IG offers a highly competitive trading platform for beginners and experienced investors to trade on platforms that suit their level. The FCA/NFA/CFTC regulated broker proves its credibility and maintains a reputation of safety and security for its client’s funds. Overall, IG is a choice for clients in over five continents, including those in the US.

Pros

- Comprehensive research and education tools

- Robust selection of financial instruments

- Regulated by FCA, NFA, & CFTC

- Accepts US clients

Cons

- Slow customer support

- High CFD fees

- No negative balance protection for US clients

Stuart Wheeler founded IG in 1974 as a spread betting firm. His goal was to empower people by giving them access to the financial markets to ‘bet’ and make profits. Over the years, IG has grown to reach people in five continents, having a clientele of over 239,000.

Today, IG is part of the IG Group Holdings PLC, listed for public trading with the London Stock Exchange (LSE: IGG). It’s also registered and supervised by reputable supervisory bodies in the US (NFA & CFTC), the UK (FCA), and other regions worldwide.

The award-winning FX and CFD broker offers an extensive product catalog, state-of-the-art trading platforms, superior research tools, and comprehensive educational resources. US clients signing up to IG have access to FX products only, while the rest of the clients access all the other products.

Regulation

IG is severely regulated in the entire region where it offers its services. The financial authorities regulating it include:

- Federal Financial Supervisory Authority – Germany

- Financial Markets Authority (FMA) – New Zealand

- Dubai Financial Services Authority (DFSA) – Dubai

- Swiss Financial Market Supervisory Authority (FINMA) – Switzerland

- Monetary Authority of Singapore (MAS) – Singapore

- Financial Sector Conduct Authority (FSCA) – South Africa

- Australian Securities and Investment Commission (ASIC) – Australia

- Financial Services Authority (FSA) – Japan

- Commodity Futures Trading Commission (CFTC) – USA

- Financial Conduct Authority (FCA) – UK

- National Futures Association (NFA) – USA

- Bermuda Monetary Authority (BMA) – International

Account Types

IG clients can open different account types depending on the account availability in their region. These accounts and the areas of availability include:

- Australia – IG trading account, share dealing account, Limited risk account

- The UK – IG trading account, spread betting account, share dealing account, IG professional account.

- Dubai – IG trading account, swap-free account, limited risk account

- USA – IG trading account (FX)

- Europe (excluding the UK & Switzerland) – IG options account, IG professional account, IG trading account, IG Turbo24 trading account

- Japan – IG trading account, limited risk account

- Switzerland – IG trading account, limited risk account

- New Zealand – IG trading account, limited risk account

- South Africa – IG trading account, limited risk account

- Singapore – IG trading account, limited risk account

Clients globally can access the IG trading account, which allows them to trade with high leverages on CFD products. Clients in the US are an exception as their IG trading account only enables them to trade Forex products.

Here are the accounts.

IG trading account

It’s mainly a CFD trading account but clients in the US trade FX only.

- Trading instruments – 17,000+ markets

- Minimum deposit – $0

- Minimum Trade Size – $1/trade (First two weeks)

- Trading Platforms – All IG platforms

- Inactivity fee – $18/month after 24 months of inactivity

- Commission – Yes

- Leverage/Margin – 0.25% Forex and 5% on Shares and Indices

- Available to all clients

Spread betting account

- Trading instruments – 17,000+ markets

- Minimum deposit – $200

- Trading Platforms – All IG platforms

- Inactivity fee – $18/month after 24 months of inactivity

- Commission – No

- Margin – 20%

- Available for UK clients only

IG professional account

The professional account is for selected European clients who have consistently grown their trading accounts and built their portfolios over time. Eligible clients must meet the qualifying criteria, which involves having a positive answer in at least two of these three questions.

- Have you engaged in trading leverages in high volume in the last four quarters?

- Is your financial instrument portfolio like cash, stocks, shares, mutual funds, trading accounts, etc., exceeding $500k?

- Have you worked as a professional in a formal financial sector requiring you to trade derivatives for over a year?

A professional account will give you access to superior features and pro services from the IG team. However, some benefits are cut out once you join as a professional client. For example, you’ll no longer be under the negative balance protection offered to retail clients.

Share dealing account

This account is only for UK clients. It provides access to financial instruments like EFTs, shares, etc. When opening a share dealing account, a client will be expected to choose between the sub-accounts of the main account.

These sub-accounts are:

- Stocks & Shares ISA – it allows you to invest and get returns without paying any taxes. You can invest up t0 £20,000.

- Smart portfolio – invest a minimum of £500 and build a portfolio according to your goals through the smart portfolio tool.

- A standard share dealing account allows you to trade global shares and EFTs at no commission for US shares and a £3 commission on UK shares.

How to open a trading account

Step 1: Enter the correct details of your resident country, full name, email address, etc., on the onboarding form to complete your profile. You’ll also choose a username and a password for your account.

Step 2: Provide a valid phone number and home address for contact purposes. Ensure that the contact information is accurate for verification.

