Cathy Wood was the superstar fund manager behind Ark Investment Management that took the equity markets by storm in 2020. As the markets crashed in March at the start of the pandemic in the US, she ramped up positions in some high-profile names on the belief they were significantly undervalued after a massive pullback.

The play did payout as Wood’s ended up outperforming every other equity mutual or exchange-traded fund as the overall market bottomed out. Ark Investment Management ended up delivering blockbuster returns in the pandemic stricken 2020, with most of the ETF products posting triple-digit percentage gains.

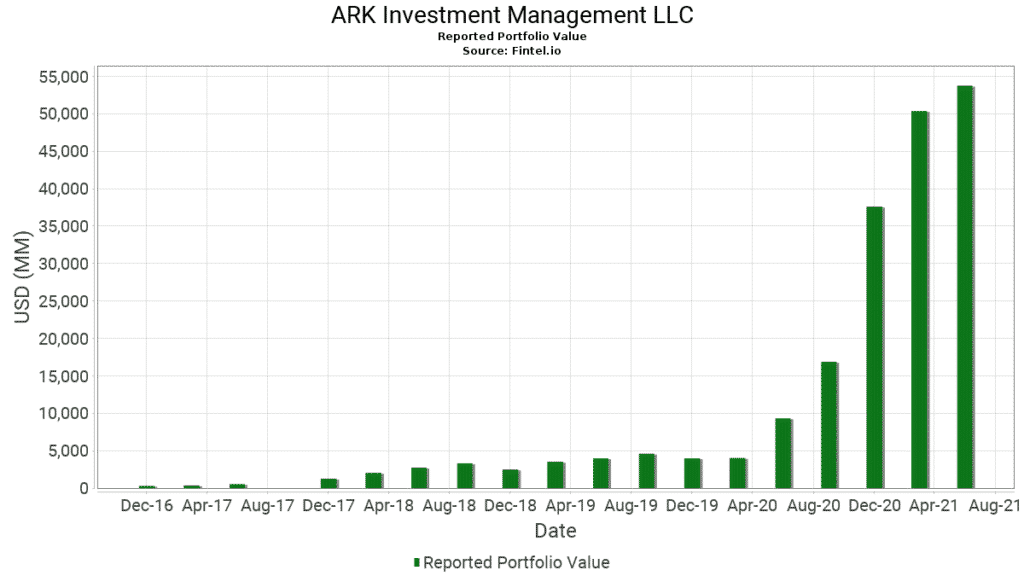

As of the start of the year, the firm had over $50 billion invested in ETF products after huge inflows last year.

Ark Investment success catalysts

One of the reasons behind Wood’s impressive performance in 2020 has to do with the stock selection process that ended up being a big success. Positions in some stocks that ended up being big winners amid the pandemic all but affirmed Wood’s edge as one of the best in the business when it comes to stock selection. At the height of the stock-picking frenzy was Tesla that ended up being a big winner.

Ark’s big bets on disruptive technology expected to change how the world looks ended up fuelling stellar performance. As the COVID-19 pandemic was causing havoc, digitization and dependency on the internet became a central theme presenting unique investment opportunities that Wood took advantage of.

Wood’s Ark Investment Management also placed bold bets on cloud computing, an emerging technology that experienced tremendous growth as people were forced to work from home. Bets on online shopping and digital payments also paid up as people were forced to do shopping online and have items delivered to their doorstep.

Cathie Wood’s top performers

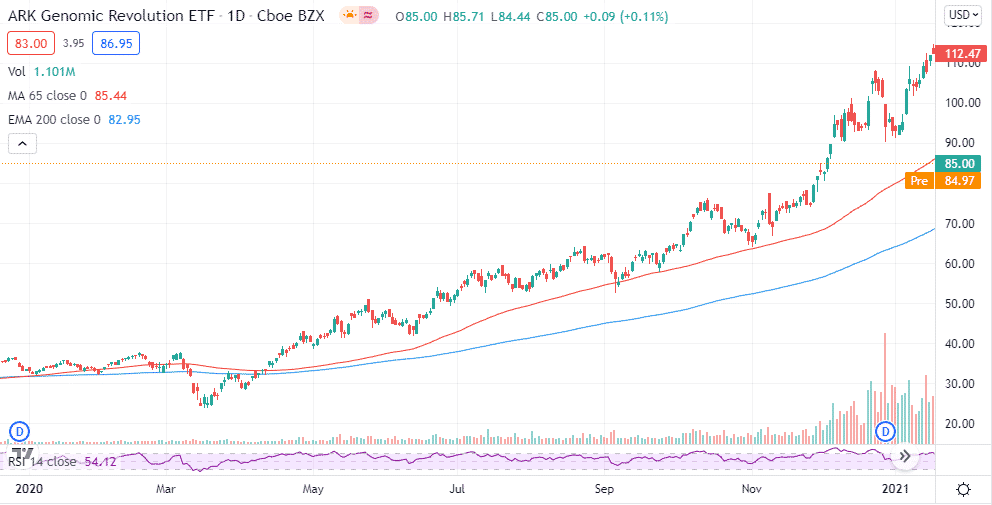

Ark Genomic Revolution ARKG

It was the best performing ETF for Wood’s hedge fund, returning a whopping 208% last year.

