- Spreads type — variable

- Spreads from — 0 pip on forex

- Max. open orders — 500

- Trading platforms — MT4 & 5 on all interfaces

- Fifth decimal — yes

- Available trading instruments — all

- Execution type — market execution

- Min. trade size — 0.01 lots (1,000 units of the base currency)

- Min. total trade size — 60 standard lots per position

- Margin call / stop out level — 50% / 20%

- Telephone trading — yes

- Account currency — USD, EUR, NGN, JPY

- Personal account manager — yes

- Limit and stop levels — starting from two pips

- Commission — yes

- Raw bonus — no

Auto account

- Minimum deposit — $200

- Leverage up to — 1:500

- Spreads type — variable

- Spreads from — one pip

- Max. open orders — 300

- Trading platforms — MT4 & 5 on all interfaces

- Fifth decimal — yes

- Available trading instruments — all

- Execution type — market execution

- Min. trade size — 0.01 lot

- Min. total trade size — 60 standard lots per position

- Margin call / stop out level — 50% / 20%

- Telephone trading — yes

- Account currency — USD, EUR

- Personal account manager — yes

- Limit and stop levels — starting from two pips

- Commission — no

- Raw bonus — no

PAMM (premium)

- Minimum deposit — $250

- Leverage up to — 1:300

- Spreads type — variable

- Spreads from — 1.1 pip but from 0.3 pips for premium plus clients

- Max. Open orders — 500

- Trading Platforms — MT4 on all interfaces

- Fifth decimal — yes

- Available trading instruments — forex, metals, oil, indices

- Execution type — market execution

- Min. trade size — 0.01 lot

- Min. total trade size — 500

- Margin call / stop out level — 50% / 20%

- Telephone trading — yes

- Account currency — USD

- Commission — no but $5 per 100,000 USD traded for the premium plus clients

HFCOPY account

- Minimum deposit — $500 for strategy provider, $100 for follower

- Leverage up to — 1:400

- Spreads type — variable

- Spreads from — one pip

- Max. Open orders — 300

- Trading Platforms — MT4 & 5 on all interfaces

- Fifth decimal — yes

- Available trading instruments — forex, indices, spot, gold

- Execution type — market execution

- Min. trade size — 0.01 lot

- Min. total trade size — 60 standard lots per position

- Margin call / top out level — 50% / 20%

- Telephone trading — yes

- Account currency — USD

- Personal account manager — yes

- Maximum followers — 100 – 400

- Commission — no

- Raw bonus — no

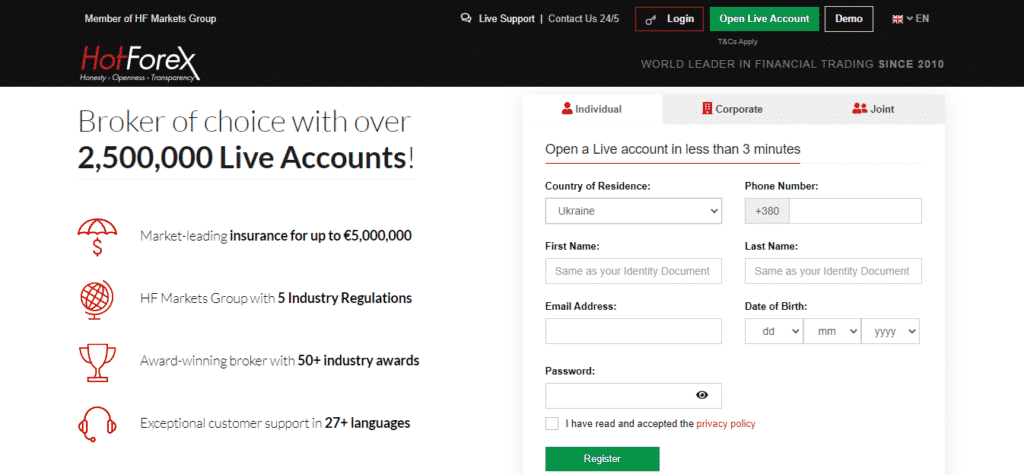

How to open a HotForex account?

Like we’ve discussed in this review, HotForex targets both retail and institutional traders. The broker provides a wide range of accounts to cater to its different clients’ needs. With an overview of the accounts offered at HotForex, the looming question is, “Why do you open a HotForex account?”

Step 1. Log into their official website and click the “open live account button.”

Step 2. Fill in your details on the form that pops up.

Step 3. Verify your email address and provide the required KYC documents.

Step 4. Activate the account through the activate button.

Step 5. Select your account type and fund the required amount.

Step 6. Start trading.

