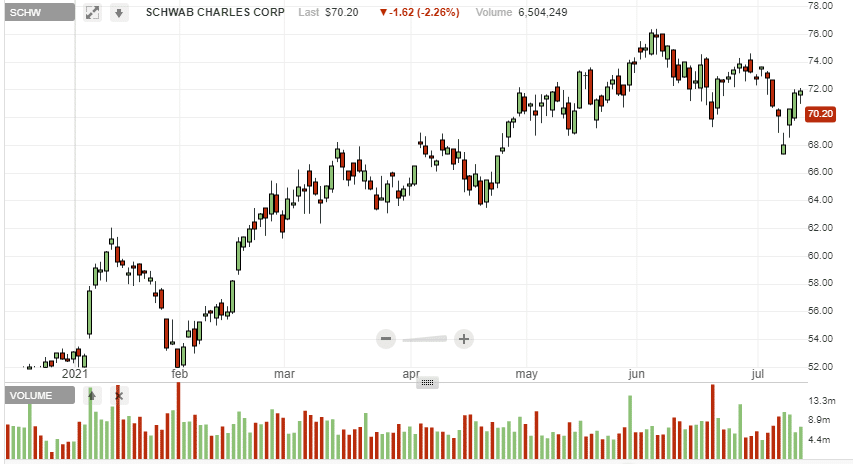

- Stock is up 30% ahead of the Q2 report.

- Earnings per share are expected at $0.71.

- Sales are expected at $4.6 billion.

- The focus is on the new account opening and the impact on trading revenue.

Charles Schwab Corporation is slated to report its result for the June quarter, on July 16, 2021, before the market open. The brokerage and wealth management company heads into the session at the back of an impressive run in the stock market. The stock is up by more than 30%, outperforming the S&P 500.

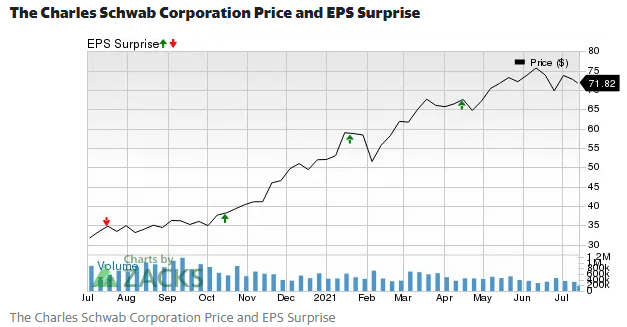

Expectations are high that the company will report results that top analysts’ expectations on the revenue and earnings front. Q1 results came in better than expected at the back of a solid client asset balance. During the quarter, the company also benefited from growth in brokerage accounts.

Additionally, the previous quarter’s results were driven by strong client activity as volatile markets made it easy for the company to make money from trading accounts. Additionally, the company benefited from an increase in total client assets and brokerage accounts.

In recent months, the company has registered a significant increase in new clients, which has seen daily trading activity edge higher.

Earnings expectations

Wall Street expects the company to report earnings of $0.71 a share. In contrast, it reported an EPS of $0.48 last year during the same period. In the last four quarters, the firm has topped estimates backed by an average beat of about 3.7%. In the last two quarters, EPS has come higher than expected.

Sales, on the other hand, are expected at $4.46 billion, representing an 81.98% year-over-year increase.

Amid the anticipated growth in earnings and revenues, the company is estimated to register a significant increase in operating expenses. Regulatory spending and strategic buyouts have been on the rise, believed to have triggered a significant increase in capital expenditures. For instance, the company faces a probe by the Securities and Exchange Commission, which could lead to a charge of about $200 million.

What to look out for

In the March quarter, sales were up 80% year over year to $4.7 billion, attributed to growth in trading proceeds and net interest proceeds. Fast forward, a recovering US economy is believed to have taken a significant toll on trading proceeds. Consequently, trading returns might come in lower than projected.

In the most recent quarter, market volatility was not that much. New brokerage accounts stood at 609,000 in April and 549,000 in May, affirming the deceleration on this front.

Amid the declines in new accounts opening, the focus will be on the trading revenue. As it stands, the Street does not expect revenues in the trading segment to have grown owing to the effects of reduced market volatility. The company might also have felt the effects of market normalization.

Consequently, trading revenues are anticipated at $900 million, which could signal a 26% decline from the previous period. Total client assets are projected to come in at $7.3 trillion, signaling a 3.7% increase sequentially.

In addition, the focus will be on the impact of the low-interest rates on the wealth management net interest revenue. The firm could post growth in interest-earning revenue supported by growth in assets that earn interest. Net interest revenue is projected at $2 billion, suggesting a 5.1% increase.

Bottom line

Charles Schwab has been on an impressive run ahead of the quarterly report. The 30% plus rally has come at the back of an impressive March quarter report. A report that affirms underlying growth would strengthen the stock’s sentiments, consequently fueling another push higher in the stock market.