OctaFX rolled out in 2011, targeting beginners, intermediaries, and professional traders in the forex and CFD trading market. Over the last decade, the broker grew and currently serves more than 3.5 million traders in Asia and Europe. It is headquartered in St. Vincent and the Grenadines offshore regions. Even though it’s an offshore located broker, OctaFX’s extensive client base resides in Europe. It owns a subsidiary in Cyprus Europe regulated by the CySEC that meets the demands of the many traders in the European region. The broker offers forex pairs, live quotes, CFDs, commodities, cryptocurrencies, and major global indices.

Pros

- The broker has no commissions in withdrawals, deposits, or trading.

- Offers tight spreads starting from 0.6 pips.

- It offers a 50% bonus on your first deposit.

- It has protection against the negative account balance.

- Initial deposit — $100.

- Many deposit channels to choose from Visa, Skrill, Neteller, BTC, Mastercard, among others.

- Targets all traders, including newbies.

- Many trading platforms for choosing.

- It offers copy trading.

- Trading platforms include tools like autochartist and other plugins for trade analysis.

- Available in diverse languages.

- No swaps, hidden fees, nor delay amid trade executions.

- Exécution type — STP/ECN.

Cons

- It is regulated by only one two-tier agency.

- It has just a few tradable assets — 32 FX pairs, ten index CFDs, few metals and natural gas-related commodities, only five cryptocurrencies.

- Max leverages vary from one asset block to another (for currency pairs, it’s 500:1, while for index CFDs, it’s 50:1).

- For the FX, the minimum spread varies between currency pairs. For example, EUR/USD starts from 0.6pips while for GBP/USD from 0.9 pips.

- Account trading conditions differ. For example, cTrader faces floating spreads starting from 0.8 pips and experiences commission on the markup spread.

OctaFX brokerage company launched in 2011 under the wings of the Octa Markets Limited corporation based in Kingston. However, the broker’s main offices are based in the offshore regions of Saint Vincent and the Grenadines.

In the last ten years, as OctaFX expanded into a renowned broker, it achieved several milestones. The broker holds 38 forex industry awards, including the best trading platform of 2021, and cites having more than 3.5 million active accounts and over 6 million opened accounts overall. It serves traders in more than 100 countries, with a big lot coming from the European region.

It diversifies its tradable assets to meet the needs of every trader. However, the broker’s asset bracket holds a few instruments compared with other brokerage companies. OctaFX provides cutting-edge trading opportunities such as the 50% bonus on initial deposit, protection of negative balance accounts, and different deposit methods.

The broker accepts cryptocurrency deposits and fiat deposits through bank cards and E-wallets like Skrill and Neteller. The tradable assets include; 32 FX pairs, five commodities, ten indices, and five cryptocurrencies.

Whether trading FX pairs, CFDs, or crypto-assets, the broker links traders to the interbank (the liquidity market) through three main trading platforms. OctaFX MT5, OctaFX MT4, and OctaFX cTrader. The platforms integrate with plugins like autochartist and other tools such as trading calculators and profit calculators to aid in trade analysis and swift executions. The trading methods include:

- Scalping

- Hedging

- Expert advisors

- Day trading

- Swing trading

Moreover, the floating spread varies from one platform. OctaFX cTrader is floating spread starts from 0.8pips while on the other platforms, it spreads from 0.6pips. However, the initial minimum deposit across all the platforms should be $100 and above for the first deposit. After, the amount shaves down to $25 for bank cards and $50 for E-wallets.

Its main offices operating in the offshore regions fall under the surveillance of the Mauritius Financial Commission (MFSC), and the Cyprus subsidiary serving the massive clientele in Europe, dubbed OctaFX Holding plc, operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC). Nonetheless, the broker holds several trading licenses and continues to build on its regulation imprint. The agency makes sure OctaFX conducts transparency activities and adheres to the MiFiD trading laws.

Regulation

The broker operates under the eyes of a two-tier regulation body in the European region while the other arm serves clients in Asia in response to the (FSC), Mauritius. In Europe, the CySEC ensures the broker abides by all trading laws and offers quality services to its clients. In addition, the agency makes sure the broker adheres to trading laws laid by the MiFiD in Europe.