Fees and Commissions

HotForex operates as a No Dealing Desk broker providing direct market order executions with lightning speeds. It offers a zero spread account and low spreads accounts proving it’s not a spread betting broker. However, this doesn’t signify the broker to be commission-free. HotForex charges small commissions on the markup spread and a trading commission to premium plus clients depending on the volume of trades.

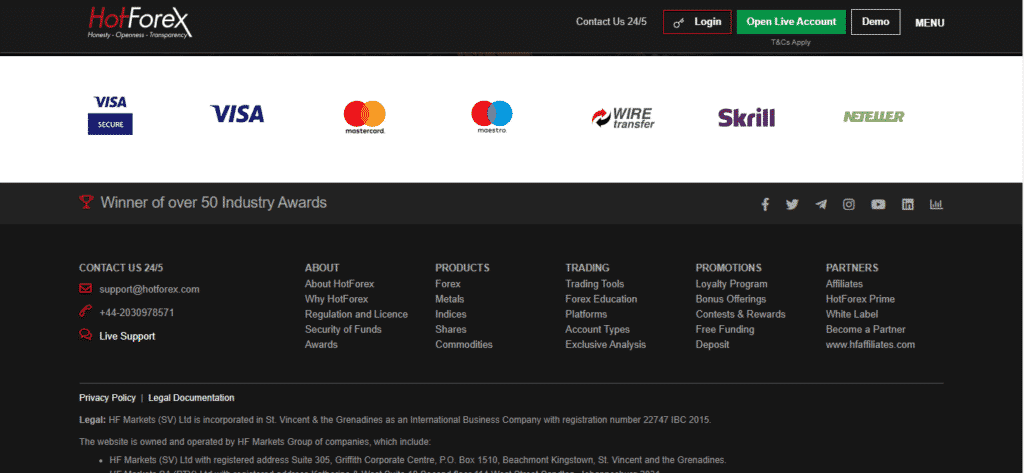

Payment options

As the broker serves millions of clients all around the globe, it provides diverse payment options to meet the demands of both local and international clients. It waives the deposit and withdrawal fees to $0, but terms and conditions may apply depending on the client’s bank institution. Some banks may impose a fee on transactions made to and from the HF wallet.

Pros

- Multiple payment options

- Deposit and withdrawal is free

Cons

- Some banks may charge a transaction fee

Deposit

HotForex accepts deposits from these methods:

- Bank Cards like Visa, Mastercard, Maestro

- E-Wallet transfers like Skrill and Neteller

- Bank wire transfers

Withdrawals

Deposit methods apply to withdrawals.

Available Markets

HotForex helps clients diversify their instruments portfolio by providing multiple asset classes that collectively offer more than 1200 trading instruments. Just as noted in this review, the asset bracket holds classes such as FX pairs, commodities, shares, indices, among others.

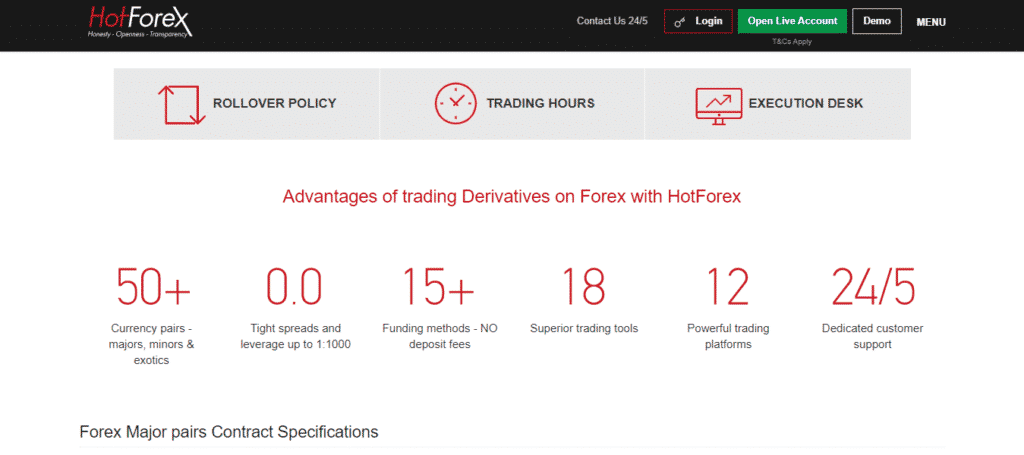

Forex

The forex market trades 24/5 at HotForex with dedicated customer support. More than 50 currency pairs trade on the broker composed of majors, minors, and exotics with tight spreads and leverages of up to 1:1000. Traders can go short and long on all currency pairs with significant pairs such as EUR/GBP and EUR/USD also available. Collectively, the currency pairs emerge from nine base currencies.