The actively managed ETF mostly invests in companies working on technologies likely to enhance human and other life quality through technology; some of the fund’s biggest bets include Pacific Biosciences (PACB), Teladoc Health TDOC, and CRISPR Therapeutics CRSP.

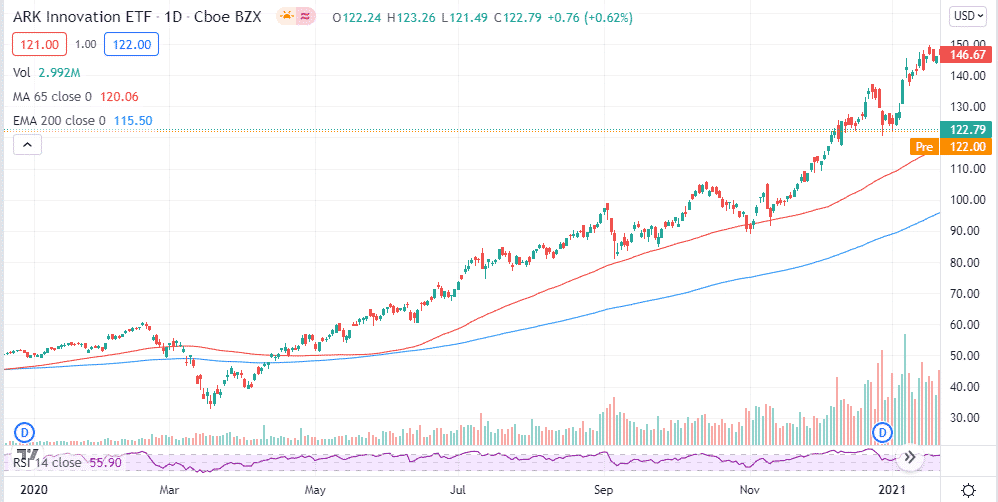

Ark Innovation

The Ark Innovation fund, which mostly grows new technologies, has been the center of attention after blockbuster returns the past year. Technology stocks outperformed in 2020 as most stocks raced to record highs.

Wood was one of the beneficiaries of the impressive run as investors rushed to companies working on the development of new products and services, consequently sending valuations higher. The actively managed fund ended up returning 169.9% thanks to bold bets on the likes of Tesla, Roku, and Square.

The firm’s assets under management on the flagship Ark Innovation fund rose from $1.86 billion as of the end of 2019 to nearly $22 billion as of the first quarter of 2021.

Ark Next Generation Internet ETF

The ETF invests mostly in companies likely to benefit from shifting the bases of technology infrastructure to the cloud or enabling mobile or local services. Some of the fund’s biggest investments include Tesla, Roku, and Bitcoin Trust. The fund ended up returning 156%.

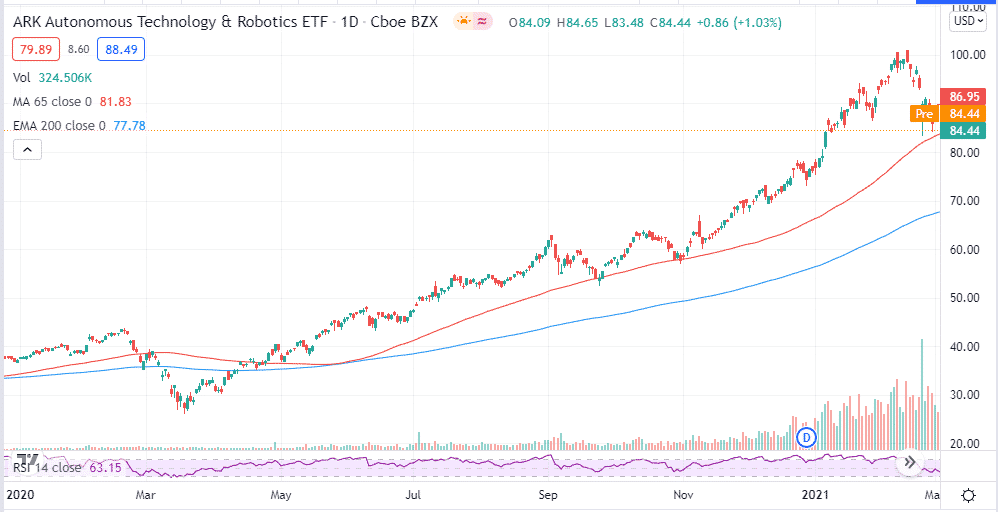

Ark Autonomous Technology

There is no doubt that autonomous cars are the auto industry’s future, a development that has presented a unique investment opportunity for Cathy Wood.