Pros

- Regulated by the CySEC

- Follows the MiFiD laws

Cons

- Only regulated by one two-tier agency

- It’s unavailable in some nations

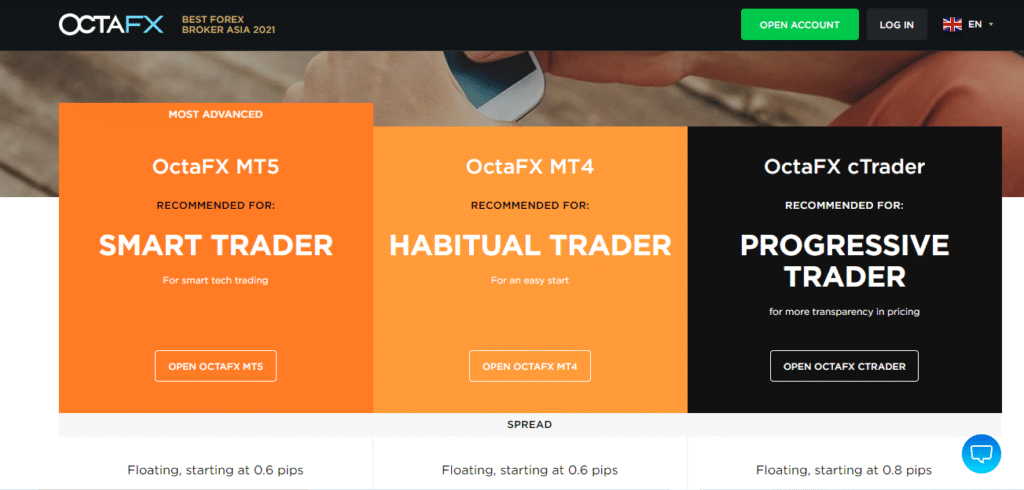

Account Types

The broker tries to serve all sorts of traders with its services. It offers several trading accounts for traders to select from depending on their skills and trading objects. One can either enroll for a smart trading account, habitual trading account, or progressive trading account. These accounts can be accessed distinctively across OctaFX’s trading platforms. For starters, the smart and habitual accounts trade on MT5 and MT4, respectively.

| Smart trader account( MT5) | Habitual trader account (MT4) | Progressive trader account (cTrader) |

| Minimum deposit — $100 or its equivalent. The floating spread starts from 0.6 pips. No commission markup. Instruments include 32 FX pairs, gold and silver +3 energies, ten indices, and five cryptocurrencies. Leverage is 500:1 for forex, 200:1 for metals,100:1 for energies, 50:1 for indices, and 25:1 for cryptocurrencies. STP/ECN exécution (under 0.1 second) Minimum lot size — 0.01 lot. Maximum lot size — 500 lots. Deposit fiat currencies USD or EUR. Margin call/stop out level — 25% / 15%. Hedging — yes. Scalping — yes. Expert advisors — yes. No swap. Precision — five digits. | Minimum deposit — $100 or its equivalent. The floating spread starts from 0.6 pips. No commission markup. Instruments include 32 FX pairs, gold and silver +3 energies, four indices, and five cryptocurrencies. Leverage is 500:1 for forex, 200:1 for metals,100:1 for energies, 50:1 for indices, and 25:1 for cryptocurrencies. STP/ECN exécution (under 0.1 second). Minimum lot size — 0.01 lot. Maximum lot size— 200 lots Deposit fiat currencies USD or EURMargin call/stop out level— 25% / 15% Hedging — yes. Scalping — yes. Expert advisors — yes. Swap — optional. Precision — five digits. | Minimum deposit — $100 or its equivalent. The floating spread starts from 0.8 pips. Instruments include 28 currency pairs + gold and silver. Commission markup — yes. Leverage is 500:1 for forex and 200:1 for metals. STP/ECN exécution (under 0.1 second). Minimum lot size — 0.01 lot. Maximum lot size— 10,000 lots. Deposit fiat currencies USD or EUR. Margin call/stop out level— 25% / 15%. Hedging — yes. Scalping — yes. Expert advisors — yes. No swap. Precision — five digits. CFD trading — no. Cryptocurrency trading— no. |

