eToro is a multi-regulated forex and CFDs broker famous among investors due to its sophisticated social trading platform. Moreover, it has a built-in web trading platform with many trading tools and $500,000 availability of assets. The main drawback of the company is that it has higher trading fees with fees on withdrawal that may hurt traders.

Pros

- Multi-regulated broker

- Commission-free trading

- Accepts US clients

- Start trading with a $50 deposit only

- Leading social trading platform

Cons

- Less variety in account types

- Takes withdrawal fee of $5

- Limited choice of ways to deposit methods

eToro is a social trading broker established in 2007. It is an Israeli fintech company with multiple regulations to provide services in several countries. It is regulated under two tier-1 jurisdictions and one tier-2 jurisdiction that makes it a safe broker for forex and CFDs trading. eToro has a sophisticated platform suitable for social trading and cryptocurrency trading that may attract traders. However, for forex trading, it is a costly broker compared to other competitors.

eToro provides social trading services in the UK under its Financial Conduct Authority (FCA) regulation. Besides, it has a physical office in the US, the UK, EU, and Australia. eToro is not a listed company on any stock exchanges, and it does not disclose its financial information on the website.

However, as it is a multi-regulated broker and follows all regulating requirements, we can consider it a trustworthy broker.

Regulation

eToro is a multi-regulated broker from different authorities. Therefore, traders can enjoy the trading environment that most international brokers allow.

Based on the eToro official site, the broker is regulated by the following authorities:

- eToro (Europe) Ltd., a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license # 109/10.

- eToro (UK) Ltd, a Financial Services Company authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

- eToro AUS Capital Pty Ltd. is authorized by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

- eToro (Seychelles) Ltd. is licensed by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License #SD076.

During our review, we did not find any complaints about eToro on any social channels. Therefore, we can consider that the broker follows all requirements accurately.

Account Types

eToro focused on fewer account types to make the process simple. During our review, we have found only two account types in eToro for retail and professional traders.

eToro retail account

- Retail account holders can trade all trading assets manually or via copy trades.

- Balance protection is available under Investor Compensation Fund and recourse to the Financial Ombudsman Service.

- There are some limitations on the leverage for retail traders.

- Negative balance protection is available for retail traders.

eToro professional account

The professional account requires retail traders to pass a test to determine the suitability as an experienced trader. Let’s have a look at the requirements to be a professional account holder:

- Investors should have a portfolio of more than $500,000, excluding property and cash.

- Investors should show verified trading history with positions of significant size.

- A trader should have previous experience in trading and work as a professional trader in derivatives, speculation, and trading.

Besides, professional account holders will also enjoy negative balance protection and higher leverage than retail accounts.

eToro Islamic account

Besides the two account types, the Islamic account focused on Muslims who strictly follow Sharia law. Within this account type, traders don’t have to pay any interest, such as overnight fees.

eToro offers an Islamic account with a minimum deposit of $1,000. However, Muslim traders may have to pay additional commissions, account management fees, or broader spreads, and Muslim traders have access to interest-free leverage.

Fees and Commissions

eToro has both trading and non-trading fees where trading fees do not include any commissions. Opening an account is also accessible without any management fees.

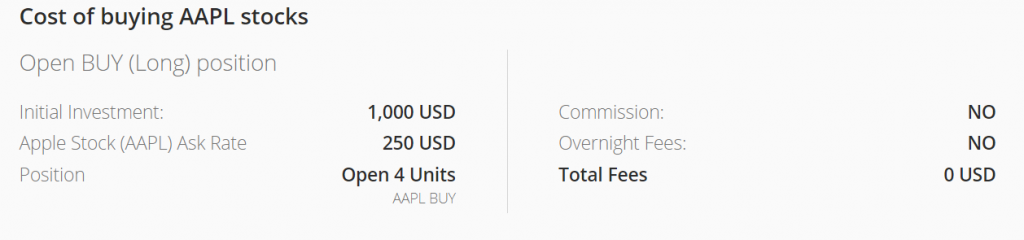

Stock & ETFs fees

- Management fees: no

- Rollover fees: no

- Ticket fees: no

- Additional broker fees: no

For example, the cost of buying one Apple stock is shown in the image below:

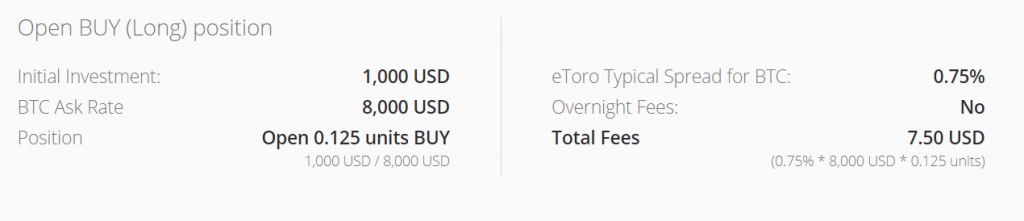

Cryptocurrency fees

- Cryptocurrency transfer fee: 0.005 unit

- Spread: minimum 0.75%

For example, the cost of buying Bitcoin is shown in the image below:

CFDs fees

- Currency pairs: starts from 1 pip

- Commodities: starts from 2 pips

- Indices: starts from 100 pips

- Stocks and ETFs: stats from 0.09%

- Cryptocurrencies (CFDs): starts from 0.75%

- Overnight fees: no

Non-trading fees

- Deposit fee: free

- Withdrawal fee: $5

- Currency conversion fee: 50 pips

- Inactivity fee: $10 per month after 12 months of inactivity

Based on our findings, spreads are higher in eToro compared to other brokers. However, it does not have any commission or overnight fees in regular trading accounts.

Payment options

Making a deposit is very easy with eToro where you should follow a simple system:

- Log in to your account

- Click on “deposit funds”

- Enter the amount and select the currency

- Finally, choose your preferred deposit method

eToro deposit option

- Debit card

- Online banking

- Bank transfer

Deposit through debit card or online banking is instant where bank transfer may require 4-7 business days from wire date.

eToro withdrawal option

To make a withdraw, you have to follow some simple steps:

- Click on the withdraw funds tab in the left-hand menu

- Enter the amount to withdraw (in USD)

- Complete the electronic withdrawal form as required

- Click “submit”

The minimum withdrawal amount is $30, and you have to wait a minimum of seven days to withdraw the invested amount.

Available Markets

Now, we will see the list of available markets on the eToro platform. In eToro, you can diversify your trading portfolio from forex, stocks, indices, commodities, and cryptocurrencies.

Forex

- eToro offers currency pairs trading with more than 50 pairs, including forex majors, minors, and exotics

- eToro provides the ability to trade personal accounts or take copy trading services from other traders through the eToro platform

Stocks

- Available stocks in nine categories

- Lots of stocks to trade from 17 different exchanges

Commodities

- Thirty-one available instruments in the commodity section, including gold, oil, copper, coffee, etc.

- Ability to perform or use social trading for commodity pairs

Cryptocurrencies

- 24/7 trading in cryptocurrencies

- Low trading cost in crypto trading: 0.75% for BTC

Trading Platforms

eToro has a web-based, desktop, and mobile platform so that traders can access the market from everywhere:

eToro web trader

eToro Web trading platform has a clean design that may influence traders to consider it an exciting platform. Based on our findings, eToro focused on the design and functionality of their trading platform. Overall we found menu buttons and color schemes to be perfect. However, it isn’t effortless to customize the platform as there are fewer options for it.

In the eToro, web trader platform, there is two-factor authentication to ensure maximum security. The built-in search function allows you to search any of the trading instruments that you like. Moreover, there are three types of trading orders- market, limits stop loss, and trailing stop loss.

You can set alerts for the price, and there is a possibility of getting notifications very easily. When the price reaches your desired price level to hit your trading entry, you will immediately notify your email address.