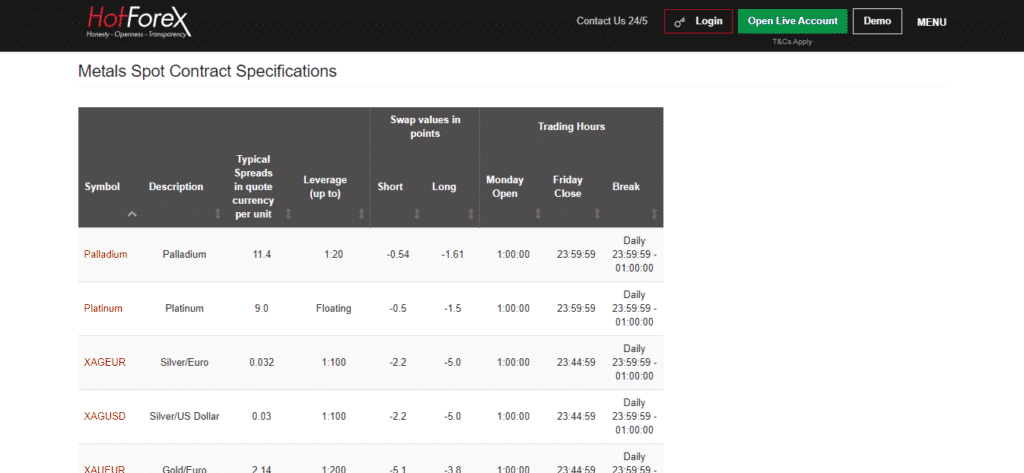

Metals

HotForex also offers a stream of spot metals, giving clients access to the precious metals market with its precious metals portfolio holding assets such as:

- Gold

- Platinum

- Palladium

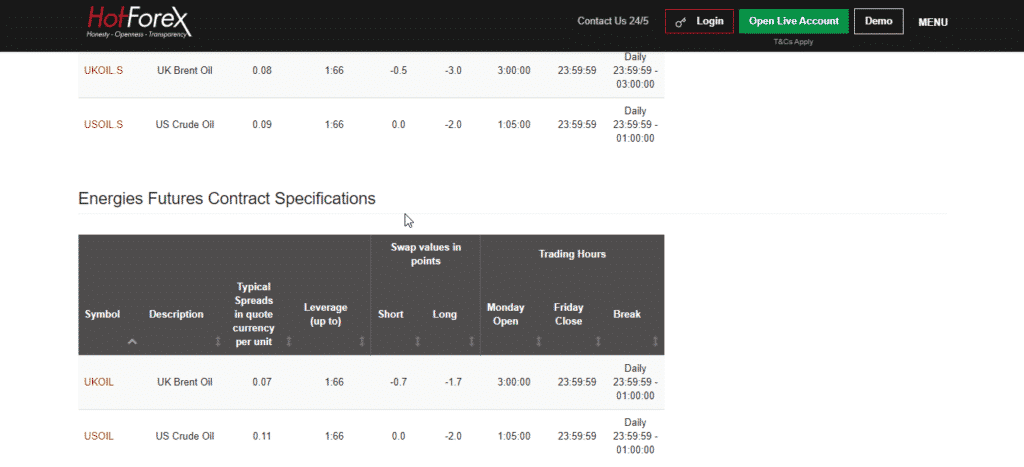

Energies

Clients also have the opportunity to trade derivatives on energies lake crude to widen their investment portfolio. The market trades 24/5 with low spreads and fast, reliable execution.

Some of the instruments include:

- US crude oil

- UK brent oil

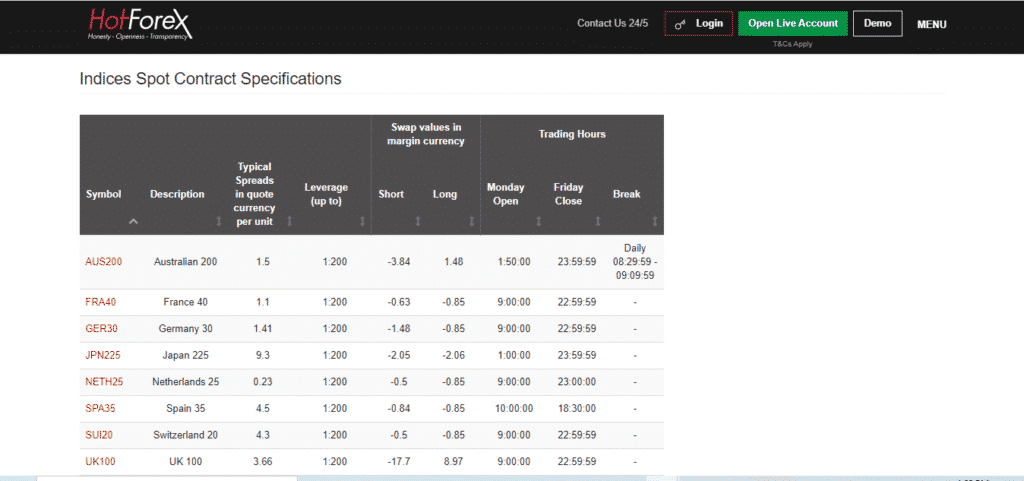

Indices

HotForex trades also explore derivatives on the world’s leading indices market 24/5 with major instruments like USA500 and UK100 among the spectrum of available indices products. Clients have the opportunity to go long or short on these instruments to yield good profits.