The star fund manager is highly invested in companies working on technological improvements and advancements to enhance automation, such as Tesla. The fund was up by 119% in 2020.

Ark Investment Management fizzling returns in 2021

Fast forward, the investment landscape has changed significantly. While the stock market has continued to grow, Cathie Wood’s big bets are under immense pressure. Some of the tech stocks that the star manager had placed too much faith in have pulled back significantly, with some in consolidation mode, making it impossible for Wood to enjoy the returns of 2020.

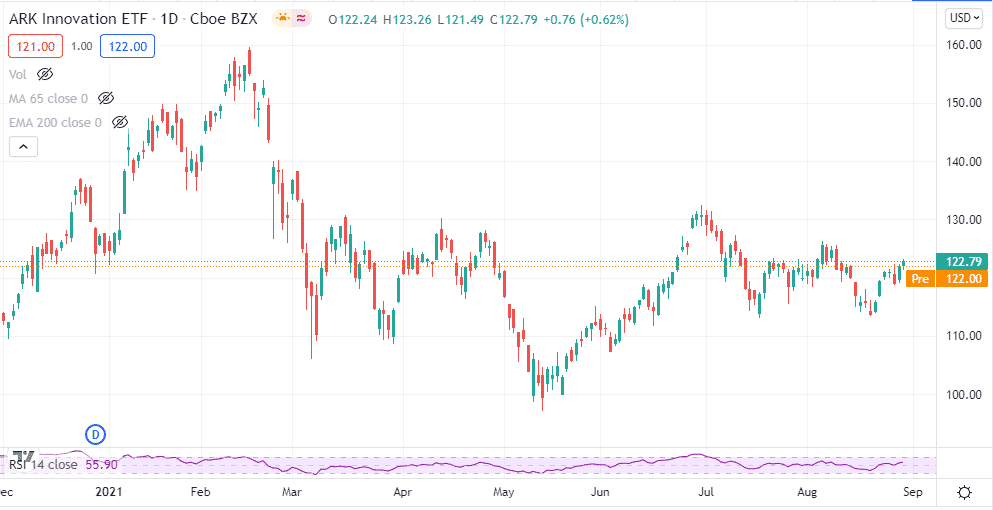

The Ark Innovation fund that posted stellar performance in 2020 is the biggest casualty shedding nearly a third of its value since its peak value in February. The fund performance has been weighed heavily by the likes of Tesla, shedding a significant amount of value since peaking last year. Biotech stocks have also shed significant value sending the fund lower.

Short interest on ARKK ETF has risen significantly since June, indicating people expect the fund to edge lower after the recent pullback.

Ark Fund’s underperformance stems from investors shunning businesses whose profits are unlikely to materialize in years to come. Inflations climbing high, fuelling concerns of the Federal Reserve hiking interest rates have forced investors to exit some positions in the tech market, sending the fund lower.

Amid the runaway inflation, investors have started placing bets on companies that are generating increasing profits in the near term instead of long-term bets. Some of the big bets include those benefiting from the COVID-19 vaccine rollout as well as the reopening of the US economy.

Cathy Wood’s confidence

Following the recent underperformance, Wood has reiterated that she remains confident about the setup. Despite the massive pullback, the fund manager expects her strategies to post a compound annual return rate of 25% to 30%.

Amid the optimism, Wood is already facing resentment with more than $1.1 billion of fund flows, leaving her notable ETFs, including ARK Innovation. Five core ETFs have lost nearly 2 billion since the start of the year, indicating investors are developing cold feet about the fund manager investment strategies.

Skeptics of the superstar fund manager are also becoming more vocal, with the latest being high profile hedge fund investor Michael Burry famous for the Big short movie. The investor has already disclosed short positions against Wood’s flagship ETFs.

Investors pulling out a record $238 million from one of Wood’s funds on a single day signals people might be running out of confidence about the current investment strategies. As it stands, the superstar investment strategies are in question more than ever after an exciting run in 2020.

Amid the growing concerns and sell-off, Wood remains upbeat, reiterating that most of her critics don’t understand the tech space’s explosive growth and investment opportunities.