Besides, you can create your trading portfolio with a detailed performance report on the web trading platform.

eToro mobile trader

eToro mobile trader is available for both Android and iOS in 21 languages as a web trading platform.

Moreover, it uses mobile-focused functions, such as push notifications. Furthermore, you can swipe left to right to see your trading portfolios.

Features

Besides general features, eToro provides more than a trader should know. Here we will see some elements that eToro supplies exclusively:

eToro club

- eToro has Silver, Gold, Platinum, Platinum+, and Diamond tier to ensure various offers.

- Silver tier members receive exclusive access to in-depth market webcasts, data-based CopyPortfolios, and a dedicated account manager.

- Gold tier members will get the same benefits plus a weekly market outlook.

- Platinum members will get free Wall Street Journal access besides all facilities mentioned above.

- Platinum plus tier members will earn one zoom session.

- Diamond members will get complimentary access to premium digital publications and many more.

Education support

- In the news and analysis section, investors will get the latest news of the market, including fundamental analysis.

- eToro financial market guides cover everything you need to know about online trading.

- In the trading academy section, investors will get video tutorials.

- eToro social trading allows you to copy successful traders’ trade directly to your trading account.

Customer Support

eToro website is available in 20 languages. Therefore, investors of most other countries can access it. eToro web UI design is very straightforward, where vital information about the broker is easily accessible.

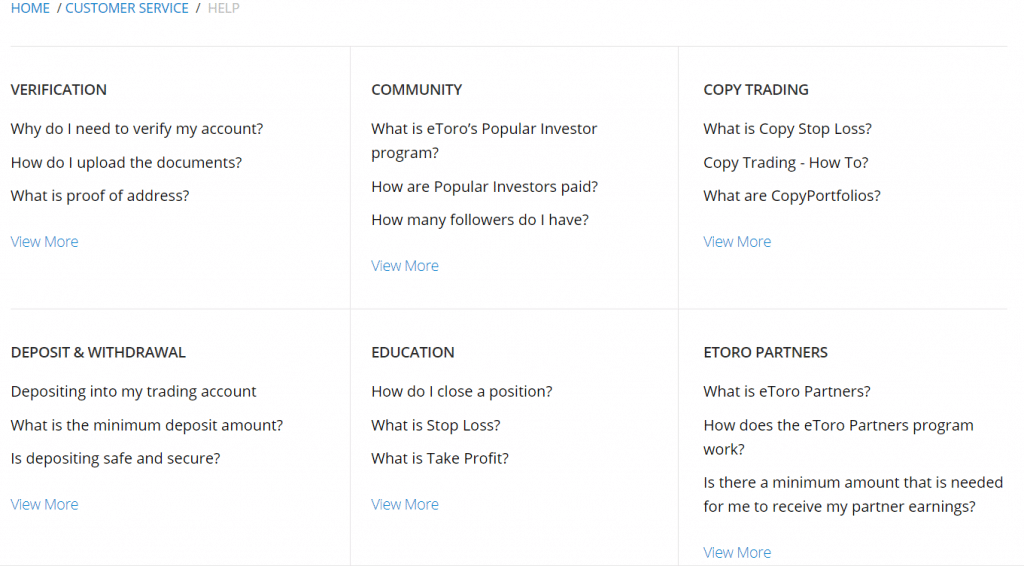

eToro support page is enriched with multiple FAQs covering all essential areas of the company:

Moreover, there are trending articles covering the most read section about the company. However, the best way to contact the broker is through its live chat that is available 24/7.

Review Summary

In summary, we can say that eToro is a forex and CFDs broker that is well-known among investors for its social trading platform.

Based on our findings of the broker, it is one of the top-tiered brokers around the world with a lot of facilities. The most attractive feature of this broker is its availability of instruments and sophisticated platform. However, it is a costly broker compared to the industry average, where its spread and trading costs are high. As long as the fund’s safety is the maximum priority, this broker is an excellent option for investors.