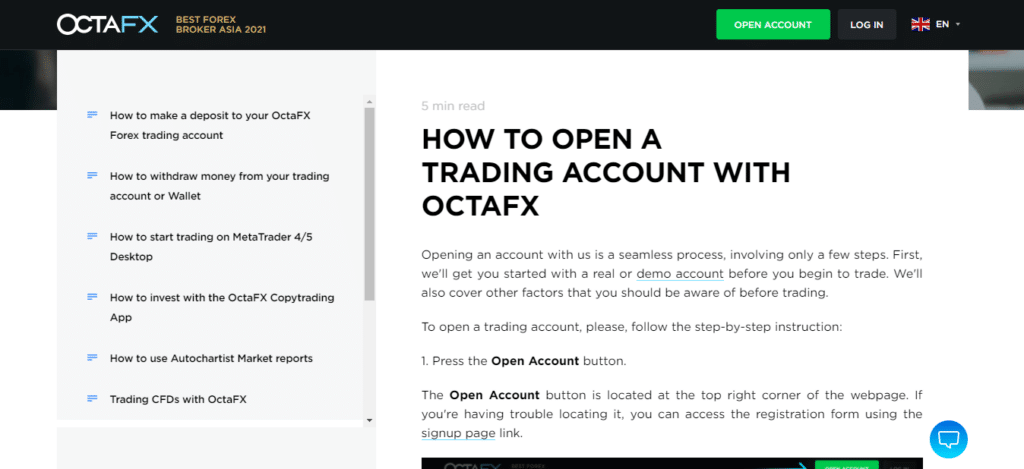

How to open an OctaFX account?

The account opening and verification process at OctaFX involves a few quick steps. The steps show the account opening procedure as illustrated by the broker. However, before you begin trading, the broker offers a demo account to improve your trading skills.

Step 1. Log into their website at OctaFX.com and press the open account button.

Step 2. Fill in your details on the form that pops up.

Step 3. Verify your email address.

Step 4. After verifying the email, you are redirected to another form that prompts you to fill in your details.

Step 5. Select a trading platform. The broker recommends MT4.

Step 6. Complete the account choice:

- Press continue to finish the account creation.

- A summary of the account is displayed, showing (account type, currency, leverage, and current balance).

Step 7. Make the first deposit starting from $100 and submit a verification document for withdrawal.

Fees and Commissions

The broker waives fees and commissions on deposits and withdrawals. However, some accounts may face inclusive overnight swap fees and commissions on the markup spread.

Minimum initial deposit should be any amount from $100 across all accounts but waives down to $50 or $25 depending on your deposit method. It accepts several deposit channels for both fiat and crypto.

For fiat, deposit channels include bank cards, wire transfers, and E-wallets like Neteller and Skrill. OctaFX also cushions traders with incentives like a 50% bonus of their first deposit monetary size and curbs their account from negative balance.

Payment options

As highlighted, OctaFX offers diverse deposit and withdrawal platforms. Surprisingly, traders can make deposits and receive payments as crypto-assets in either BTC or ETH. Besides, bank cards and E-wallets come in handy while receiving payments. The minimum withdrawal amount for Visa is $20, while both Skrill and Neteller are $5. In contrast, BTC is 0.00009000 while ETH is 0.00500000.

Pros

- Multiple payment options

- Deposit and withdrawal is free

- Accepts deposits in cryptocurrency

Cons

- There could be inclusive swap overnight and commission mark up fees for some accounts

Deposit

OctaFX accepts deposits from these methods:

- Bank Cards like Visa, Mastercard

- E-Wallet transfers like Skrill and Neteller

- Cryptocurrencies such as Bitcoin and Ethereum

Withdrawals

They occur through the following:

- Bank cards

- E-Wallets — Neteller and Skrill

- In the form of crypto-assets like BTC and ETH

Available Markets

It’s right to deem that you might have caught wind of the available markets in OctaFX through this review. As slightly discussed, the broker specializes in Forex and CFD trading and currently holds the best FX trading platform in Asia. It deals with currency pairs, indices, commodities like metals and energies, and top cryptocurrencies.

