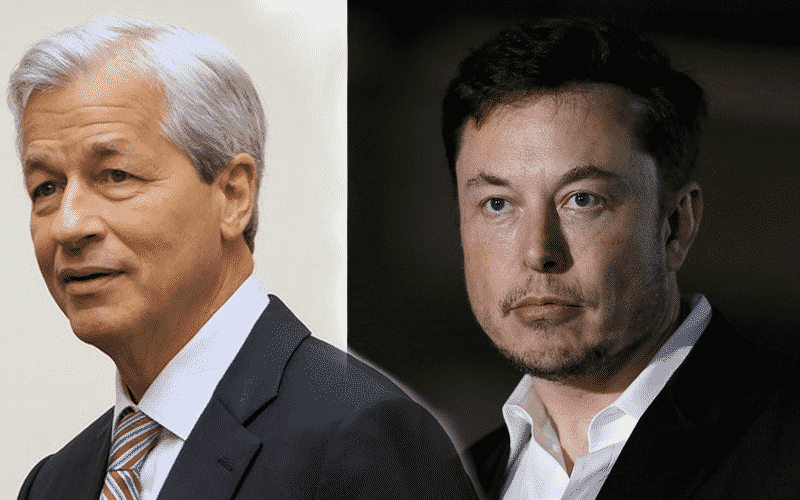

(WSJ) Tesla CEO Elon Musk is set to square out with JPMorgan’s Jamie Dimon who has said the EV maker owes it $162 million from a trade arrangement dating back to 2014.

The lawsuit by JPMorgan is seen to reignite past wounds between the two companies, with the Tesla CEO threatening to assign a one-star review of the US top bank on Yelp if it does not withdraw.

JPMorgan, which says Tesla violated its contractual obligations, says it has given the EV maker multiple chances to fulfill its terms of the agreement before resulting in litigation.

Dimon’s feud with the Tesla CEO is a rare occurrence, with the top chiefs of leading banks avoiding public fights with potential or existing clients.

The feud between Tesla and JPMorgan is evident in their business dealings, with the bank having received only $15 million from the EV maker for consultancy in the last decade. Goldman has made up to $90 million in the same period.

JPMorgan has, in the past, boasted of being better off without Tesla, and the bank has not participated in any Tesla transaction or offering since 2016. Tesla has preferred Morgan Stanley, Bank of America, and Goldman.

The $162 lawsuit by JPMorgan is now expected to heighten tensions between the CEOs of the two companies. Musk has promised “serious responses to serious allegations” in the ongoing tussle.