Shares

HotForex also opens the gate for clients to trade CFDs on shares of global companies with low spreads, fast execution, and competitive commission. Some of the instruments traded include;

- FB

- AMZN

- AAPL

The broker also notes having various other assets such as bonds, commodities like copper, coffee, and cocoa, trading with low margin requirements, and negative balance protection. In addition, it lately added new assets to the asset class basket, such as stocks DMA and ETFs.

Trading Platforms

Just as mentioned, HotForex provides the MT4 and MT5 trading platforms on diverse interfaces. These platforms feature on applications like Windows, Mac Os, IOS, Android, and the Web.

As a result, the broker rolls out many MT4 and MT5 trading platform versions that clients choose to depend on the operating system they prefer or the interface they use. The broker also provides API trading through its HF fix/API platform.

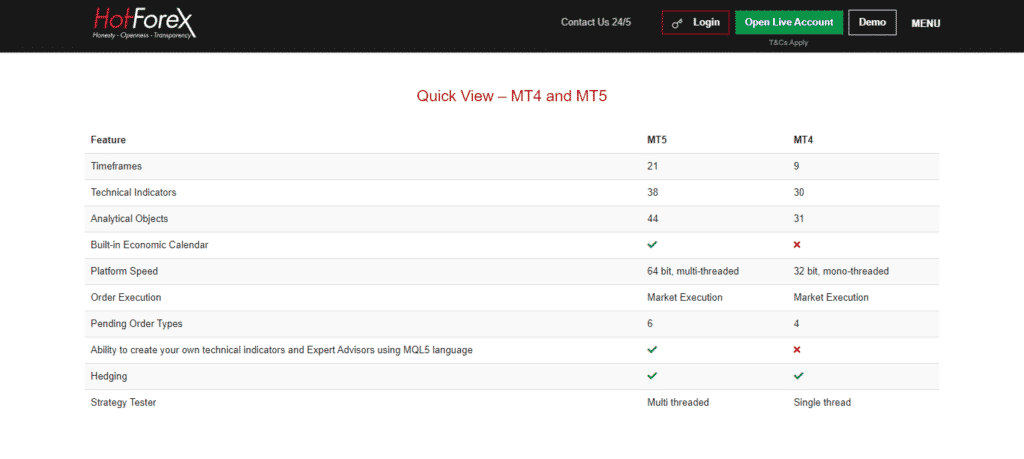

MT4 trading platform

- Time frames — 9

- Technical indicators — 30

- Analytical objects — 31

- Built-in Economic calendar — no

- Platform speed — 32 bit, mono-threaded

- Pending order Types — 4

- Ability to create EA and technical indicators using MQL5 — no

- Hedging — yes

- Strategy Tester — Single thread

MT5 trading platform

- Time frames — 21

- Technical indicators — 38

- Analytical objects — 44

- Built-in Economic calendar — yes

- Platform speed — 64 bit, multi-threaded

- Pending order Types — 6

- Ability to create EA and technical indicators using MQL5 — yes

- Hedging — yes

- Strategy tester — multithread

Features

HotForex features generally include:

Trading tools

- Autochartist

- Expert advisors

- Trading calculators

- VPS hosting

- One-click trading

Analytical tools

- Market watch tools

- Technical analysis tools

- Economic calendar

- Forex news

Education

HotForex ensures clients have the best informative content to boost their trading skills and make good profits in the long run. It provides rich educational resources such as:

- Forex trading webinars

- Tutorial videos

- E-courses

- Forex Faqs

Customer Support

The broker also provides a well-furnished customer support center to interact with clients 24/5 solving their issues. The customer support system encompasses a live support section that allows clients direct interaction with the support team through an email, chat, or phone call. A contact section provides a platform for anyone to contact the support team by filling a form.

Review Summary

HotForex Group Limited prides itself with over ten years of experience in the Forex and CFDs trading industry. It operates as an NDD broker providing market order executions on its range of instruments and notes, offering 1200+ trading products.

The brokerage company runs a portfolio of branches around the globe serving millions of traders and claims to have hit a milestone of 2.5 million+ live accounts. Its clientele hovers above retail and institutional clients and proves to be a friendly platform for both newbies and veteran traders.