Step 3: Provide relevant answers to the questions on your financial status.

Step 4: The questions in this step test your knowledge of the financial markets and investing, so answer them to the best of your ability.

Step 5: Upload the required documents for account verification. It may take up to 3 days to verify your account.

Fees and Commissions

IG offers thousands of financial products, so it can be quite challenging to understand its fee structure. IG’s transparency on the fee structure lets clients know what they are dealing with and the charges they are paying as they trade on IG.

Share dealing charges

IG’s share dealing account charges a flat-rate fee of £8 for every investment made in UK shares. This means that no matter the amount you invest in shares, the charge will be the same. A person investing £200 and another investing £200,000 will pay the same amount in costs.

When you compare with other UK stockbrokers like eToro, you’ll notice that IG is quite expensive because eToro charges no commissions to buy or sell shares.

Trading international shares have a different fee structure. For example, buying US shares will cost £10 for the first three trades in a month. If you’re an active trader, you enjoy zero commissions after the first three trades, but this status can change as it resets every month.

CFD & spread betting fees

IG charges no commissions on CFDs, except stock CFDs, where the commission varies in percentage. The charge applied for CFD trading is the market spread.

The tightest spreads on IG start from 0.6 pips on Forex CFDs, 0.3 pips on Commodity CFDs, 0.2 pips on cryptocurrency CFDs, and 0.1 pips on Index CFDs. These spreads keep fluctuating according to the prevailing market conditions.

For clients trading on a spread betting account, the charges also apply as spreads for every spread bet on the CFD products. A client is expected to trade a minimum bet of £1 for Forex and FTSE 100.

Non-trading fees

They include:

- Inactivity fee – IG charges $18 every month after two years of inactivity on your account.

- Overnight charges – leveraged positions held overnight attract a financing fee depending on the products you are trading.

- Deposit fee – credit card deposits incur a charge of 0.5% to 1% of the amount.

Leverage

IG allows investors to trade at leverage on all their products. They can leverage up to:

- Stocks – 1:5

- Cryptocurrencies – 1:2

- Gold, major Indices, and minor FX pairs – 1:20

- Other indices and commodities – 1:10

- Major FX pairs – 1:30

Professional traders have access to leverage of up to 1:200.

Payment options

IG accepts six base currencies for withdrawals and deposits. These are USD, EUR, AUD, HKD, GBP, and SGD.

Deposit

Accepted deposit methods include:

- Bank Wire Transfer

- E-wallets

- Debit cards like Visa, Maestro, MasterCard

- Credit cards like Discover, MasterCard, Visa

Withdrawals

You can withdraw your funds through bank transfer, e-wallets, credit cards, and debit cards. IG collects no withdrawal fee.

Available Markets

The IG markets have assets broken down into different streams of investment. These include CFDs, Real Stocks, EFTs, Options, Turbo24, Smart Portfolio, and IPOs.

CFD Trading

IG has thousands of products available for CFD trading. They include:

- Stock CFDs – trade over 10,000 stock CFDs at leverages of 1:5

- Forex – 200+ currency pairs to trade on, including major, minor, and exotic pairs

- Commodity CFDs – invest in 47+ popular commodities, including gold

- EFT CFDs – 1900+ EFTs on IG

- Bond CFDs – 13+ bonds you can invest in and make huge profits

- Stock Index CFDs – trade over 78 world’s most popular indices

- Cryptocurrencies – IG hosts 8+ cryptocurrencies, including Bitcoin and Ethereum

Real Stocks and EFTs

IG allows its clients to buy real stocks from over eight major companies globally. The EFT selection is wide, with up to 2,000 EFTs available on the broker.

These market products are available for clients residing in Australia, Cyprus, Ireland, and the UK.

Options

Trading options is done on the IG Options trading platform, which is available for clients in the European region. Clients can trade Vanilla or Barrier options types.

The options tradable on IG include Forex, Equity Index, and Commodities.

Turbo24

Turbo24 is an innovative trading product available for clients in the European region. This product is traded through a knock-out strategy that works like leverage in ordinary accounts.

Smart portfolio

This is a kind of auto-trading service because the Share’s ETF portfolios are managed on the broker by BlackRock. IG Smart Portfolio is a product accessible by UK clients only.

IPO

IPOs and other launches are available on the IG trading platform. Investors who love tapping into the markets from the launch or buying shares from companies selling them publicly can participate in IPOs available on IG.