- Forex

Forex trading occurs in 32 available currency pairs 24/5. The spreads speculate depending on the currency pair, but the minimum spreads start from 0.6 pips. For instance, the floating spread of NZD/CAD begins from 1.4 pips while EUR/USD starts at 0.6 pips. However, traders experience leverages of 500:1 across all accounts.

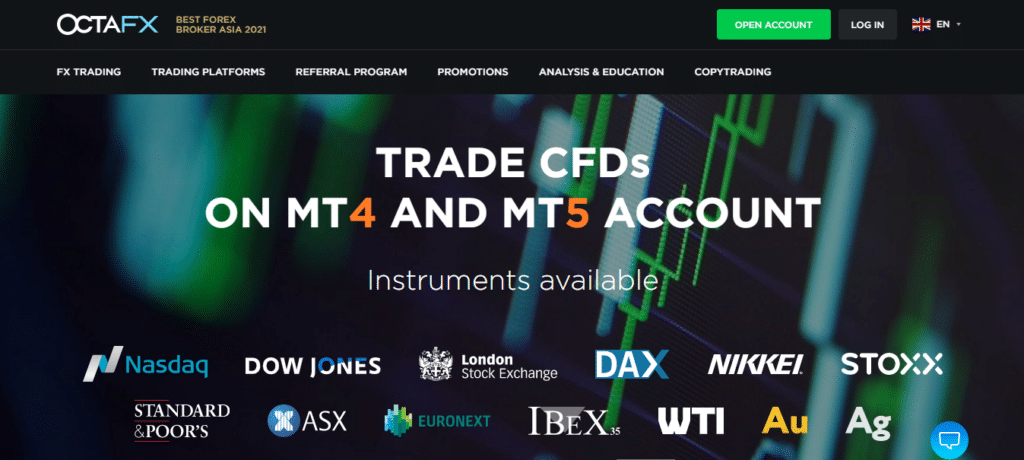

- Indices

Indices trading occurs on the Metatrader training platforms. The broker offers clients access to popular stocks like Dow Jones, Nasdaq, Nikkei, and Euro Stoxx 50. However, max leverage slightly lowers compared to forex, and traders can only trade up to 200:1 leverage.

- Commodities

OctaFX offers some tradable commodities to traders. These include precious metals such as gold and silver and energies like; Brent crude oil and West Texas Intermediate crude oil. Metals trade across its three platforms with currency pairs but energies trade only on MT4 and MT5. The max leverage for metals is up to 200:1, while for energies hovers at 50:1.

- Precious metals

As introduced above, commodities include all physical assets such as metals, like gold, silver, platinum, etc., and energies in the crude oil bracket. OctaFX offers trading of commodities at no round-turn commissions and tight spreads. Leverage fluctuates up to 200:1 across all platforms and allows traders access to free-market trending news and analytics.

