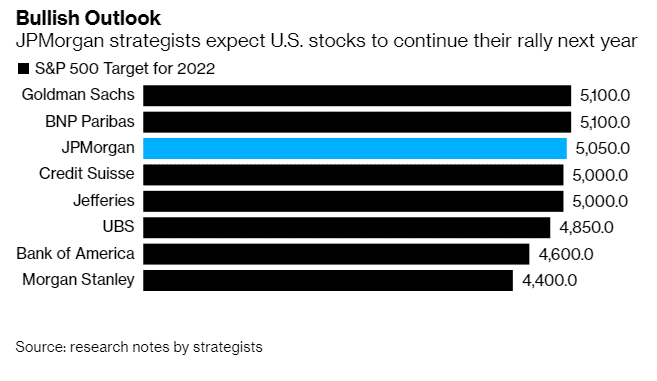

(Bloomberg) JPMorgan strategists say the Omicron variant will not derail the stock rally, expecting S&P 500 to gain up to 9% by the end of 2022. The strategists foresee a 17% gain for Eurozone equities.

The bank pegs the projections of equity returns on easing of supply chain bottlenecks and better-than-expected earnings.

JPMorgan says the events such as the outbreak of Omicron should be viewed as “sporadic setbacks,” with the strategists expecting post-pandemic normalization in 2022.

The projections come amid cautious optimism in global stocks, which fell on Tuesday, as researchers work around to determine the severity of the new variant.

The strategists cite hawkish tones by central banks as impediments to the bullish projections. They recommend investors to pick small cap stocks, financials, energy, and consumer services.

JPMorgan expects European stocks to perform better than those of the US. Emerging markets will outperform the developed world’s stocks, with the Chinese ones the most gainers.

SPY is down -1.18%, CSI 300 is down -0.40%, DAX is down -0.84%.