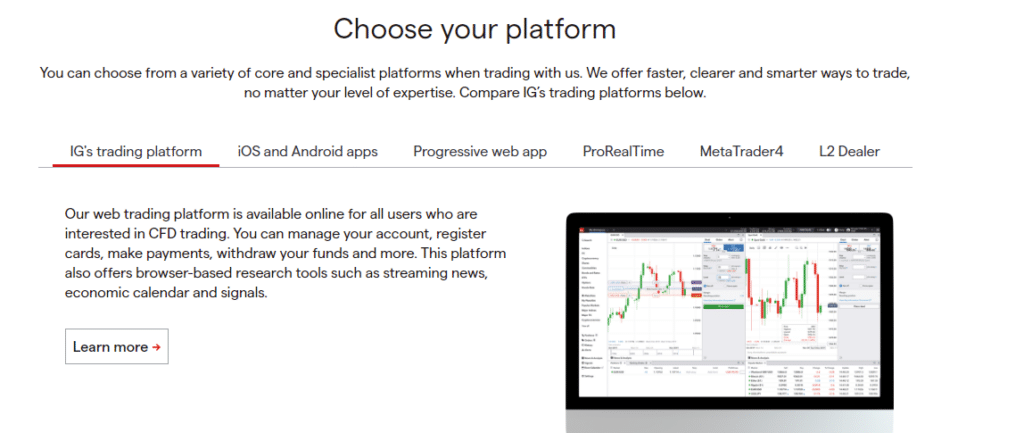

Trading Platforms

IG has a core trading platform available on the web, mobile app, and desktop. Other third-party platforms like MT4 offer customers an opportunity to trade with the most powerful trading tools in the market. Let’s look at the features of the core trading platforms.

IG Desktop trading platform

- Fast execution of 0.014s averagely

- Four timeframes

- 28 indicators and 19 drawings for in-depth technical analysis

- Instant trading

- Integrated real-time news from Twitter, Reuters

- 256-bit SSL encryption for safe money transactions

- Suitable for all traders

- Market products available – CFDs

- Charts – AutoChartist, IG Charts, ProRealTime access

Mobile App trading platform

- Interactive price charts with zoom and scroll features

- 28 technical indicators

- Trading signals on email and SMS

- Alerts for market events

- 17,000+ markets

- 256-bit SSL encryption technology

- Suitable for all traders

- Market products available – CFDs

- Charts – IG mobile Charts

IG Web trading platform

- Browser-based

- 28 technical indicators for analysis

- 17,000+ markets

- Suitable for all traders

- Market products available – CFDs

- Charts – None

Other third-party trading platforms include:

Meta Trader 4 (MT4)

- Accessibility – Desktop and Mobile

- Suitable for – Forex Traders

- Tradable products – Forex, Commodities & Indices

- Charts – advanced MT4 charts

- Available market products – CFDs

- Auto Trading

- Platform add-ons – 18 bespoke apps + Autochartist

ProRealTime

- Accessibility – desktop only

- Suitable for – technical chart users

- Tradable products – all available products

- Charts – advanced ProRealTime charts

- Available market products – CFDs

- Auto Trading

- Platform add-ons – import indicators

L2 Dealer

- Accessibility – Desktop only

- Suitable for – Advanced Shares Traders

- Tradable products – DMA Forex and shares, Commodities, OTC Forex, & Indices

- Charts – ProRealTime access

- Available market products – CFDs

- Platform add-ons – Bloomberg, FIX API

- Minimum balance – $2,000

Features

IG has many features and add-ons in different account types to ensure traders enjoy a seamless trading experience.

Some of them include:

- Charts – you get free charts for analysis, customization, and trading without opening deal tickets.

- News Feed – you can stream news through Thomson Reuters Corporation, IGTV, Twitter, and other resources.

- Economic Calendar – keeps you updated with the upcoming events and their impact on the markets.

- IG Community – investors congregate here to share ideas, experiences, and strategies with others.

- Signal Centre – provides real-time signal alerts when it’s the right time for trading and with buy/sell suggestions.

Watchlist – you can group your favorite markets, track them from one place, and easily navigate multiple windows.

Education

The IG Academy has learning resources categorized as beginner, intermediate, and advanced to meet every trader’s needs. These resources include:

- Scheduled live sessions

- Platform tutorial videos

- Educational videos on different trading topics

- Webinars

- A free demo account

The trading courses are structured with quizzes and interactive exercises to sharpen skills that a trader gains. The demo account provides a platform for practice.

Customer Support

You can contact IG’s customer support through email, live chat, and phone. However, their response is slow and may not be a quick solution to your problem.

Phone calls go through, but it may take up to about 10 minutes to connect to a representative. They answer the questions relevantly so that you may get help with all your queries.

If your questions are not urgent and require detailed explanations, you can try using the email. It may take up to 2 days to get a reply, but the answers will be satisfactory.

The live chat can be an efficient option, but most times, the agent is offline. Therefore, you can send in your question and wait for several minutes before you get a reply.

IG also has a well-detailed FAQ section that answers almost every question you might have regarding the platform. You can have a quick look there before contacting the support team.

Review Summary

IG is one of the biggest CFD brokers globally, with over 17,000 offerings in the market. It has a superior web trading platform for fast trade executions and instant trading. The multiple regulations from different financial authorities offer tight security to clients on the broker and their funds.

New traders have an opportunity to increase their trading knowledge through the trading courses and practice on the demo account. Also, the many features and add-ons on the platform ease the trading process.

On the flip side, IG’s charges are pretty high compared to other brokers on its level. Customer support could also improve and serve clients much faster.