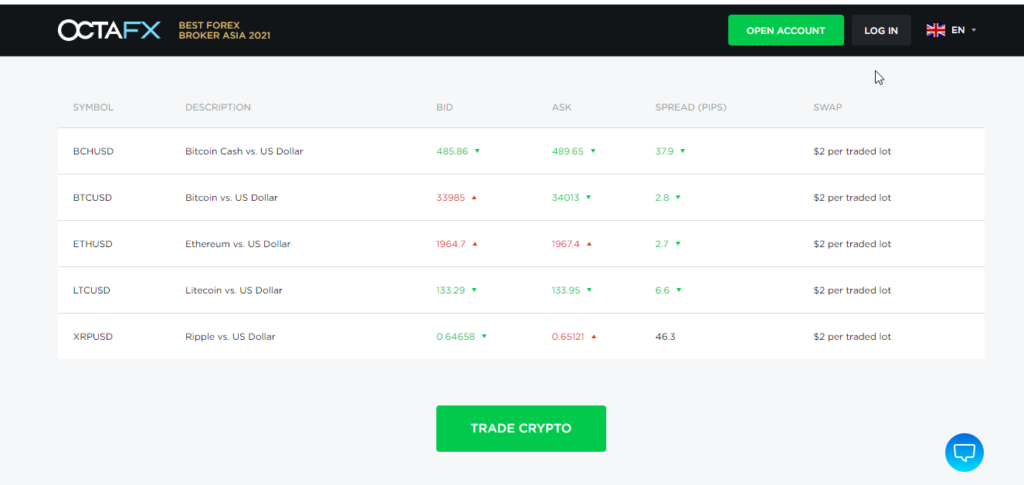

- Cryptocurrencies

At OctaFX, cryptocurrencies trade on the MT4 and MT5 trading platforms. cTraders can’t trade crypto-assets and energies. The broker allows traders to start dealing with significant digital assets such as Bitcoin with only $100. They trade against USD as the quoted currency with leverage of 1:200. They include BTC, Bitcoin Cash, ETH, Litecoin, and Ripple.

Trading Platforms

| MT4 | MT5 | cTrader |

| The MT4 platform is available on the web, mobile in Android and IOS, and desktop versions for easy accessibility in Windows and Mac OS. It rolls out robust trading technology that paves the way for the following. Flexibility: offers varieties of assets to trade. User-friendly: has an interface suitable to all traders. Customizable: allows traders to develop their own EA, technical indicators, and windows and charts arranged for each profile. Efficiency: never slows down the performance of your phone or PC. Charting tools: tools help analyze the technical aspects of the market. EA: trading robots automate trades and acquit customers with algorithmic trading benefits. Language: accessible in many languages. | The MT5 platform is a predecessor of the MT4 and allows clients to experience next-generation trading because of its advanced tools and top-notch trading capabilities. OctaFX incorporates multiple trading features and also offers copy trading. It is also available in Windows and Mac OS, Android and IOS, and on the Web. More pending order types: traders place eight types of pending orders. New hedging for cryptocurrency: allows intraday swing trading and scalping for crypto. One-click trading: opening a new position is efficient. More technical analysis tools provide additional specialized tools. Clear segregation: allows segregation between terms. Optimized strategy tester: improved testing capabilities for EAs. Improved EAs: integrated MQL forex market product tab. Economic calendar: traders stay up to date with emerging trends in the market in real-time. | The platform provides improved trading services offering direct market access.Efficient for Forex and CFD trading with over 26 prebuilt cTrader chart views, customizable interface, and up to 50 chart templates. Rapid entry and execution offer fast filling of numerous orders at the same time. Level II quotes: order books fill through volume-weighted average price (VWAP). Transparency in prices: trade executions get verified against the prices streamed from liquidity providers. |

Features

OctaFX features generally include:

Trading tools

- Autochartist pro

- Expert advisors

- Trading calculator

- Profit calculator

- Charting tools

Analytical tools

- Market watch information tools

- Technical analysis tools

- Indicators

- Signals

Education

OctaFX offers trading tutorials to traders looking to improve their skills. Learners access tutorial resources via its websites like videos, webinars, and glossary. It tops up the resources with short content-based learning materials such as Forex basics, instructions, and answered FAQs for those who possess some trading foundations.

Customer Support

OctaFX’s website details all the information that can render you contact customer care. The information distributes well on the website, and accessibility is easy. However, the broker offers several channels to solve the trader’s problem. For example, one can access the FAQ section containing several questions likely to be raised by the trader. In addition, it provides a live chat section that links traders with the nearest customer care.

Review Summary

OctaFX prides itself with over 3.5 million active traders and operates in more than 100 nations. The broker holds about 38 achievements under its wings with only ten years in the forex trading arena. However, it falls in the two-tier regulation category as only the CySEC supervises its operations in Europe. Despite the bruise of being poorly regulated, its services attract more clientele every day.

It offers a 50% bonus of the initial deposit stake and multiple seamless deposit and withdrawal methods. Traders transact both fiat and cryptocurrencies to their trading accounts. In addition, the minimum initial deposit starts from $100, and all the OctaFX mitigates all commissions for traders across its accounts. It offers several trading accounts targeting both newbies and experienced traders.